Share This Page

Drug Sales Trends for montelukast

✉ Email this page to a colleague

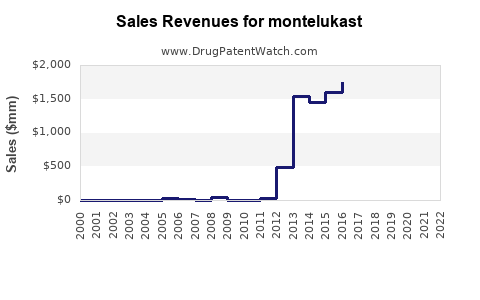

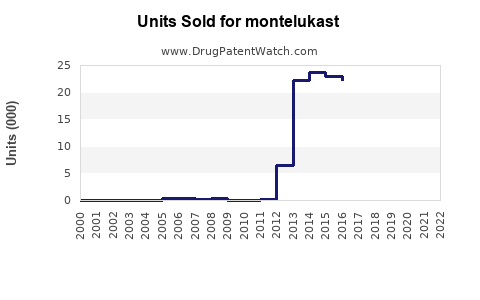

Annual Sales Revenues and Units Sold for montelukast

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MONTELUKAST | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MONTELUKAST | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MONTELUKAST | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MONTELUKAST | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Montelukast

Introduction

Montelukast, a leukotriene receptor antagonist, is widely prescribed for managing asthma and allergic rhinitis. Since its introduction, it has become a mainstay in respiratory disease treatments, supported by global prevalence of asthma and allergic conditions. This analysis evaluates current market dynamics, competitive landscape, regulatory environment, and project future sales trajectories for Montelukast over the next five years, providing strategic insights for stakeholders.

Market Overview

Global Market Size and Growth

The global respiratory drug market is valued at approximately USD 40 billion in 2023, with asthma therapies constituting a significant segment. Montelukast's global sales are estimated to account for around USD 1.5 billion annually, driven by its proven efficacy, oral administration convenience, and favorable safety profile. The compound’s uptake across pediatric and adult populations sustains its strong market presence.

Projected compound annual growth rate (CAGR) for Montelukast sales is approximately 5-6% through 2028, underpinned by increasing asthma prevalence, expanding indications, and generic penetration.

Prevalence of Indications

According to the World Health Organization (WHO), asthma affects an estimated 262 million people globally, with childhood prevalence rising in both developed and developing regions. Allergic rhinitis impacts approximately 10-30% of the global population. These large patient bases continue to stimulate demand, especially with increased awareness and diagnosis.

Competitive Landscape

Montelukast faces competition from inhaled corticosteroids (ICS), long-acting beta-agonists (LABAs), biologics (e.g., omalizumab), and newer leukotriene pathway agents. Notably, the patent expiry of Singulair (brand name for Montelukast) in many markets has facilitated generic entrants, substantially reducing prices and increasing accessibility.

Major generic manufacturers, along with branded pharmaceutical firms, are competing for market share. The rise of biologics in severe asthma management, however, poses a competitive threat in specific patient segments.

Regulatory and Market Dynamics

Patent and Regulatory Environment

The original patent for Montelukast expired in 2012 in some regions, prompting a surge of generics. Recent concerns over neuropsychiatric side effects have prompted regulatory reviews, impacting prescribing patterns but not substantially diminishing global demand.

Regulatory agencies like the FDA and EMA continue to approve new formulations and indications, supporting product lifecycle extension and market growth.

Pricing and Reimbursement Policies

Pricing strategies vary globally, with high-income countries offering robust reimbursement frameworks favoring branded versions. In emerging markets, affordability drives generic sales, with government reimbursement schemes expanding access.

Sales Projections (2023-2028)

Forecast Assumptions

- Continued prevalence of asthma and allergic rhinitis

- Incremental adoption of Montelukast in combination therapies

- Penetration into newly diagnosed and underserved populations

- Impact of COVID-19 pandemic recovery on respiratory medication demand

- Ongoing competition from generics and biologics

Projected Revenue Growth

Based on current trends, Montelukast sales are expected to grow from USD 1.5 billion in 2023 to approximately USD 2.3 - 2.6 billion in 2028, representing a CAGR of 6-7%. Growth will be most pronounced in emerging markets, where increasing healthcare access and awareness balance out pricing pressures.

Market Segmentation

- By Geography: North America (40%), Europe (25%), Asia-Pacific (20%), Latin America and Africa (15%)

- By Patient Demographics: Pediatric (40%), Adult (60%)

- By Indication: Asthma (70%), Allergic Rhinitis (20%), Combination/Other (10%)

In particular, Asia-Pacific is projected to witness accelerated growth owing to rising asthma prevalence, urbanization, and expanding healthcare infrastructure.

Strategic Insights

- Market Penetration: Manufacturers should target generic distribution channels and develop strategic partnerships with local distributors in emerging markets.

- Product Differentiation: Investing in fixed-dose combinations and delivery systems could enhance adherence and market share.

- Regulatory Engagement: Proactively addressing safety concerns and obtaining label expansions will support sustained demand.

- Pipeline Development: Advancing research into novel leukotriene receptor antagonists or combination therapies could open new revenue streams.

Risks and Challenges

- Regulatory re-evaluations due to safety concerns may temporarily dampen sales.

- Price erosion from patent expiries and increasing generics erodes margins.

- Competition from biologics may relegate Montelukast to earlier intervention stages, impacting premium pricing.

- Variability in regional healthcare policies influences access and sales; flexibility is essential.

Conclusion

Montelukast maintains a stable and growing footprint within the respiratory therapeutics landscape. Its broad indication base, continued prevalence of target diseases, and expanding access in emerging markets support optimistic sales projections. Strategic adaptation to market dynamics, regulatory developments, and competitive threats will be essential for sustained growth.

Key Takeaways

- The global Montelukast market is projected to grow at a CAGR of approximately 6-7% through 2028, reaching USD 2.3-2.6 billion.

- Dominant sales in North America and Europe will be complemented by accelerating growth in Asia-Pacific and Latin America.

- Patent expiries have facilitated generic competition, but demand remains robust due to the large patient population.

- Safety profile concerns and regulatory reviews exert downward pressure, necessitating proactive regulatory strategies.

- Expanding indications and developing combination formulations offer avenues for growth.

Frequently Asked Questions (FAQs)

Q1: How does generic competition impact Montelukast sales projections?

A1: Generic entrants significantly reduce product prices, leading to decreased revenue per unit but increasing market volume due to broader accessibility. Despite price erosion, total sales are expected to grow due to expanding patient populations and increased geographic reach.

Q2: What role do emerging markets play in Montelukast's future sales?

A2: Emerging markets, characterized by rising asthma and allergic disease prevalence and improving healthcare infrastructure, will contribute substantially to sales growth, filling the gap left by saturation in mature markets.

Q3: Are there new formulations or indications for Montelukast in development?

A3: While current development focuses on fixed-dose combinations and novel delivery systems, ongoing research into expanded indications could further stimulate sales.

Q4: What competitive threats does Montelukast face from biologic therapies?

A4: Biologics target severe asthma and allergic rhinitis refractory to conventional therapy, potentially replacing Montelukast in these niches. However, biologics' cost and administration routes limit widespread displacement.

Q5: How are safety concerns affecting Montelukast’s market position?

A5: Reports of neuropsychiatric side effects have prompted regulatory reviews and label updates, impacting prescribing habits temporarily. Clear safety profiles and communication strategies are vital for maintaining confidence and sales stability.

References

[1] WHO Global Asthma Report 2022.

[2] Market Research Future. "Leukotriene Receptor Antagonists Market Analysis," 2023.

[3] IQVIA Data on Global Respiratory Drugs Trends, 2023.

[4] FDA Drug Safety Communications, 2022.

[5] European Medicines Agency. "Review of Montelukast and Neuropsychiatric Effects," 2022.

More… ↓