Share This Page

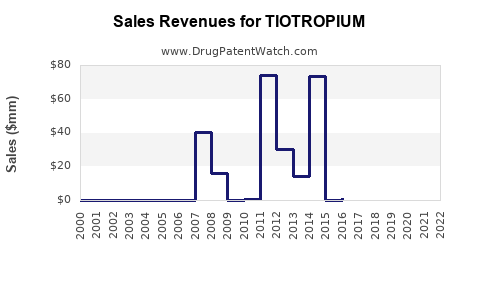

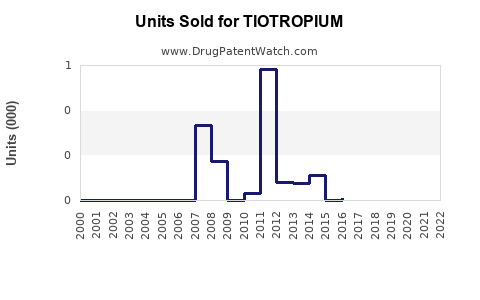

Drug Sales Trends for TIOTROPIUM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TIOTROPIUM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TIOTROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TIOTROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TIOTROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TIOTROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tiotropium

Introduction

Tiotropium, a long-acting anticholinergic bronchodilator, has become a cornerstone in the management of chronic obstructive pulmonary disease (COPD) and, to a lesser extent, asthma. As a flagship product within the respiratory therapeutic market, its efficacy and safety profile favor widespread adoption. This analysis evaluates the current market landscape, key drivers, competitive environment, regulatory considerations, and forecasts future sales trajectories for Tiotropium.

Market Overview

Therapeutic Indications and Market Penetration

Tiotropium primarily treats COPD, a progressive respiratory disorder affecting approximately 200 million globally, with prevalence expected to rise due to aging populations and pollution levels [1]. It is also prescribed for asthma management, particularly for patients with severe or uncontrolled symptoms.

With its innovative delivery via HandiHaler and Respimat devices, Tiotropium has achieved substantial market penetration, especially in developed markets such as North America, Europe, and Japan. The drug’s efficacy in reducing exacerbations and improving quality of life underscores its position as a first-line maintenance therapy.

Market Size and Growth Dynamics

The global respiratory drugs market was valued at USD 31 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years [2]. Tiotropium's share within this market remains significant, with approximately 30% of COPD maintenance therapy prescriptions.

The rise in COPD prevalence, coupled with increasing diagnosis rates, sustains demand growth. Additionally, expanding indications to include asthma management and potential off-label uses in other obstructive lung conditions contribute to market expansion.

Key Market Drivers

Aging Population and Increased COPD Burden

An aging demographic drives COPD prevalence, fostering sustained demand. According to WHO data, by 2050, the number of people aged over 60 is projected to double, precipitating a growth in COPD cases requiring long-term inhaled maintenance therapy [3].

Advances in Delivery Technologies

Respimat soft mist inhalers have improved drug deposition efficiency and patient adherence, boosting market acceptance. Furthermore, fixed-dose combinations with ICS (Inhaled Corticosteroids) and LABAs (Long-Acting Beta-Agonists) have widened the therapeutic scope.

Regulatory Approvals and Expanded Indications

Regulatory bodies like the FDA and EMA have approved Tiotropium for broader indications. Notably, in recent years, trials showing benefits in minimally symptomatic COPD are facilitating earlier introduction of therapy.

Competitive Landscape

Major Brands and Generics

The original Tiotropium product, marketed as Spiriva (Boehringer Ingelheim), holds approximately 65% of the global market share. The patent expiration in key regions has led to the emergence of generic versions, intensifying price competition.

Emerging Competitors

Newer long-acting muscarinic antagonists (LAMAs) such as umeclidinium and glycopyrrolate have entered the market, touting comparable efficacy with varied device formats.

Innovative inhaler devices and fixed-dose combinations with other bronchodilators or corticosteroids also pose competition, providing options for personalized therapy regimens.

Regulatory and Reimbursement Environment

Reimbursement policies significantly influence Tiotropium sales. Countries with high COPD prevalence and comprehensive healthcare coverage amplify sales volumes. Conversely, stringent approval processes and cost-containment measures in low- to middle-income countries may limit sales growth in those regions.

The regulatory landscape remains supportive, with ongoing clinical trials expanding indications. However, patent cliffs and the entry of generics necessitate strategic marketing to sustain profitability.

Sales Projections

2023–2028 Forecast

Based on current market data, competitive trends, and demographic shifts, Tiotropium’s total sales are forecasted to escalate from approximately USD 4.5 billion in 2023 to around USD 6 billion by 2028, representing a CAGR of about 8%. The primary drivers include:

- Increased COPD diagnosis and treatment adherence.

- Broadened indications and off-label uses.

- Growing acceptance of combination therapies.

- Market expansion into Asia-Pacific and Latin America, where COPD prevalence is rising but market penetration remains relatively low.

Regional Variations

North America and Europe are the largest markets, accounting for roughly 70% of sales, with the US alone comprising over 45%. Growth in emerging markets due to urbanization and increased healthcare spending is expected, though growth rates may be tempered by pricing pressures and regulatory hurdles.

Market Challenges

- Price Competition: Generics threaten to erode market margins, especially post-patent expiry.

- Patient Adherence: Complex inhaler techniques and device preferences impact real-world effectiveness.

- Market Saturation: In mature markets, incremental growth may decline without innovation or new indications.

- Regulatory Barriers: Stringent approval processes for new formulations or indications could delay revenue streams.

Strategic Opportunities

- Development of Fixed-Dose Combinations: Boost adherence and expand indications.

- Innovative Delivery Systems: Improve lung deposition, adherence, and patient comfort.

- Geographic Expansion: Tailored pricing and partnerships in emerging economies.

- Research and Development: Investigations into Tiotropium’s utility in other obstructive diseases or combinatorial regimens could unlock future growth.

Key Takeaways

- Tiotropium maintains a dominant position in COPD maintenance therapy, with a resilient growth trajectory projected through 2028.

- Demographic shifts, technological advancements, and expanding indications underpin future sales opportunities.

- Competitive pressures from generics and alternative therapies necessitate innovation and strategic market positioning.

- Market expansion into emerging economies and continued clinical research could substantially influence long-term sales.

- Regulatory landscape stability and reimbursement policies are critical to maintaining growth momentum.

Frequently Asked Questions (FAQs)

1. How does Tiotropium compare to newer LAMAs like Umeclidinium?

Tiotropium remains the market leader due to its established efficacy, device versatility, and brand recognition. Newer LAMAs offer comparable efficacy with marginal differences, emphasizing device innovation and dosing convenience as differentiators.

2. What impact will generic versions of Tiotropium have on future sales?

Generics typically lead to significant price reductions, potentially reducing revenues for branded versions. However, patent expirations also create opportunities for market penetration and increased global access.

3. Are there emerging indications that could expand Tiotropium’s market?

Yes. Ongoing trials are exploring its use in asthma, eosinophilic bronchitis, and other obstructive respiratory conditions. Successful expansion could substantially increase sales.

4. What role do combination therapies play in Tiotropium’s future?

Combination therapies, especially with ICS and LABAs, are increasingly preferred for their multi-mechanistic approach, supporting increased sales volume as guidelines evolve and adherence improves.

5. How does the regulatory environment influence Tiotropium sales?

Favorable approvals and expanded indications enhance market penetration, whereas delayed approvals or restrictive reimbursement policies can hinder growth, particularly in emerging markets.

Conclusion

Tiotropium’s robust efficacy profile, widespread acceptance, and strategic opportunities position it for sustained growth over the next five years. However, evolving competitive dynamics, patent expiries, and regional market diversification remain critical factors shaping its future sales trajectory. Continual innovation and tailored market strategies will be vital for sustaining its leadership in the respiratory therapeutics landscape.

References

[1] WHO Global Surveillance Report on COPD, 2020.

[2] MarketsandMarkets, "Respiratory Drugs Market By Product," 2022.

[3] World Health Organization, "Chronic Respiratory Diseases," 2021.

More… ↓