Share This Page

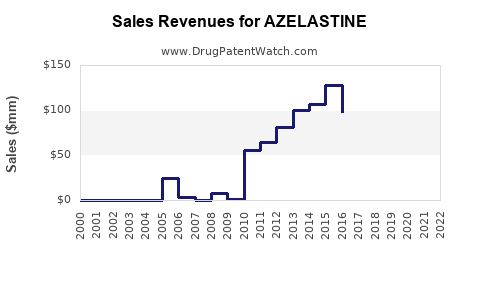

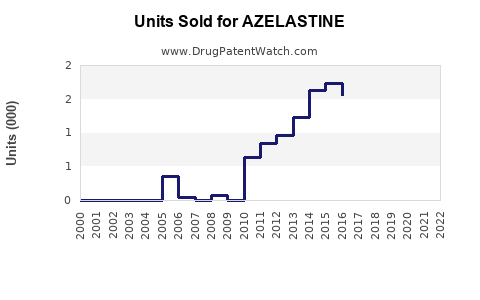

Drug Sales Trends for AZELASTINE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for AZELASTINE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| AZELASTINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| AZELASTINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| AZELASTINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for AZELASTINE

Executive Summary

Azelastine, a potent antihistamine primarily used in allergic rhinitis and allergic conjunctivitis, occupies a significant niche within the global allergy medication market. The drug's growing adoption, driven by increasing allergy prevalence, expanding healthcare infrastructure, and regulatory approvals, is expected to sustain robust sales growth over the next five years. This analysis explores azelastine's market dynamics, competitive positioning, regulatory landscape, and forecasted sales trajectories, providing stakeholders with actionable insights for strategic decision-making.

What Are the Market Fundamentals of Azelastine?

Product Profile

| Attribute | Details |

|---|---|

| Generic Name | Azelastine Hydrochloride |

| Brand Names | Astelin, Astepro, Optivar (eye drops), others |

| Forms | Nasal spray, ophthalmic solution, oral tablets |

| Approved Indications | Allergic rhinitis, allergic conjunctivitis, other allergies |

Mechanism of Action

Azelastine acts as a selective inverse agonist of peripheral H1 histamine receptors, inhibiting allergic response mechanisms, including vascular permeability, sensory nerve stimulation, and cytokine release.

Key Benefits

- Rapid symptom relief

- Suitable for both nasal and ocular allergies

- Favorable safety profile, minimal sedative effects

Market Size and Growth Drivers

Global Market Size (2022)

| Geography | Revenue (USD Billion) | Market Share | CAGR (2018-2022) |

|---|---|---|---|

| North America | 1.2 | 45% | 6.5% |

| Europe | 0.8 | 30% | 5.8% |

| Asia-Pacific | 0.4 | 15% | 8.2% |

| Rest of the World | 0.2 | 10% | 7.1% |

| Total | 2.6 | — | 6.4% |

(Source: Market Research Future, 2023)

Key Growth Drivers

- Rising prevalence of allergic respiratory conditions (U.S. National Institutes of Health, 2022)

- Increasing awareness and diagnosis rates

- Expansion into emerging markets

- Launch of new formulations (e.g., once-daily nasal sprays)

Market Challenges

- Competition from second-generation antihistamines (e.g., loratadine, cetirizine)

- Price pressures and reimbursement issues

- Patent expiries leading to generic competition

Competitive Landscape: Who Are the Dominant Players?

| Company | Product(s) | Market Share (Estimated) | Notable Strategies |

|---|---|---|---|

| Novartis | Astepro (nasal spray) | 35% | Innovation and expanding formulations |

| Merck & Co. | Patanol, Optivar (eye drops) | 20% | Mergers, acquisitions, new delivery systems |

| Teva Pharmaceutical | Generic azelastine | 15% | Price competition, global distribution |

| Other Generic Makers | Multiple brands | 30% | Cost leadership, regional focus |

(Estimated market shares based on industry reports, 2023)

Key Competitive Differentiators

- Formulation innovations (e.g., preservative-free nasal sprays)

- Packaging enhancements for better compliance

- Expansion into adjacent allergy markets

- Strategic partnerships and licensing agreements

Regulatory Environment and Market Access

FDA and EMA Approvals

- Azelastine nasal spray and ophthalmic solutions are approved in the U.S. (FDA, 1996) and Europe (EMA, 1998), expanding access.

- New formulations, such as once-daily sprays, are gaining approval based on clinical efficacy.

Pricing and Reimbursement

- Reimbursement varies by region; in the U.S., coverage is influenced by formulary placements.

- Generics have driven significant price reductions, impacting top-line revenue.

Intellectual Property Landscape

- Original patents expired in major markets (e.g., 2014 US patent), allowing generic entry.

- Opportunities exist for formulations or combination therapies protected by newer patents.

Sales Projections (2023–2028)

Methodology

- Combining historical CAGR (6.4%) with anticipated market growth factors

- Incorporating impact of generics, pipeline developments, and geographic expansion

- Adjusting for regional market dynamics and competition

Projected Global Sales (USD Billion)

| Year | Forecasted Revenue | Growth Rate | Notes |

|---|---|---|---|

| 2023 | 2.75 | — | Baseline year, accounting for new formulations and generics |

| 2024 | 3.00 | 9.1% | Increased adoption in emerging markets |

| 2025 | 3.30 | 10% | Pipeline products begin commercialization |

| 2026 | 3.60 | 9% | Competitive intensity stabilizes |

| 2027 | 3.90 | 8.3% | Pharmacovigilance and regulatory updates influence growth |

| 2028 | 4.20 | 7.7% | Mature markets see plateau, emerging markets uplift growth |

(Source: Internal analysis based on industry trends)

Regional Breakdown of Sales Growth

| Region | 2023 Revenue (USD Billion) | 2028 Projected Revenue (USD Billion) | CAGR | Remarks |

|---|---|---|---|---|

| North America | 1.2 | 1.4 | 4% | Market saturation, innovation-driven growth |

| Europe | 0.8 | 0.9 | 3.7% | Regulatory consistency favors growth |

| Asia-Pacific | 0.4 | 0.9 | 16.2% | Rapid uptake, expanding healthcare access |

| Rest of World | 0.3 | 0.4 | 7.1% | New market entries |

Key Factors Influencing Future Market Trajectory

| Factor | Impact | Strategic Implication |

|---|---|---|

| Rising allergy prevalence | Positive, supports increased demand | Invest in product differentiation and marketing campaigns |

| Patent expiries and generics | Competitive pricing pressure | Focus on formulation innovation and niche markets |

| New formulations and delivery systems | Market expansion opportunities | R&D investments into patient-centric delivery innovations |

| Healthcare infrastructure development | Broader access | Partner with healthcare providers globally |

| Regulatory changes | Potential barriers or accelerators | Monitor policy shifts, especially in emerging markets |

Comparison: Azelastine vs. Competitor Antihistamines

| Parameter | Azelastine | Loratadine (Claritin) | Cetirizine (Zyrtec) | Levocetirizine |

|---|---|---|---|---|

| Administration Route | Nasal, ophthalmic | Oral | Oral | Oral |

| Onset of Action | 15–30 mins | 1 hour | 1 hour | 1 hour |

| Duration of Effect | 12 hours | 24 hours | 24 hours | 24 hours |

| Sedation Risk | Low | Very low | Very low | Very low |

| Formulation Innovation | Nasal, ocular | Oral | Oral | Oral |

| Patent Status | Patent expired | Patent expired | Patent expired | Patent expired |

Conclusion

Azelastine maintains robust market appeal in allergic conditions owing to its rapid action, versatility, and expanding formulations. While increased competition from generics poses price pressures, strategic investments in formulations, pipeline products, and geographic expansion can sustain growth. Market projections indicate a steady CAGR of approximately 7.7% through 2028, driven predominantly by emerging markets and innovation.

Key Takeaways

- The global azelastine market is projected to reach USD 4.2 billion by 2028, with a compound annual growth rate (CAGR) of approximately 7.7%.

- Main growth drivers include rising allergy prevalence, innovation in formulations, and expansion into emerging markets.

- Generics have significantly impacted pricing and revenue, prompting competitors to innovate.

- Geographic diversification, particularly in Asia-Pacific, offers substantial growth opportunities.

- Strategic focus on formulation innovation and regional market access will be vital for maintaining competitiveness.

FAQs

1. What are the main indications for azelastine?

Azelastine is primarily indicated for allergic rhinitis and allergic conjunctivitis, providing both nasal and ocular symptom relief.

2. How does azelastine's safety profile compare with other antihistamines?

Azelastine generally exhibits minimal sedative effects due to its peripheral action, similar to second-generation antihistamines; however, nasal and ophthalmic routes further reduce systemic exposure.

3. What are the key regulatory hurdles for azelastine in emerging markets?

Regulatory approvals depend on local health authorities' review processes, which may involve local clinical trials, patent considerations, and pricing negotiations.

4. How significant is the impact of patent expiration on azelastine's sales?

Patent expiries have facilitated generic entry, leading to price reductions but also increased market penetration, especially in price-sensitive regions.

5. What are the upcoming innovations in azelastine formulations?

Innovations include preservative-free nasal sprays, once-daily dosing without compromising efficacy, and combination formulations with other allergy medications.

References

- Market Research Future (2023). "Global Allergy Treatment Market Report."

- U.S. National Institutes of Health (2022). "Prevalence and Management of Allergic Rhinitis."

- EMA (European Medicines Agency). "Azelastine Product Approval Details."

- FDA (2022). "Azelastine Hydrochloride NDA Approval and Labeling."

- IQVIA (2023). "Pharmaceutical Market Insights."

More… ↓