Last updated: July 27, 2025

Introduction

Lorazepam, a benzodiazepine with anxiolytic, sedative, and anticonvulsant properties, remains a cornerstone in the management of anxiety disorders, insomnia, and status epilepticus. Developed by Wyeth Laboratories in the 1960s, lorazepam has since maintained a significant presence in psychiatric and emergency medicine. This analysis evaluates current market dynamics and projects future sales trajectories, considering clinical demand, regulatory factors, competition, and societal trends.

Market Overview

Global Therapeutic Landscape

Lorazepam's therapeutic niche is well-established, with global sales anchored in private and public healthcare sectors. In 2021, the benzodiazepine market was valued at approximately USD 3.25 billion, expected to grow at a CAGR of 2.8% through 2028 [1]. Lorazepam accounts for a significant segment within this, especially in North America and Europe, where prescribing patterns favor its efficacy and well-documented safety profile.

Key Market Drivers

-

Prevalence of Anxiety and Sleep Disorders: Data indicate that nearly 30% of adults globally experience anxiety at some point [2], fueling demand for fast-acting anxiolytics like lorazepam.

-

Emergency Medicine Usage: Lorazepam’s efficacy in managing status epilepticus positions it as essential in emergency protocols, supporting consistent demand in hospital settings.

-

Off-Label and Niche Applications: Outside primary indications, lorazepam is utilized for sedation in intensive care units, further broadening its market penetrance.

Market Challenges

-

Regulatory and Abuse Concerns: Rising awareness of benzodiazepine dependency has led to tighter prescribing restrictions, impacting long-term sales.

-

Generic Competition: The availability of cost-effective generics reduces brand-name sales margins, shifting market share.

-

Alternative Therapies: Cognitive-behavioral therapy (CBT) and newer pharmacologics (e.g., SSRIs, SNRIs) provide non-addictive alternatives for anxiety, influencing prescription trends.

Pharmacoeconomic and Regulatory Considerations

The increasing emphasis on drug safety has prompted regulatory agencies like the FDA and EMA to implement stricter guidelines on benzodiazepine prescriptions. This impacts market growth, especially in regions prioritizing opioid-like dependency controls. Conversely, withdrawal management programs for benzodiazepine dependence foster certain demand for lorazepam in specialized settings.

Furthermore, patent expirations have led to proliferating generic options, with private label manufacturers capturing price-sensitive segments. Nonetheless, brand loyalty remains in specific clinical niches, especially for formulations with improved bioavailability or delivery methods.

Regional Market Analysis

North America

The largest market, accounting for around 45% of global lorazepam sales, driven by high prevalence of anxiety disorders and robust healthcare infrastructure.

Europe

Significant demand, especially in the UK, Germany, and France, with increasing regulation curbing overprescription but expanding use in acute care.

Asia-Pacific

A high-growth area with expanding healthcare systems and increasing awareness of mental health, projected to expand at a CAGR of approximately 4.0% through 2028 [3].

Latin America and Middle East & Africa

Emerging markets with growing access to psychiatric medications; potential growth driven by expanding mental health initiatives.

Sales Projections

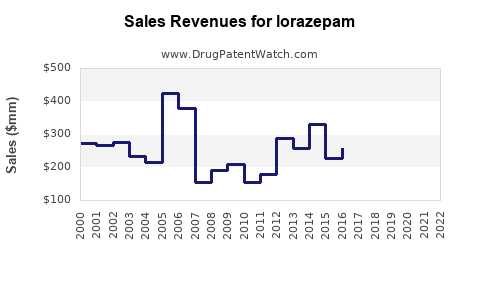

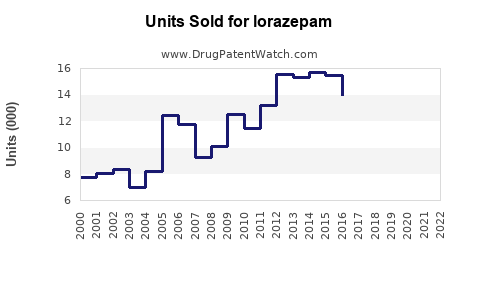

Historical Trends

Between 2018 and 2022, global lorazepam sales experienced modest growth from approximately USD 750 million to USD 830 million, reflecting stability in hospital and emergency settings but flattening due to regulatory tightening and popularity of alternatives.

Forecast for 2023-2028

Assuming steady but cautious growth, driven by:

- Demographic shifts: Aging populations in developed countries will increase prevalence of comorbidities like anxiety and seizures.

- Emerging markets: Rapid expansion of healthcare infrastructure supports increased prescriptions.

- Regulatory environment: Continued restrictions may limit new prescriptions but sustain demand in acute care.

Projected sales volumes could reach USD 1.0 billion by 2028, with an average annual growth rate of approximately 3%, considering market saturation and regulatory constraints.

Segment and Formulation Trends

- Formulation Diversification: Injectable lorazepam for emergency use and sublingual formulations may experience higher growth.

- Generic Penetration: Continued proliferation of generics will dominate sales, with branded versions focusing on niche markets.

Competitive Landscape

Leading generics manufacturers like Hikma, Teva, and Sandoz dominate in producing cost-effective formulations. Brand manufacturers are focusing on formulations with improved safety profiles (e.g., abuse-deterrent forms) and targeted marketing in hospital systems.

Emerging players are investing in digital health integration and pharmacovigilance to distinguish their offerings amidst stringent regulatory environments.

Impact of Emerging Trends

- Digital Health and Telemedicine: Increased virtual consultations may influence prescribing patterns, favoring short-term, supervised benzodiazepine use.

- Alternative Therapies: Adoption of non-pharmacological interventions might temper long-term sales growth but leave emergency applications largely unaffected.

- Policy Shifts: Governments may implement stricter controls on benzodiazepines, dampening future sales but simultaneously creating niche markets for specialized formulations.

Conclusion

Lorazepam maintains a vital role in classical clinical settings, with stable but cautiously optimistic sales projections. The drug's future hinges on balancing regulatory oversight, evolving clinical guidelines, and societal attitudes toward benzodiazepine use. Market opportunities are present in emerging regions and formulations, although growth will likely be moderated by shifts toward alternative therapies and stricter prescribing policies.

Key Takeaways

- Stable Foundations: Lorazepam’s established clinical role ensures consistent demand, particularly in emergency and hospital settings.

- Market Growth Potential: Emerging markets and formulation innovations present growth avenues, with a forecasted USD 1 billion global sales by 2028.

- Regulatory Constraints: Tighter controls and addiction concerns will restrict long-term prescribing, emphasizing acute and short-term uses.

- Generic Market Dominance: Generics will continue capturing substantial market shares due to cost competitiveness.

- Societal and Policy Influences: Mental health awareness and policy shifts toward non-addictive treatments will shape future prescribing trends.

FAQs

1. What are the primary clinical indications for lorazepam?

Lorazepam is mainly prescribed for anxiety disorders, insomnia, preoperative sedation, and as initial treatment for status epilepticus.

2. How does regulatory oversight impact lorazepam's market?

Regulatory agencies impose prescribing restrictions due to abuse potential, which can limit long-term sales but uphold emergency and acute care demand.

3. Who are the main competitors in the lorazepam market?

Major generic manufacturers like Hikma, Teva, and Sandoz lead production, with branded options focusing on niche formulations and safety features.

4. What is the significance of the emerging markets in lorazepam’s future?

Rapid healthcare infrastructure development and increasing mental health awareness support growth in Asia-Pacific, Latin America, and Middle East Africa regions.

5. How might alternative therapies influence lorazepam sales?

Growing acceptance of psychological interventions and non-benzodiazepine medications could reduce long-term prescriptions but leave acute and emergency uses largely unaffected.

References

[1] Mordor Intelligence. "Global Benzodiazepines Market – Growth, Trends, and Forecast (2022-2028)."

[2] WHO. "Mental health: Strengthening our response." World Health Organization, 2022.

[3] Grand View Research. "Asia-Pacific Benzodiazepines Market Size, Share & Trends Analysis Report," 2022.