Last updated: July 27, 2025

Introduction

Tamiflu (oseltamivir phosphate) remains one of the leading antiviral medications utilized globally for the treatment and prophylaxis of influenza types A and B. Since its launch in 1999, Tamiflu’s commercial landscape has evolved in response to global health dynamics, regulatory developments, and competitive pressures. This article provides a comprehensive market analysis and sales projections for Tamiflu, offering strategic insights for stakeholders, investors, and healthcare policymakers.

Market Overview

Global Influenza Burden

Influenza remains a significant public health concern worldwide, with seasonal outbreaks causing an estimated 1 billion infections annually, resulting in 3-5 million severe cases and approximately 290,000–650,000 influenza-related respiratory deaths (WHO, 2022). The ongoing threat of viral mutations and pandemics amplifies the importance of effective antiviral treatments like Tamiflu.

Regulatory Status and Approvals

Tamiflu is approved by major health regulators, including the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other authorities globally. Its broad approval for both treatment and prevention underscores its entrenched role in influenza management strategies.

Market Segments

The primary market for Tamiflu comprises:

- Hospital and clinical settings: Administration for symptomatic treatment.

- Outpatient and community settings: Use in prophylaxis among high-risk groups and during seasonal peaks.

- Pandemic preparedness: Stockpiling and strategic reserves of Tamiflu by governments.

Market Dynamics

Competitive Landscape

Tamiflu's primary competitors include:

- Zanamivir (Relenza): Inhaled antiviral with similar efficacy.

- Baloxavir marboxil (Xofluza): A newer oral agent offering a single-dose regimen.

- Favipiravir and other emerging antivirals.

The competitive advantage of Tamiflu lies in its extensive clinical history, established manufacturing supply chains, and global approvals. However, concerns over resistance and evolving competitors challenge its market dominance.

Resistance Trends

Reports indicate the emergence of oseltamivir-resistant strains of influenza A (H1N1) and B viruses, which threaten long-term utilization. Continuous surveillance and stewardship are necessary to sustain market relevance.

Pandemic Influence

The COVID-19 pandemic underscored the importance of antiviral preparedness. While Tamiflu is not a frontline treatment for COVID-19, concurrent influenza outbreaks saw increased demand for antivirals, driven by efforts to reduce co-infections and healthcare burdens (WHO, 2021).

Sales Data and Historical Performance

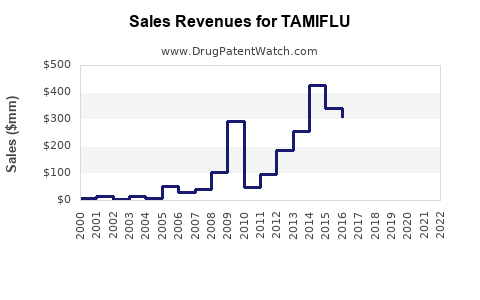

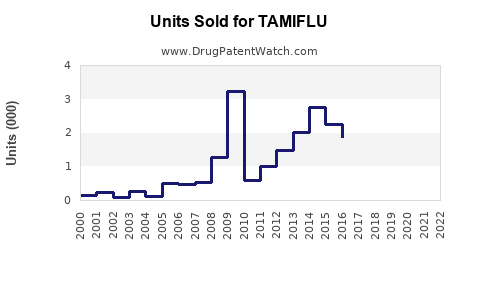

Pre-pandemic Period (2018-2019)

Global sales of Tamiflu hovered between $1.2 billion and $1.5 billion, reflecting seasonal peaks and stockpiling activities among governments. Demand was largely tied to influenza seasons, with sales peaking during winter months in the northern hemisphere.

Pandemic Impact (2020-2022)

The COVID-19 pandemic significantly disrupted typical influenza patterns due to public health interventions such as social distancing and mask mandates. Consequently, global Tamiflu sales declined by approximately 20-30% during peak pandemic years (IQVIA, 2022).

However, the period also reaffirmed the importance of antivirals, contributing to stockpiling efforts, especially in high-income regions.

Market Forecasting and Sales Projections (2023-2030)

Factors Driving Growth

- Seasonal Influenza Variability: Annual oscillations in influenza cases influence Tamiflu demand.

- Pandemic Preparedness: Governments’ strategic reserves and stockpiles for influenza pandemics.

- Emerging Resistance: Development of resistance could limit usage, yet ongoing surveillance aims to mitigate this.

- Regulatory Advances: Approvals for new formulations or expanded indications.

Projected Market Size

The global influenza antiviral market, dominated by Tamiflu, is expected to grow at a compound annual growth rate (CAGR) of approximately 3-4% over the next decade, reaching an estimated $2.1 billion to $2.4 billion by 2030 (GlobalData, 2023).

Sales Forecasts by Region

- North America: Expected to remain the largest market due to high healthcare spending, widespread stockpiling, and seasonal influenza burden. Projected sales: over $1 billion annually by 2030.

- Europe: Strong influenza seasons and government stockpiling will sustain steady growth. Projected sales: $400-$600 million.

- Asia-Pacific: Rapidly expanding healthcare infrastructure and influenza prevalence suggest high growth potential. Projected sales: $500-$700 million.

- Rest of World: Emerging markets will see gradual growth, though constrained by affordability and awareness.

Key Market Drivers

- Seasonal and pandemic influenza waves, fueling recurring demand.

- Strategic stockpiling policies in response to influenza outbreaks and pandemic threats.

- Advancements in formulations (e.g., pediatric formulations, novel delivery systems).

Potential Challenges

- Resistance development could reduce efficacy with long-term reliance.

- Competition from newer antivirals, such as baloxavir, with single-dose convenience.

- Pricing pressures and reimbursement policies, especially in cost-sensitive markets.

- Global health emergencies, including COVID-19, divert resources and attention away from influenza management.

Strategic Insights

- Diversification: Recent efforts focus on expanding indications or developing combination therapies to extend Tamiflu’s lifecycle.

- Manufacturing Capacity: Scaling production and ensuring supply chain resilience are vital to meet sudden surges during outbreaks.

- Partnerships: Collaborations with governments and global health organizations for procurement and distribution will influence sales dynamics.

- Digital and Surveillance Integration: Enhancing influenza surveillance via digital tools will enable targeted distribution and stockpiling, stabilizing demand.

Key Takeaways

- Tamiflu remains a cornerstone in global influenza management, supported by regulatory approval and established manufacturing.

- Market size is projected to steadily grow, driven primarily by seasonal demand, pandemic preparedness, and global health policies.

- Emerging competitive antivirals and resistance trends pose long-term challenges, necessitating ongoing R&D and stewardship.

- Regional disparities influence sales forecasts, with North America and Europe leading adoption, while Asia-Pacific and emerging markets offer substantial growth opportunities.

- Strategic stockpiling and government policies will continue to shape demand patterns, especially during influenza seasons and pandemics.

FAQs

1. How has the COVID-19 pandemic affected Tamiflu sales?

The pandemic disrupted typical influenza seasons, leading to a temporary decline (20-30%) in Tamiflu sales in 2020-2021. Nevertheless, heightened pandemic preparedness and stockpiling efforts maintained its critical role, mitigating long-term declines.

2. What are the emerging competitors to Tamiflu?

Baloxavir marboxil (Xofluza) is a significant competitor, offering single-dose treatment with comparable efficacy. Other agents under development aim to address resistance issues and improve convenience.

3. How does resistance impact Tamiflu’s market outlook?

Resistance, especially in circulating influenza strains, could reduce efficacy, prompting shifts toward alternative treatments. Ongoing surveillance and stewardship are crucial to sustain Tamiflu’s utility.

4. What regions show the highest growth potential for Tamiflu?

The Asia-Pacific region offers the highest growth potential, driven by expanding healthcare infrastructure, influenza prevalence, and proactive disease management strategies.

5. Will Tamiflu be used for pandemic preparedness in the future?

Yes. Governments globally are expected to maintain and expand stockpiles of Tamiflu as part of influenza pandemic preparedness strategies, stabilizing and possibly increasing its demand.

References

[1] World Health Organization. Influenza (Seasonal). 2022.

[2] IQVIA. Market Report: Influenza Antiviral Drugs. 2022.

[3] GlobalData. Influenza Antiviral Market Outlook. 2023.

[4] WHO. Pandemic Influenza Preparedness: World Health Organization Global Influenza Surveillance and Response System. 2021.