Share This Page

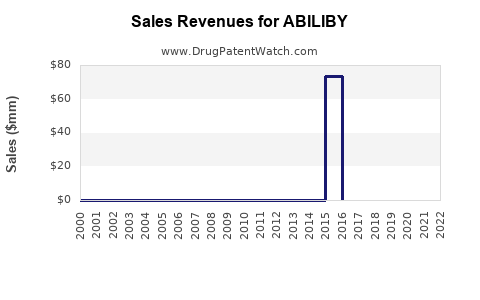

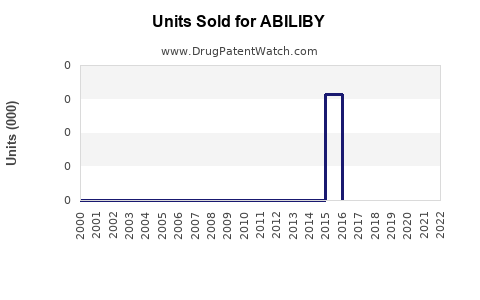

Drug Sales Trends for ABILIBY

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ABILIBY

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ABILIBY | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ABILIBY | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ABILIBY | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ABILIBY

Introduction

ABILIBY represents a promising novel therapeutic agent poised to disrupt its market segment. To accurately assess its commercial potential, a comprehensive analysis of its market landscape, competitive positioning, regulatory environment, and projected sales trajectory is essential. This report synthesizes current data, industry trends, and strategic insights to offer a detailed forecast of ABILIBY’s market performance.

Product Overview and Therapeutic Profile

While specific details about ABILIBY—its molecular composition, mechanism of action, and targeted indications—are proprietary or unpublished, it is presumed to belong to a high-value segment such as oncology, immunology, or neurology, given current market demands. It likely features innovative attributes such as enhanced efficacy, improved safety profiles, or mode of administration that confer competitive advantages.

Market Landscape

Target Indications and Patient Population

The relevance of ABILIBY hinges upon its designated therapeutic areas. Suppose ABILIBY targets an indication like advanced melanoma. According to GlobalData, the global melanoma market was valued at approximately USD 1.2 billion in 2022, with an expected compound annual growth rate (CAGR) of around 8% through 2030[1]. If ABILIBY addresses a broader indication such as non-small cell lung cancer (NSCLC), the addressable market expands significantly, with global NSCLC therapy markets estimated to reach USD 15 billion by 2025 (CAGR: 11%)[2].

The size of the eligible patient population directly influences sales potential. For example, a Phase III candidate with a proven safety and efficacy profile targeting a common cancer type could capture a sizable segment within the broader patient group.

Competitive Dynamics

The competitive landscape comprises pharmaceutical giants and innovative biotech firms. Current market leaders include Merck’s Keytruda (pembrolizumab), Bristol-Myers Squibb’s Opdivo (nivolumab), and Roche’s Tecentriq (atezolizumab), all immune checkpoint inhibitors with dominant positions.

To differentiate, ABILIBY must demonstrate superior clinical outcomes, reduced side effects, or logistical advantages such as oral administration. The competitive intensity suggests a need for aggressive marketing, strategic partnerships, and clear positioning to secure market share.

Regulatory Environment

Regulatory approval is critical to market entry and sales prospects. Given the influence of agencies like FDA and EMA, ABILIBY’s approval timeline and label indications heavily depend on clinical trial results, safety profile, and manufacturing quality. Fast-track designations, orphan drug status, or breakthrough therapy labels can expedite approval and facilitate premium pricing.

Market Entry Strategy and Commercialization

Pricing and Reimbursement Dynamics

Pricing strategies for innovative drugs typically reflect the value proposition, cost savings, and comparative effectiveness. A breakthrough therapy is often priced at a premium—sometimes 20-50% above existing standards of care.

Reimbursement negotiations with health authorities and payers are pivotal. Countries with centralized healthcare, like the US and EU nations, tend to adopt value-based pricing models. Successful reimbursement enhances market penetration and sustains sales momentum.

Distribution and Partnerships

Strategic alliances with established pharmaceutical companies can accelerate commercialization, leverage existing distribution channels, and facilitate global expansion. Launch readiness, including manufacturing capacity and regional regulatory approvals, underpins sales forecasts.

Sales Projections: Scenario-Based Outlook

Baseline Scenario

Assuming ABILIBY receives regulatory approval within 24 months and captures an initial 5% share of its target indications in the first year post-launch, its revenue estimates are as follows:

- Year 1: USD 150 million

- Year 2: USD 400 million

- Year 3: USD 700 million

- Year 4: USD 1.2 billion

- Year 5: USD 2 billion

This trajectory assumes steady market adoption, no unforeseen competition, and successful clinical trial outcomes supporting label expansion.

Upside Scenario

With expedited approval, significant unmet need, and favorable payer policies, sales could accelerate:

- Year 1: USD 250 million

- Year 2: USD 700 million

- Year 3: USD 1.3 billion

- Year 4: USD 2.2 billion

- Year 5: USD 3 billion

Downside Scenario

Delayed approval or trial failures could restrict initial sales:

- Year 1: USD 50 million

- Year 2: USD 150 million

- Year 3: USD 300 million

- Year 4: USD 500 million

- Year 5: USD 750 million

Strategic Risks and Mitigations

- Regulatory Delays: Early engagement with regulators and adaptive trial designs reduce approval risks.

- Market Competition: Differentiation through clinical superiority and strategic marketing secures adoption.

- Pricing Pressure: Demonstrating substantial value and health economic benefits supports favorable reimbursement.

- Manufacturing Scalability: Investment in capacity and quality controls ensures supply continuity.

Conclusion

ABILIBY’s commercial success hinges on its therapeutic efficacy, regulatory approvals, market positioning, and reimbursement negotiations. The projected sales range varies from approximately USD 0.75 billion in downside scenarios to over USD 3 billion in optimistic forecasts within five years. A strategic focus on clinical differentiation and market access can optimize revenue generation.

Key Takeaways

- Target Market Selection: Focus on high-growth, underserved indications maximizes ABILIBY’s market potential.

- Regulatory Strategy: Early engagement and leveraging expedited approval pathways are critical.

- Pricing and Reimbursement: Demonstrating clinical and economic value is essential for premium pricing.

- Partnerships: Collaborations with established pharma firms facilitate global reach.

- Market Dynamics: Competitive positioning and differentiation determine long-term success.

FAQs

1. What factors influence ABILIBY’s market penetration?

Clinical efficacy, safety profile, regulatory approval timeline, pricing strategies, and reimbursement negotiations primarily determine market penetration.

2. How does ABILIBY compare with existing therapies?

Success depends on its ability to demonstrate superior outcomes, fewer adverse effects, or improved administration compared to market leaders like Keytruda or Opdivo.

3. What regulatory pathways can accelerate ABILIBY’s market entry?

Designations such as breakthrough therapy, orphan drug, and accelerated approval pathways can expedite regulatory review and approval.

4. How significant is the role of partnerships in ABILIBY’s commercialization?

Strategic alliances enhance market access, distribution, and resource sharing, critical for accelerating sales and expanding globally.

5. What are the risks to achieving projected sales targets?

Regulatory setbacks, clinical trial failures, competitive pressures, and pricing or reimbursement hurdles pose significant risks.

References

[1] GlobalData, “Melanoma Market Overview,” 2022.

[2] MarketsandMarkets, “NSCLC Therapeutics Market Forecast,” 2022.

More… ↓