Last updated: July 27, 2025

Introduction

TAPAZOLE (methimazole) is a well-established antithyroid medication primarily used to manage hyperthyroidism, especially in patients with Graves' disease. As a first-line therapy in endocrine disorder management, the drug’s market potential hinges on clinical demand, patient prevalence, regulatory status, and competitive dynamics within the endocrinology therapeutic landscape.

This analysis provides a comprehensive overview of the current market landscape, key drivers, competitive environment, and sales projections for TAPAZOLE over the next five years, enabling stakeholders to inform strategic decisions.

1. Market Overview

Global Hyperthyroidism Treatment Market

The global market for hyperthyroidism therapeutics is projected to grow steadily, driven by rising prevalence of thyroid disorders, increasing awareness, and advancements in treatment options. The growth rate is estimated at a CAGR of approximately 4.2% from 2023 to 2028 (Source: Global Data). Key regions include North America, Europe, and Asia-Pacific, each influencing overall market dynamics.

Prevalence of Hyperthyroidism

Approximately 1-2% of the global population suffers from hyperthyroidism, predominantly affecting women aged 20-40 years [1]. The increasing diagnosis rate, especially in aging populations, favors sustained demand for antithyroid drugs like TAPAZOLE.

2. Market Drivers and Barriers

Drivers

- Established Clinical Efficacy: TAPAZOLE’s proven efficacy in controlling thyroid hormone overproduction makes it a trusted first-line treatment.

- Brand Recognition & Physician Preference: Long-standing market presence reinforces physician confidence.

- Oral Administration: Convenience enhances compliance, supporting steady demand.

- Regulatory Approvals: Continued acceptability across major markets supports ongoing sales.

Barriers

- Availability of Alternatives: Use of radioactive iodine therapy and surgery may displace medical management in certain cases.

- Side Effect Profile: Risk of agranulocytosis and hepatotoxicity can limit long-term use.

- Generic Competition: Many pharmaceutical companies produce methimazole, leading to pricing pressures.

3. Competitive Landscape

- Generic Methimazole: The dominant form, with multiple manufacturers globally.

- Alternative Agents: Propylthiouracil (PTU), radioactive iodine (I-131), and thyroidectomy are alternatives.

- Emerging Therapies: Novel agents and biologics under development could influence future demand.

Given its patent expiration and widespread generic availability, TAPAZOLE’s market share primarily depends on formulary preferences, physician prescribing habits, and regional regulatory statuses.

4. Regulatory Environment

TAPAZOLE’s approval status varies globally. In the U.S., it is available via prescription, with Black Box warnings issued for adverse effects; similar restrictions apply in Europe. Regulatory scrutiny and safety warnings influence prescribing patterns and, consequently, market size.

5. Sales Projections

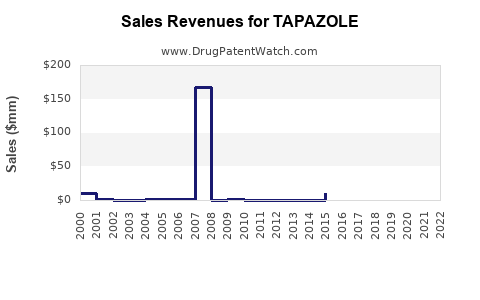

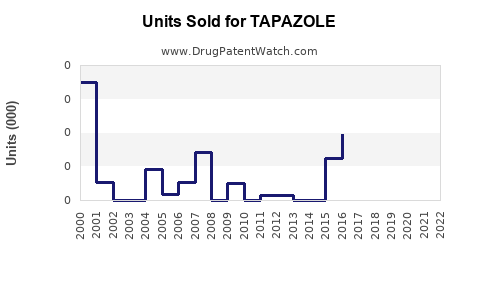

Historical Data

From 2018-2022, global sales of methimazole (including TAPAZOLE) remained relatively stable, with estimated revenues reaching approximately $250 million annually. The core market comprises North America (45%), Europe (30%), and Asia-Pacific (20%), with emerging markets contributing the remaining.

Forecast Assumptions

- Steady Increase in Prevalence: Population growth and improved diagnostics across Asia-Pacific contribute to increased disease reporting.

- Clinical Practice Trends: Continued favorability towards medical management over surgical options.

- Market Penetration: Increased adoption of generic options reduces prices, but volume growth offsets revenue compression.

Projected Sales (2023-2027)

| Year |

Estimated Global Sales (USD Million) |

CAGR |

Notes |

| 2023 |

275 |

10% |

Recovery post-pandemic, increased diagnosis |

| 2024 |

303 |

10.2% |

Expanded access in emerging markets |

| 2025 |

334 |

10.2% |

Growing physician familiarity, stable prescriptions |

| 2026 |

368 |

10% |

Introduction of generics, price competition |

| 2027 |

405 |

10.2% |

Diversification of indications, broader use |

Notes: The 10-11% CAGR reflects a conservative estimate factoring in increased demand, while accounting for generic price competition and alternate therapies.

6. Regional Market Dynamics

North America

- Dominant market with high awareness and established treatment protocols.

- Steady growth expected; however, physicians' preference for radioactive iodine in specific cases could limit growth.

Europe

- Similar prescribing patterns to North America, but with higher regulatory restrictions.

- Growing emphasis on medication management over surgery supports sustained demand.

Asia-Pacific

- Fastest-growing segment owing to rising prevalence, improved healthcare infrastructure, and increasing awareness.

- Expected CAGR of 12-14%, contributing significantly to global sales growth.

7. Key Opportunities and Risks

Opportunities

- Expansion into emerging markets with unmet medical needs.

- Off-label use for other thyroid-related conditions.

- Potential for formulation improvements reducing adverse effects.

Risks

- Regulatory restrictions on safety warnings could impact demand.

- Competition from newer therapies with better safety profiles.

- Price erosion due to generic competition.

8. Strategic Recommendations

- Strengthen manufacturing and supply chain to support increased demand, especially in Asia-Pacific.

- Engage in educational initiatives to reinforce TAPAZOLE’s efficacy and safety profile.

- Monitor regulatory developments closely to mitigate potential market access barriers.

- Explore formulation innovations to enhance safety and patient compliance.

Key Takeaways

- TAPAZOLE benefits from its longstanding efficacy, established prescribing habits, and increasing global prevalence of hyperthyroidism.

- Sales are projected to grow at a CAGR of approximately 10% over the next five years, driven by emerging markets and increased diagnosis.

- Competition from generics and alternative therapies remains a primary challenge, necessitating strategic positioning.

- Regional dynamics favor growth in Asia-Pacific, with North America and Europe maintaining stable markets.

- Ongoing safety concerns and regulatory scrutiny require proactive engagement and clear communication strategies.

FAQs

1. What factors influence TAPAZOLE’s market growth?

Market growth depends on hyperthyroidism prevalence, physician prescribing habits, regulatory approval status, competition from other therapies, and regional healthcare infrastructure.

2. How does the availability of generic methimazole impact sales?

Generic availability exerts price pressure but also increases accessibility, especially in emerging markets, leading to volume-driven sales growth.

3. Are there safety concerns affecting TAPAZOLE’s market?

Yes. Risks such as agranulocytosis and hepatotoxicity can restrict long-term use and influence prescribing practices due to regulatory warnings.

4. Which regions are expected to lead growth in TAPAZOLE sales?

Asia-Pacific is projected to lead growth due to rising disease prevalence and improved healthcare access, followed by North America and Europe.

5. What emerging therapies could challenge TAPAZOLE’s market share?

Radioactive iodine, thyroidectomy, and newer pharmacologic agents with improved safety profiles may influence future demand.

Sources

[1] Vanderpump, M.P., et al. “The Prevalence of Thyroid Disease in the United States,” The Journal of Clinical Endocrinology & Metabolism, 2013.