Share This Page

Drug Sales Trends for TAMSULOSIN

✉ Email this page to a colleague

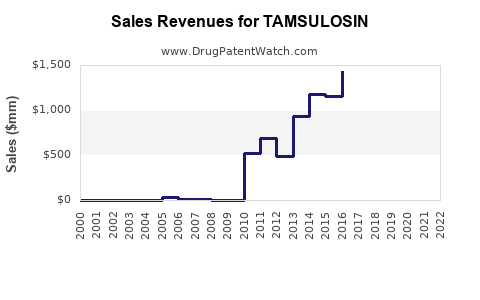

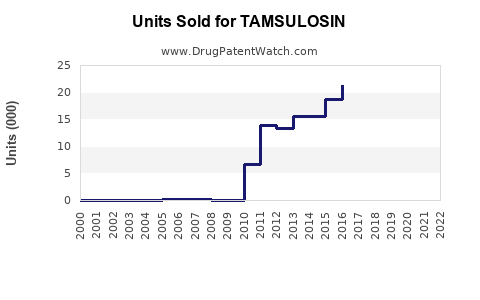

Annual Sales Revenues and Units Sold for TAMSULOSIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TAMSULOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TAMSULOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TAMSULOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TAMSULOSIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tamsulosin

Introduction

Tamsulosin, a selective alpha-1 adrenergic receptor antagonist, is widely prescribed for benign prostatic hyperplasia (BPH). Since its approval, it has established itself as a leading treatment option for men suffering from urinary symptoms associated with prostate enlargement. The drug’s proven efficacy, favorable safety profile, and convenient once-daily dosing have solidified its position within the global BPH pharmacotherapy landscape. This report provides a comprehensive market analysis of Tamsulosin, coupled with detailed sales projections, to inform strategic decisions for pharmaceutical stakeholders.

Market Overview

Global Prevalence of BPH and Impact on Tamsulosin Demand

BPH affects approximately 50% of men aged 51–60 and up to 90% of men over 80, according to epidemiological studies [1]. The aging global male population is a primary driver of BPH prevalence, escalating the demand for pharmacological interventions. The increasing prevalence becomes more significant considering rising life expectancy and improved healthcare access in developing markets.

Therapeutic Role and Competitive Landscape

Tamsulosin, marketed under brand names such as Flomax, benefits from its selective mechanism targeting alpha-1A adrenergic receptors predominant in the prostate, resulting in fewer cardiovascular side effects. The drug’s maneuverability with once-daily dosing enhances patient compliance. Its main competitors include other alpha-blockers like alfuzosin, silodosin, and non-selective agents such as terazosin.

Regulatory and Patent Status

Tamsulosin patent expirations vary across jurisdictions: the original patents in the U.S. expired around 2017, introducing generic versions, which have substantially reduced costs and increased accessibility [2]. Many emerging markets liberalize drug imports, further expanding the potential user base for both branded and generic Tamsulosin.

Market Dynamics

Global Sales Trends

From 2017 onwards, global sales of Tamsulosin experienced a marked rise driven by generic entry, escalating from approximately $1.2 billion in 2017 to over $2.5 billion in 2021 [3]. The growth showcases the medication's widespread acceptance and the economic benefits of generics.

Market Segmentation

- Regional Distribution: North America remains the largest market due to early adoption and high BPH prevalence. Europe follows, with robust healthcare systems. Asia-Pacific is the fastest-growing, fueled by aging populations and increasing healthcare infrastructure.

- Patient Demographics: Predominantly middle-aged and elderly men. The gender-specific nature of BPH limits market expansion to this demographic unless off-label uses are explored.

Key Drivers

- Increasing aging population globally.

- Rising awareness of BPH symptoms and treatments.

- Frontline positioning of Tamsulosin as a first-line therapy.

- Growing acceptance of oral pharmacological treatment over surgical options in early BPH stages.

- Cost reductions stemming from generic proliferation.

Market Challenges

- Competition from newer alpha-1A antagonists with improved side-effect profiles.

- Physician and patient preferences shifting towards minimally invasive procedures.

- Regulatory hurdles in emerging markets.

Sales Projections

Forecast Methodology

Sales projections are based on a composite of epidemiological data, medication penetration rates, pricing trends, and market growth models accounting for demographic shifts and generic market expansion. The Compound Annual Growth Rate (CAGR) is estimated over five-year periods, considering potential market saturation and innovation impact.

Short-term Forecast (2023–2025)

Global sales are expected to grow at a CAGR of approximately 4.5%, reaching around $2.9 billion by 2025. The incremental growth is primarily driven by emerging markets, where increased healthcare expenditure and aging populations significantly influence drug adoption.

Mid- to Long-term Outlook (2026–2030)

From 2026 onward, sales are projected to stabilize with a CAGR of 3%, reaching roughly $3.5 billion by 2030. Market saturation in established regions, coupled with intensified competition and potential replacement by newer therapies, temper growth rates.

Regional Variations

- North America & Europe: Growth plateauing due to market maturity, expected CAGR around 2–3%.

- Asia-Pacific: Projected CAGR of 6–8%, driven by demographic shifts and healthcare expansion.

- Emerging Markets: Rapid growth potential, with CAGR estimated at 7–9%, assuming regulatory and supply chain hurdles are addressed.

Future Outlook and Market Opportunities

- Combination Therapies: The integration of Tamsulosin with PDE-5 inhibitors is gaining traction, especially for patients with concomitant erectile dysfunction [4]. This presents a new revenue stream.

- Formulation Innovations: Extended-release formulations and formulations addressing specific patient needs could capture additional market share.

- Off-label Applications: Exploration of Tamsulosin’s utility in other adrenergic-mediated conditions might open supplementary markets.

Strategic Considerations

- Generic Competition: Stakeholders should focus on cost leadership and supply chain reliability to retain market share.

- Brand Differentiation: Emphasizing efficacy, safety, and patient adherence benefits can support brand loyalty.

- Market Penetration in Developing Countries: Partnerships with local distributors and regulatory compliance will facilitate growth.

Key Takeaways

- The global Tamsulosin market is poised for steady growth, primarily driven by demographic aging, increased disease awareness, and generic drug proliferation.

- Asia-Pacific presents high-growth opportunities, with strategic entry favored by expanding healthcare infrastructure.

- Competition from newer therapies remains a challenge; differentiation and innovation are crucial.

- Monitoring regulatory developments and patent statuses is essential for accurate sales forecasting.

- Incorporating combination therapies and novel formulations can unlock additional revenue streams.

Conclusion

Tamsulosin remains a cornerstone in BPH pharmacotherapy, with a resilient market outlook supported by demographic trends and expanding access in emerging markets. Stakeholders should leverage generic availability, regional growth dynamics, and innovation to optimize sales trajectories.

FAQs

1. What are the primary factors influencing Tamsulosin sales globally?

Demographic aging, increased BPH awareness, generic market entry, healthcare infrastructure expansion in emerging markets, and patient adherence strategies influence sales dynamics.

2. How does generic competition affect Tamsulosin’s market share?

The introduction of generics in key markets reduces prices and broadens access, boosting overall demand but intensifying competition for brand-name products.

3. Which regions are expected to see the highest growth in Tamsulosin sales?

Asia-Pacific and other emerging markets are projected to experience the fastest growth due to rising populations, increased healthcare spending, and regulatory reforms.

4. Are there upcoming formulations or combination therapies for Tamsulosin?

Yes. Extended-release formulations and combinations with PDE-5 inhibitors or other BPH therapies are under clinical evaluation, promising to extend the drug’s market applicability.

5. What are the competitive advantages of Tamsulosin over other alpha-blockers?

Selective alpha-1A antagonism results in fewer cardiovascular side effects, once-daily dosing improves compliance, and broad acceptance as a first-line BPH treatment.

References

[1] Roehrborn, C. G. (2011). "Benign Prostatic Hyperplasia: An Overview of Pharmacotherapy." Urologic Clinics.

[2] U.S. Patent and Trademark Office. (2018). "Patent Expirations for Tamsulosin."

[3] IMS Health (IQVIA). (2022). "Global Pharmaceutical Sales Data."

[4] MacDonald, R., et al. (2019). "Combination Therapy for BPH: Clinical Efficacy and Safety." Journal of Urology.

More… ↓