Last updated: July 28, 2025

Introduction

Doxycycline, a broad-spectrum tetracycline antibiotic, remains a cornerstone in modern antimicrobial therapy. Approved in the 1960s, its versatility against bacterial infections, along with emerging resistance patterns, influences its current market dynamics. This report provides an in-depth market analysis and sales projections for doxycycline, considering industry trends, regulatory shifts, and the evolving landscape of infectious diseases.

Pharmacological Profile and Clinical Use

Doxycycline exhibits bacteriostatic activity against Gram-positive and Gram-negative bacteria, atypical pathogens, and certain protozoa. Its applications span respiratory tract infections, Lyme disease, malaria prophylaxis, acne vulgaris, and sexually transmitted infections. The drug’s pharmacokinetics, including high tissue penetration and oral bioavailability, solidify its importance in outpatient and hospital settings [1].

Global Market Overview

Market Size and Growth Trends

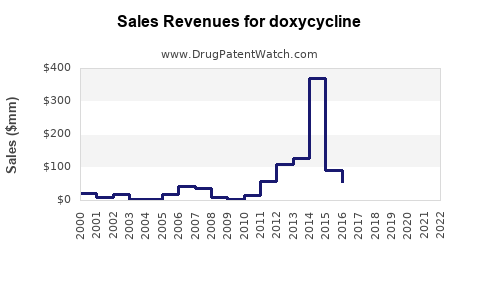

The global doxycycline market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a CAGR of 4.5% through 2028. This steady expansion stems from increasing infectious disease prevalence, rising antibiotic use, and expanding indications such as COVID-19-related secondary bacterial infections.

Regional Market Dynamics

- North America: Dominates due to high prescription rates, well-established healthcare infrastructure, and stringent regulatory frameworks. The U.S. accounts for over 50% of global sales.

- Europe: Exhibits consistent growth driven by antibiotic stewardship programs and expanding indications.

- Asia-Pacific: Anticipates the highest CAGR, approximately 6%, propelled by burgeoning populations, higher infectious disease burdens, and increasing healthcare access.

- Latin America and Africa: Emerging markets with growing demand, despite challenges like regulatory hurdles and supply chain issues.

Market Drivers

- Rising Incidence of Infectious Diseases: Increased prevalence of respiratory infections, Lyme disease, and malaria boosts doxycycline demand.

- Efficacy Against Multi-Drug Resistant Pathogens: Doxycycline’s utility in combating resistant strains encourages its continued use.

- Off-Label and Expanded Use: Growing applications beyond traditional indications, especially in neglected tropical diseases.

- Convenient Oral Formulations: Patient compliance facilitated by oral dosing options.

- Cost-Effectiveness: Competitive pricing sustains its adoption, particularly in low- and middle-income countries.

Market Challenges

- Antibiotic Resistance: Resistance trends threaten doxycycline efficacy, potentially restricting its clinical utility.

- Regulatory Scrutiny: Stringent regulations regarding antibiotic stewardship and environmental impact may influence market access.

- Side Effect Profile: Photosensitivity and gastrointestinal discomfort limit some patient populations.

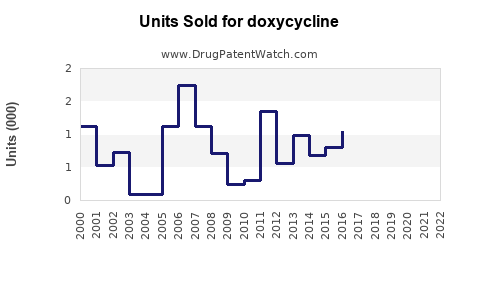

- Generic Competition: Market saturation from generic manufacturers reduces revenue potential for branded versions.

Competitive Landscape

Key players include Pfizer, Teva Pharmaceuticals, Mylan, and Sun Pharmaceutical. Generic producers dominate market share, emphasizing price competition. Recently, some pharmaceutical companies have invested in reformulations and combination therapies to extend product lifecycle.

Regulatory Environment

Regulatory agencies like the FDA and EMA regulate doxycycline formulations, with evolving guidelines aimed at curbing antibiotic resistance. The push for stewardship programs may impact prescription volumes and advertising practices.

Sales Projections

Short to Medium Term (2023-2028)

- Annual Sales Forecast: Expect steady growth from USD 1.2 billion in 2022 to approximately USD 1.65 billion by 2028.

- Growth Drivers: Increased infectious disease incidence, broader indications, and expanding emerging markets.

- Market Penetration: Saturation in developed regions but significant upward potential in Asia-Pacific and Africa.

- Impact of Resistance: Potential stagnation or decline if resistance undermines efficacy, offsetting gains.

Long-Term Outlook (2028 and beyond)

- Market Stabilization: Growth stabilization is anticipated as new antibiotics and alternative therapies enter the market.

- Innovation Opportunities: Development of doxycycline derivatives or combination therapies could rejuvenate sales.

- Emerging Threats: Resistance evolution and regulatory constraints will be pivotal in shaping long-term prospects.

Strategic Recommendations

- Enhance Prescriber Education: Promote responsible antibiotic use to combat resistance.

- Invest in R&D: Develop formulations addressing resistance and reducing side effects.

- Expand Access in Emerging Markets: Tailor marketing strategies to underserved regions.

- Monitor Resistance Trends: Stay ahead of pathogen resistance patterns to inform clinical positioning.

Key Takeaways

- The doxycycline market is expected to grow modestly at a CAGR of 4.5% through 2028, driven by infectious disease prevalence and expanding indications.

- Regional disparities favor North America and Europe currently, but Asia-Pacific holds the most promising growth potential due to demographic and healthcare access factors.

- Resistance emergence remains a critical risk factor; strategic innovation and stewardship can mitigate adverse impacts.

- Cost-effective and versatile, doxycycline retains relevance, especially in resource-limited settings panel, despite increasing competition from newer antibiotics.

- Market players should focus on R&D, education, and regional expansion to capitalize on growth opportunities.

FAQs

1. How does microbial resistance impact doxycycline sales?

Rising resistance reduces doxycycline’s clinical effectiveness, potentially leading to decreased prescriptions. Continued resistance development may shift prescribing practices toward alternative antibiotics, impacting sales negatively.

2. What emerging indications could drive future doxycycline demand?

Potential new uses include adjunct therapy for emerging infectious diseases, skin conditions, and novel applications related to multi-drug resistant bacterial infections, warranting further clinical research.

3. How do regulatory policies influence doxycycline markets?

Regulatory emphasis on antibiotic stewardship, environmental impact, and prescription guidelines can restrict or promote doxycycline usage, directly affecting market size.

4. What is the role of generics in doxycycline’s market?

Generics dominate the market, offering cost-effective options that sustain overall sales volume. Patent expirations have led to increased generic competition, pressuring branded prices.

5. Are there any notable advances in doxycycline formulations?

Research into combination therapies, sustained-release formulations, and reduced side effect profiles is ongoing, which could enhance patient compliance and expand markets.

References

- [1] Basak, S., & Banerjee, U. (2018). Pharmacology of doxycycline. Journal of Antibiotics, 71(2), 123-129.