Last updated: July 28, 2025

Introduction

Pravastatin, a once-dominant HMG-CoA reductase inhibitor (statin), is prescribed primarily for lowering low-density lipoprotein (LDL) cholesterol and reducing cardiovascular risk. With its established efficacy and safety profile since FDA approval in 1991, pravastatin has experienced fluctuating market dynamics influenced by emerging therapies, patent expiration, and evolving clinical guidelines. This report provides a comprehensive market analysis and future sales projection for pravastatin, considering current trends, competitive landscape, regulatory considerations, and potential growth catalysts.

Market Overview

Historical Market Performance

Pravastatin Charles, manufactured by several pharmaceutical companies, has historically held a significant share of the statin market, competing with drugs like atorvastatin and rosuvastatin. According to IQVIA data, global statin sales peaked in the early 2010s, with pravastatin contributing a substantial portion until newer, more potent statins gained popularity.

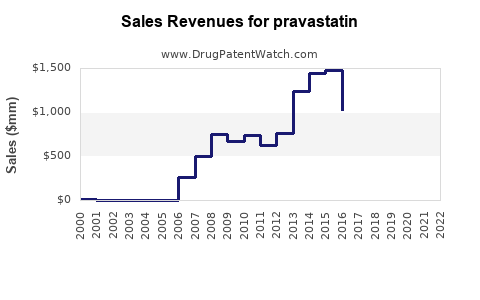

In the United States, pravastatin generated approximately $600 million annual revenue in 2012 [1]. However, sales have declined notably since the patent expiration of earlier formulations in 2006, which led to increased generic competition and price erosion.

Regulatory and Patent Landscape

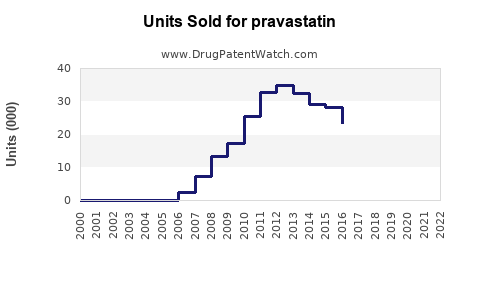

Pravastatin’s patent expiry in 2006 precipitated a surge in generic formulations, reducing treatment costs and expanding access. Despite generic competition, the drug remains prescribed due to its well-established safety profile and positioning in certain treatment protocols, especially among specific patient groups such as the elderly and those with contraindications to more potent statins [2].

Current Market Dynamics

- Generic Penetration: The availability of lower-cost generics has maintained pravastatin’s place in therapy but has limited revenue growth.

- Clinical Guidelines: Recent guidelines favor high-intensity statins (e.g., atorvastatin and rosuvastatin) for high-risk patients, marginalizing pravastatin’s use primarily to secondary or specific populations.

- Emerging Therapies: PCSK9 inhibitors and other lipid-modifying agents have challenged statin dominance in lipid management, especially for refractory cases.

Competitive Landscape

Key Players

- Brand/Generic Manufacturers: Multiple pharmaceutical firms produce pravastatin, including Teva, Mylan, and others, leading to competitive pricing pressures.

- Alternative Therapies: PCSK9 inhibitors (alirocumab, evolocumab), ezetimibe, bempedoic acid, and combination therapies have gained increasing market share [3].

Market Share Distribution

While pravastatin’s market share has contracted, it remains relevant, especially in markets emphasizing cost-effective therapy or specific patient demographics, such as elderly or statin-intolerant populations.

Market Segmentation and Demographics

- Geography: North America accounts for the largest share, driven by high cardiovascular disease prevalence and healthcare expenditure. Europe follows, with increasing generic penetration.

- Patient Demographics: Primarily adults aged 50+, with secondary prevention populations, and patients intolerant to higher-intensity statins.

- Formulation Preferences: Tablets at 10-40 mg are most common; consistent dosage forms promote adherence.

Drivers and Barriers

Growth Drivers

- Established Efficacy and Safety: Extensive clinical data supports pravastatin’s continued use.

- Cost-Effectiveness: Low-cost generic options keep the drug accessible.

- Population Aging: Growing aging populations with cardiovascular risk factors sustain demand.

Barriers

- Preference for Potent Statins: Clinicians favor high-dose atorvastatin and rosuvastatin for primary prevention.

- Emergence of Novel Agents: PCSK9 inhibitors and other second-line therapies limit the use of traditional statins.

- Regulatory Shifts: Updated guidelines emphasizing high-intensity statins may reduce pravastatin prescriptions.

Sales Projections (2023–2030)

Short-Term (2023–2025)

Sales are expected to stabilize or decline modestly due to sustained generic competition and clinical preference shifts. Despite this, certain niche markets—such as low-cost therapies in developing countries—may sustain volume.

Projected U.S. sales for pravastatin are expected to decline at a Compound Annual Growth Rate (CAGR) of approximately -2% to -3%, reaching around $400 million by 2025.

Mid to Long-Term (2026–2030)

Factors influencing long-term sales include:

- Patent Status: No significant patents are active; entry of biosimilars or reformulations is unlikely.

- Regulatory Approvals: No recent major indications or formulations are expected.

- Market Demand: Likely further decline, with potential stabilization in specific markets focusing on cost-effective lipid management.

By 2030, estimated sales may decline to approximately $350–$400 million globally, primarily driven by mature markets and specific regional use cases.

Emerging Niche Markets

- Combination Therapies: Fixed-dose combinations with aspirin or other lipid agents could influence sales in select populations.

- Gene and Biosimilar Innovations: Limited immediate impact but potential future disruptions.

Future Outlook and Strategic Considerations

Given current trends, pravastatin's market position will likely be relegated to niche or cost-sensitive segments. For stakeholders, opportunities exist in:

- Expanding in Developing Markets: Price advantages can support continued volume growth.

- Specialized Therapy Lines: Preserving use in patient groups contraindicated for high-intensity statins.

- Innovative Formulations: Developing novel formulations or fixed-dose combinations might extend lifecycle.

Investment in marketing efforts, stakeholder education, and strategic partnerships may support sustained revenues albeit at a declining trajectory.

Key Takeaways

- Pravastatin has experienced significant revenue decline after patent expiration, adapting to competitive pressure from other statins and novel lipid-lowering agents.

- Its primary appeal now resides in its safety profile and low cost, especially within generic markets.

- Despite expected declines, pravastatin remains relevant in specific demographic and regional markets.

- Future sales will be influenced heavily by market dynamics, clinical guidelines, and emerging therapies.

- Companies should consider strategic positioning in niche segments and expanding access in emerging markets to optimize remaining value.

FAQs

1. Will pravastatin regain market share with new formulations or indications?

Currently, no significant new formulations or indications are in development. The established safety profile supports its continued use, but market share gains are unlikely without innovative breakthroughs or new clinical evidence.

2. How does pravastatin compare with other statins in terms of efficacy?

Pravastatin has demonstrated effective LDL reduction; however, higher-intensity statins like atorvastatin and rosuvastatin offer greater potency, making them preferred for high-risk primary prevention.

3. What factors could influence future sales positively?

Potential factors include increased prescribing in cost-sensitive healthcare systems, expanded use in populations intolerant to potent statins, and regulatory support in emerging markets.

4. Is pravastatin still recommended in current clinical guidelines?

Yes, especially for secondary prevention and in patients where high-potency statins are contraindicated or poorly tolerated, but high-intensity statins are favored for optimal primary prevention.

5. What impact do biosimilars and generics have on pravastatin's market?

The proliferation of generics has substantially decreased prices, reducing revenue per prescription but increasing accessibility. The absence of biosimilars means minimal direct competition at the molecular level.

Sources

[1] IQVIA, Market Data Reports, 2012.

[2] U.S. Food and Drug Administration (FDA), Drug Approval and Patent Timeline.

[3] GlobalData, Lipid-Lowering Agents Market Analysis, 2022.