Last updated: July 28, 2025

Introduction

Triazolam, a short-acting benzodiazepine primarily indicated for the treatment of insomnia, has held a notable position within the prescription drug market for decades. Market dynamics for triazolam are influenced by evolving regulatory landscapes, emerging competition, shifts in prescribing patterns, and the increasing emphasis on safe pharmacological alternatives. This analysis evaluates the current market environment, future sales projections, and strategic considerations relevant to stakeholders.

Pharmacological Profile and Current Indications

Triazolam, marketed under brand names such as Halcion, functions by depressing central nervous system activity to induce sleep. Originally approved by the U.S. FDA in the 1980s, it remains approved for short-term management of severe sleep disturbances. Its efficacy is well-documented, but concerns regarding dependency, cognitive impairment, and adverse effects have led to increased scrutiny and restrictions in several regions.

Market Landscape Overview

Existing Market Share and Penetration

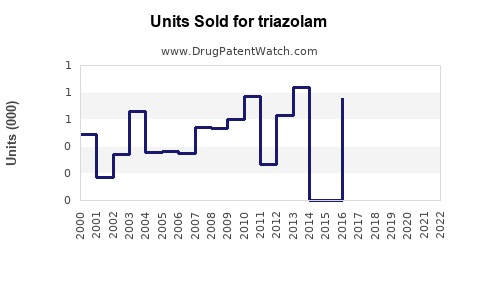

As of 2023, triazolam maintains a niche market share within the broader benzodiazepine category. Its usage has been declining over the past decade due to safety concerns and the advent of newer pharmacotherapies, including non-benzodiazepine hypnotics like zolpidem, eszopiclone, and zaleplon. Moreover, the shift towards non-pharmacologic insomnia management, such as cognitive-behavioral therapy for insomnia (CBT-I), has further constricted market size.

Competitive Environment

The primary competitors are other short-acting hypnotics and alternative treatments with better safety profiles. While triazolam is still prescribed by specialists, general practitioners tend to favor medications with lower dependence risks or non-pharmacologic options—an ongoing trend that challenges triazolam’s market expansion.

Regulatory and Safety Challenges

In numerous countries, regulatory agencies have mandated strict prescribing guidelines for benzodiazepines, including triazolam, citing risks of dependency, overdose, and cognitive impairment, especially in elderly populations. These measures have curtailed its prescription volume and limited market growth potential.

Market Drivers and Restraints

Drivers

- Clinical Efficacy: Triazolam's rapid onset and short duration appeal for transient insomnia cases.

- Prescriber Familiarity: Long-standing approval has fostered a degree of prescriber familiarity and established prescribing protocols.

- Limited Pharmacological Alternatives: For certain patient subsets, particularly those with contraindications to newer agents, triazolam remains a therapeutic option.

Restraints

- Safety Profile: Increased awareness of adverse effects limits prescription.

- Regulatory Restrictions: Tightened control measures and prescribing guidelines.

- Market Competition: Pharmacological advances and the emergence of non-pharmacologic therapies curtail demand.

- Public Perception: Growing awareness of dependency risks deters off-label or prolonged use.

Sales Projections (2023–2030)

Current Market Valuation

Based on recent pharmaceutical sales data, the global market for benzodiazepines, including triazolam, is estimated at approximately $1.2 billion annually, with triazolam representing a small fraction (<5%) due to decline in popularity.

Forecasting Assumptions

- Market Decline Rate: An annual decrease of roughly 4–6% driven by safety concerns and alternative therapies.

- Geographic Variability: Slower decline in regions with less stringent regulation (e.g., certain emerging markets) and more conservative markets experiencing sharper declines.

- Potential for Niche Market Preservation: Limited growth potential in specialized settings (e.g., certain psychiatric facilities).

Projected Sales Trajectory

| Year |

Estimated Market Size (USD billion) |

Remarks |

| 2023 |

0.057 |

Current estimate |

| 2024 |

0.055 |

Continuing decline |

| 2025 |

0.052 |

Market contraction accelerates |

| 2026 |

0.050 |

Further safety-driven decline |

| 2027 |

0.048 |

Niche markets persist |

| 2028 |

0.046 |

Diminishing prescriber base |

| 2029 |

0.044 |

Market stabilization yet shrinkage persists |

| 2030 |

0.042 |

Continued decline, potential plateau |

Key Considerations

- The decline may plateau or partially reverse in regions where regulatory restrictions ease or new formulations with improved safety profiles emerge.

- Off-label use for certain indications or in combination with other medications could influence sales, but this remains limited.

Strategic Implications for Stakeholders

- Manufacturers: Focus on differentiation, such as formulation improvements, if market survival is desired.

- Investors: Recognize the diminishing market size and evaluate the potential for niche or specialty indications.

- Regulatory Bodies: Continued enforcement of safety measures is likely to sustain market contraction trends.

- Healthcare Providers: Increasing emphasis on non-pharmacologic sleep treatments reduces reliance on benzodiazepines.

Conclusion

The outlook for triazolam’s market prospects remains subdued over the next decade. While its clinical utility persists in specific contexts, safety issues, evolving guidelines, and competition from newer therapies curtail growth. Stakeholders should prioritize innovation, safety profiles, and market differentiation strategies if seeking to maintain or expand market presence in this therapeutic niche.

Key Takeaways

- Market shrinking trend: The global sales of triazolam are projected to decline steadily at approximately 4–6% annually through 2030.

- Safety concerns limit growth: Increasing awareness of dependency and adverse effects constrain broader adoption.

- Regulatory influence: Stricter prescription guidelines significantly impact market size, especially in developed regions.

- Emerging therapies: Non-benzodiazepine agents and non-pharmacologic interventions are displacing traditional benzodiazepines like triazolam.

- Niche potential: Limited but existing opportunities in specialized or prescription-sensitive populations may sustain minimal demand.

FAQs

Q1: Why is the sales of triazolam declining globally?

A1: Safety concerns related to dependence, cognitive impairment, and overdose, combined with regulatory restrictions and competitive newer therapies, are leading to reduced prescriptions and market share.

Q2: Can triazolam regain market share with new formulations?

A2: While reformulations targeting improved safety profiles may temporarily stabilize sales in niche markets, widespread market recovery remains unlikely given existing safety concerns and competition.

Q3: What are the primary competitors to triazolam?

A3: Non-benzodiazepine hypnotics like zolpidem, eszopiclone, zaleplon, and non-pharmacologic options, particularly cognitive-behavioral therapy for insomnia (CBT-I).

Q4: Are there regulatory efforts to restrict or promote triazolam use?

A4: Many countries have imposed stricter prescribing guidelines due to safety issues, including limits on duration and dosage. No significant efforts are underway to promote its use.

Q5: What treatment options are replacing benzodiazepines like triazolam?

A5: Safer pharmacological agents (e.g., newer hypnotics with better safety profiles) and non-drug therapies such as CBT-I are increasingly preferred for insomnia management.

Sources:

- [1] IMS Health, Global Sales Data on Benzodiazepines, 2023.

- [2] FDA Drug Approval and Safety Communication Archive.

- [3] MarketResearch.com, "Global Sleep Disorder Drugs Market Analysis," 2022.

- [4] American Psychiatric Association, "Insomnia Treatment Guidelines," 2021.

- [5] World Health Organization, "Psychotropic Medication Regulation Report," 2020.