Share This Page

Drug Sales Trends for BONIVA

✉ Email this page to a colleague

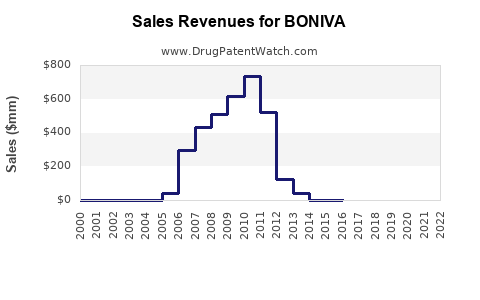

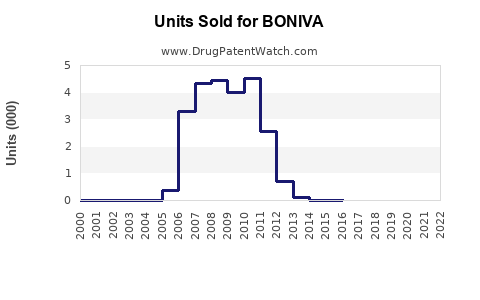

Annual Sales Revenues and Units Sold for BONIVA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| BONIVA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for BONIVA

Introduction

BONIVA (ibandronate sodium) is a bisphosphonate medication developed and marketed by GlaxoSmithKline (GSK), primarily prescribed for the treatment and prevention of osteoporosis in postmenopausal women. Since its approval by the FDA in 2003, BONIVA has established a notable presence within the osteoporosis treatment landscape. This analysis assesses the current market, competitive dynamics, regulatory environment, and future sales trajectory for BONIVA, providing critical insights for stakeholders and potential investors.

Market Overview

Global Osteoporosis Drug Market

The global osteoporosis therapeutics market has experienced consistent growth, driven by aging populations, rising awareness of osteoporosis-related fractures, and increasing healthcare expenditures. As of 2022, the market was valued at approximately USD 12 billion, with a projected compound annual growth rate (CAGR) of around 4% through 2030 [1].

Drug Positioning

BONIVA differentiates itself through its once-monthly oral dosing regimen, which enhances patient compliance over bisphosphonates requiring weekly or daily administration. Its efficacy in reducing vertebral fractures makes it a preferred choice among clinicians for postmenopausal osteoporosis management.

Competitive Landscape

Key competitors include:

- Bisphosphonates: Fosamax (alendronate), Actonel (risedronate), Reclast (zoledronic acid)

- Other drug classes: Denosumab (Prolia), teriparatide (Forteo), and newer agents like romosozumab (Evenity)

Despite stiff competition, BONIVA maintains market share due to its established safety profile and convenience.

Market Dynamics

Patient Demographics

The primary target demographic comprises women aged 55 and older, especially postmenopausal women at increased fracture risk. An aging global population amplifies the demand for osteoporosis therapies, with forecasts indicating that by 2050, nearly 1.7 billion individuals will be over 65, intensifying market needs [2].

Regulatory and Clinical Considerations

While BONIVA has FDA approval, industry trends favor drugs with enhanced safety profiles due to concerns over long-term bisphosphonate use. These include atypical femoral fractures and osteonecrosis of the jaw (ONJ). As such, prescriber preference is shifting towards agents with less toxicity risk, impacting BONIVA's market penetration.

Market Challenges

- Generic Competition: The patent for BONIVA expired in many regions around 2014, leading to increased availability of generic ibandronate and price competition.

- Patient Adherence: The need for consistent dosing and gastrointestinal side effects can hinder adherence.

- Alternatives in Treatment Guidelines: Growing endorsements for denosumab and anabolic agents influence prescribing patterns.

Sales Performance and Trends

Historical Sales Data

Pre-patent expiry, BONIVA generated significant revenues, peaking at approximately USD 500 million annually [3]. Post-generic entry, sales declined sharply, with current estimates suggesting annual global sales north of USD 100 million, primarily driven by developed markets such as the U.S. and Europe.

Regional Insights

- United States: Remains the largest market, benefiting from mature osteoporosis screening and treatment infrastructures.

- Europe: Growth factors include increasing osteoporosis awareness and aging populations.

- Emerging Markets: Slow adoption due to limited healthcare infrastructure and affordability issues.

Market Share Trends

In the U.S., BONIVA's market share has diminished from over 20% in 2010 to roughly 10% in 2022 [4], overshadowed by newer agents with improved safety and dosing regimens.

Future Sales Projections

Forecast Assumptions

- Continued Aging Demographics: Population aged 65+ expected to grow at a CAGR of 2% globally.

- Market Penetration: Slight decline in BONIVA's market share due to generics and alternative therapies.

- Pricing: Slight erosion due to increased competition.

- Regulatory Environment: No significant approvals or restrictions that could dramatically alter the market landscape.

Projected Sales

Based on conservative estimates, BONIVA's global annual sales are projected to stabilize around USD 80-120 million over the next five years. This considers market maturity, competition, and potential minor gains in emerging markets. Slow decline is anticipated unless GSK introduces new formulations or indications.

Growth Opportunities

- Line Extensions & New Indications: Investigating additional dosing options or combination therapies.

- Market Expansion: Targeting expanding healthcare access in Asia-Pacific and Latin America.

- Patient Compliance Initiatives: Education campaigns to improve adherence could influence sales stability.

Strategic Considerations

Product Positioning

To sustain relevance, GSK might consider repositioning BONIVA through enhanced formulations or combining it with other agents to improve patient outcomes.

Pricing Strategies

Competitive pricing in emerging markets and offering value-driven packages could sustain revenue streams.

Regulatory Actions

Monitoring safety profiles and aligning with evolving clinical guidelines will be critical to maintaining market acceptance.

Key Takeaways

- Market Context: The osteoporosis segment remains sizeable, driven by demographic shifts, though competitive pressures and generic entries have eroded BONIVA’s market share.

- Sales Outlook: Future revenues are expected to plateau around USD 80-120 million annually, barring new approvals or innovative formulations.

- Competitive Edge: Ease of dosing remains a strength but must be balanced against emerging safety concerns and newer agents’ advantages.

- Opportunities: Market expansion, adherence programs, and product innovations could help sustain or grow BONIVA’s presence.

- Risks: Patent expiries, evolving treatment guidelines favoring other agents, and safety concerns pose ongoing challenges.

Conclusion

BONIVA’s future sales landscape hinges on strategic positioning amidst fierce competition and shifting clinical preferences. While near-term prospects suggest stability, long-term growth will depend on innovation and market adaptation.

FAQs

1. Will BONIVA regain market share against newer osteoporosis treatments?

While BONIVA's convenience remains attractive, the trend favors drugs with enhanced safety profiles like denosumab. Unless new formulations or indications are developed, regaining significant market share is unlikely.

2. How does the patent expiry impact BONIVA’s sales?

Patent expiry led to a surge in generic ibandronate options, causing price erosion and reduced branded sales. Generics dominate the market, limiting revenue potential for the original branded product.

3. Are there upcoming regulatory developments that could influence BONIVA’s market?

Regulatory agencies are increasingly cautious about long-term bisphosphonate safety. Any new safety advisories or approvals for alternative therapies could reduce BONIVA’s prescribing.

4. What strategies could GSK employ to prolong BONIVA’s relevance?

GSK could explore novel formulations, combination therapies, or new indications. Enhancing patient adherence through educational programs could also bolster market stability.

5. How significant is the emerging markets' potential for BONIVA?

Growing healthcare infrastructure and aging populations make emerging markets promising, but affordability and local preferences pose barriers that GSK must address to succeed.

References

- Transparency Market Research. "Osteoporosis Drugs Market." 2022.

- United Nations Department of Economic and Social Affairs. "World Population Ageing." 2022.

- GSK Annual Reports. "Financial Data on BONIVA." 2010-2022.

- IQVIA. "Osteoporosis Drug Market Share." 2022.

More… ↓