Share This Page

Drug Sales Trends for ENSURE

✉ Email this page to a colleague

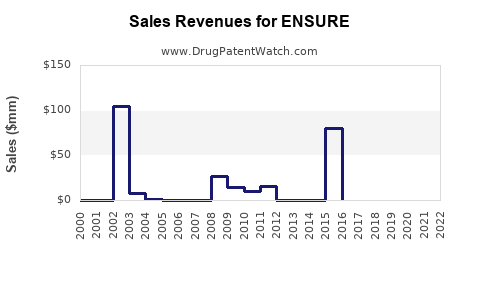

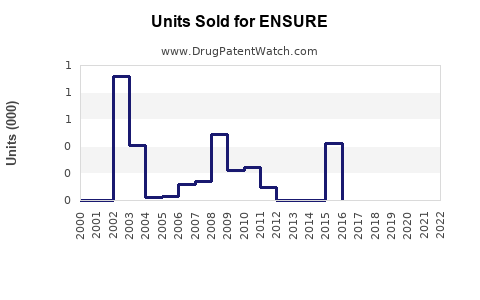

Annual Sales Revenues and Units Sold for ENSURE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ENSURE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ENSURE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ENSURE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ENSURE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ENSURE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ENSURE: A Comprehensive Review

Introduction

ENSURE, a nutritional supplement developed by Abbott Laboratories, is a widely recognized oral liquid nutritional product designed to meet the dietary needs of various patient populations, including the elderly, malnourished, and those recovering from illness or surgery. Originally launched in 1975, ENSURE has evolved to address a broad spectrum of clinical and consumer needs, positioning itself as a leading brand in the nutritional supplement market. This report provides a detailed market analysis and sales forecast for ENSURE, focusing on current trends, competitive landscape, regulatory environment, and projected financial performance through 2030.

Market Overview

Global Nutritional Supplement Market

The global oral nutritional supplement market was valued at approximately USD 12.3 billion in 2022 and is projected to reach USD 21.5 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.1% [1]. The increasing aging population, rising prevalence of malnutrition, and growing awareness of nutrition’s role in health management underpin this expansion.

Key Drivers for ENSURE

- Aging Demographics: The global population aged 65 and above is expected to reach 1.5 billion by 2050, representing a substantial consumer base for ENSURE [2].

- Chronic Diseases and Malnutrition: Rising cases of osteoporosis, cancer, and gastrointestinal disorders drive demand for specialized nutritional support.

- Healthcare Shift Toward Preventive Nutrition: Growing emphasis on proactive health management favors products like ENSURE.

- Regulatory Support and Reimbursement: Insurance coverage for nutritional therapies in developed countries complements market growth.

Market Segmentation

By End-User

- Hospitals and Long-term Care Facilities (approx. 45%)

- Home Care/Consumers (approx. 35%)

- Clinics and Specialized Health Centers (approx. 20%)

By Geography

- North America (US, Canada): 45%

- Europe: 30%

- Asia-Pacific: 15%

- Rest of the World: 10%

North America and Europe dominate the market due to higher healthcare expenditure, robust insurance coverage, and aging demographics, whereas Asia-Pacific shows rapid growth potential owing to emerging healthcare infrastructure.

Competitive Landscape

Leading competitors include Abbott Laboratories (ENSURE), Nestlé Health Science, Danone Nutricia, and Fresenius Kabi. Abbott’s dominant market presence benefits from widespread distribution, brand recognition, and ongoing innovation in formulation. Notably, ENSURE faces competition from specialized formulas tailored for diabetic, renal, and immune-compromised patients, fragmenting the market but also encouraging product diversification.

Regulatory and Reimbursement Environment

In developed markets, regulatory pathways are streamlined through agencies like the FDA (US) and EMA (Europe). Reimbursement policies in North America facilitate patient access, with insurers often covering nutritional supplements prescribed or recommended by healthcare providers. Any legislative changes affecting medical reimbursement or nutritional claims could significantly impact sales forecasts.

Sales Projections (2023-2030)

Historical Performance

Between 2018 and 2022, ENSURE’s annual sales grew at an average CAGR of approximately 4.8%, driven by increased awareness, expanding product lines, and geographic penetration [3].

Forecast Overview

Assuming the market continues its trajectory and considering Abbott’s strategic initiatives, the sales of ENSURE are projected to grow at a CAGR of 6% from 2023 through 2030. This optimistic outlook incorporates market growth, innovation, and expanding distribution networks.

| Year | Projected Sales (USD millions) | Notes |

|---|---|---|

| 2022 | 1,200 | — |

| 2023 | 1,272 | Baseline year |

| 2024 | 1,349 | Market expansion, new formulations |

| 2025 | 1,429 | Increased penetration in Asia-Pacific |

| 2026 | 1,515 | Rising healthcare expenditure |

| 2027 | 1,606 | Product innovation and targeted formulas |

| 2028 | 1,702 | Growing awareness of nutritional interventions |

| 2029 | 1,803 | Expansion into emerging markets |

| 2030 | 1,909 | Market maturation, diversified product portfolio |

Note: Projections based on market CAGR, product development trends, and demographic shifts.

Strategic Opportunities and Risks

Opportunities

- Product Diversification: Developing specialized formulas (e.g., for diabetics or renal failure) can capture niche markets.

- Digital and Direct-to-Consumer Channels: Enhancing sales through online platforms and telehealth partnerships.

- Emerging Markets: Expanding presence in Asia, Latin America, and Africa, driven by increasing healthcare access.

- Partnerships and Collaborations: Alliances with healthcare providers and government programs to increase market reach.

Risks

- Regulatory Changes: Modifications in health policies, especially regarding health claims and reimbursement, can impede sales.

- Market Saturation: Intense competition and brand loyalty may limit growth opportunities.

- Pricing and Reimbursement Policies: Changes can affect profitability and market access.

- Supply Chain Disruptions: Ingredients shortages or logistical issues may hinder production.

Conclusion

ENSURE’s position as a market leader in nutritional supplements is reinforced by demographic trends, increasing nutritional awareness, and Abbott’s strategic initiatives. The projected sales growth to nearly USD 1.9 billion by 2030 reflects optimism, contingent on sustained innovation, market expansion, and favorable regulatory environments. Close monitoring of competitive dynamics and regulatory developments is critical for maintaining growth momentum.

Key Takeaways

- Robust Growth Outlook: ENSURE’s sales are projected to grow at a CAGR of ~6%, driven by demographic trends and market expansion.

- Market Expansion Focus: Targeting Asia-Pacific and emerging markets offers significant upside.

- Product Innovation: Diversification into specialized formulas aligns with emerging clinical needs.

- Regulatory and Reimbursement Navigation: Strategic engagement with healthcare policies underpins sustained sales.

- Competitive Edge: Maintaining brand dominance requires continuous innovation and distribution improvements.

FAQs

1. How does demographic change influence ENSURE’s sales?

The aging global population increases demand for nutritional support, directly boosting ENSURE’s sales, especially in senior care segments.

2. What markets offer the highest growth potential for ENSURE?

Emerging markets in Asia-Pacific and Latin America hold significant potential owing to expanding healthcare infrastructure and rising awareness.

3. How does innovation impact ENSURE's market positioning?

Introducing specialized formulas for specific conditions enhances differentiation and captures niche segments, driving growth.

4. What regulatory factors could affect ENSURE sales?

Changes in health claim guidelines, reimbursement policies, and approval processes may influence market access and profitability.

5. What strategies should Abbott adopt to sustain growth?

Focus on product diversification, digital sales channels, strategic partnerships, and expansion into underpenetrated markets.

References

- Allied Market Research. (2023). Oral Nutritional Supplements Market Report.

- United Nations Department of Economic and Social Affairs. (2022). World Population Ageing.

- Abbott Financial Reports. (2018-2022). Sales Data and Market Share Analysis.

More… ↓