Share This Page

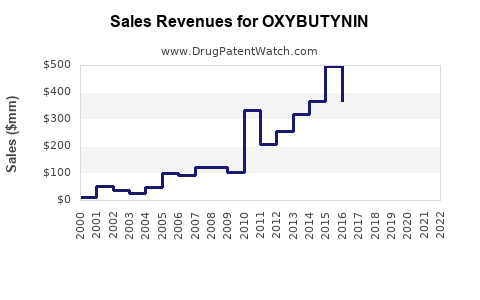

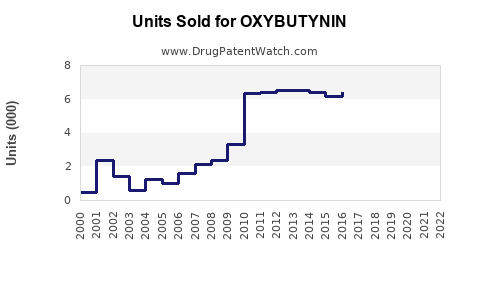

Drug Sales Trends for OXYBUTYNIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for OXYBUTYNIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| OXYBUTYNIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Oxybutynin

Introduction

Oxybutynin, a well-established anticholinergic agent primarily used to treat overactive bladder (OAB) and urinary incontinence, commands a significant position within the global urology pharmaceutical landscape. Originating in the 1970s, oxybutynin has evolved through multiple formulations, including oral tablets, transdermal patches, and topical gels, enhancing patient compliance and expanding its market reach. This analysis explores current market dynamics, competitive positioning, and future sales projections amid evolving healthcare trends, competitive innovations, and regulatory environments.

Market Overview

Therapeutic Indications and Disease Burden

Overactive bladder affects approximately 12-15% of the global population, with prevalence increasing markedly among the elderly. The condition severely impacts quality of life through symptoms such as urinary urgency, frequency, and incontinence. The growing aging population and increased awareness have amplified demand for effective therapeutics like oxybutynin. According to global estimates, the OAB market is expected to reach USD 7 billion by 2027, with a compound annual growth rate (CAGR) of around 6% (verified by Global Data and IQVIA reports).

Market Segments and Formulations

Oxybutynin is marketed in multiple formulations:

- Oral Immediate-Release Tablets: The earliest formulation, still widely prescribed.

- Extended-Release Tablets: Offer improved compliance and reduced side effects.

- Transdermal Patches: Minimize systemic anticholinergic effects, preferred among elderly patients.

- Topical Gels and Other Novel Delivery Systems: Emerging in markets emphasizing adherence and side effect profiles.

The shift from oral to transdermal and topical applications signifies a strategic focus on reducing side effects, particularly dry mouth and constipation, thus broadening patient acceptance.

Key Market Players

Prominent industry players include:

- Eli Lilly (Ditropan and Ditropan XL)

- Fresenius Kabi (generic formulations)

- Galencia and Watson Pharmaceuticals (generics)

- Innovative biotech firms developing novel delivery systems

Patent expirations for primary formulations have triggered the surge in generic entry, heightening price competition but also expanding accessibility.

Market Dynamics

Factors Driving Growth

- Aging Population: Increased prevalence of urinary incontinence elevates demand.

- Product Differentiation: Transition toward transdermal and topical formulations improves safety profiles.

- Regulatory Approvals: Accelerated approvals for novel formulations and indications.

- Healthcare Infrastructure: Expanding primary care capabilities facilitate diagnosis and prescription.

Challenges and Constraints

- Side Effect Profile: Anticholinergic burden leads to cognitive impairment risk in elderly, prompting cautious prescribing.

- Generic Competition: Price erosion affects profitability.

- Emerging Therapies: Development of β3-adrenergic agonists (e.g., mirabegron) presents competitive challenges, potentially reducing oxybutynin’s market share.

Regulatory and Market Risks

Regulatory agencies are increasingly scrutinizing anticholinergic agents for long-term cognitive risks, influencing prescribing patterns. Additionally, reimbursement policies vary globally, affecting market penetration.

Sales Projections

Historical Sales Trends

Global sales of oxybutynin peaked in the early 2010s, coinciding with high prescribing rates of oral formulations. Generic availability led to rapid price reductions but maintained volume growth due to expanding indicated populations.

Forecast Assumptions

- Continued shift toward transdermal formulations due to improved side effect profiles.

- Increased adoption of topical gels in specific markets.

- Rising awareness and diagnosis of OAB, particularly among aged populations.

- Entry of new formulations offering enhanced efficacy and safety profiles.

- Competitive pressures from novel agents like mirabegron.

Projected Market Trajectory (2023–2028)

Based on current trends, global oxybutynin sales are expected to:

- Compound Annual Growth Rate: Slightly decrease from previous levels, stabilizing around 4-5% CAGR due to market saturation and competition.

- Market Value: Anticipated to reach approximately USD 2.8–3.2 billion by 2028, compared to USD 1.9 billion in 2022.

Regional Outlook

- North America: Leading market, driven by high prevalence and healthcare spending, projected to grow at 3-4% CAGR.

- Europe: Similar trends, with increased adoption of transdermal formulations.

- Asia-Pacific: Fastest growth segments owing to rising awareness, urbanization, and aging demographics—expected CAGR of 6-7%.

Competitive Landscape

Innovations such as extended-release patches and topical gels continue to capture market share, especially amid concerns over cognitive side effects in the elderly. Companies investing in formulation improvements and patient-centric delivery systems are poised to maintain or elevate market presence. Moreover, strategic collaborations and licensing agreements facilitate faster adoption and market expansion.

Impact of Alternative Therapies

The introduction of β3-adrenergic agonists, such as mirabegron, with favorable safety profiles and minimal cognitive effects, has begun to erode oxybutynin's dominance. Nevertheless, cost advantages of generics and established efficacy keep oxybutynin relevant, particularly in markets where new agents are under patent protection or not yet widely reimbursed.

Conclusion

Oxybutynin remains a cornerstone therapy for overactive bladder, with its market poised for steady growth driven by demographic trends and formulation innovations. However, competitive pressures and regulatory scrutiny necessitate ongoing product development and strategic positioning to sustain sales momentum.

Key Takeaways

- The global oxybutynin market is projected to reach USD 2.8–3.2 billion by 2028, with a modest CAGR of 4-5%.

- Formulation diversification—especially transdermal and topical gels—enhances patient compliance and reduces side effects, fueling demand.

- Demographic shifts, particularly aging populations, will sustain market growth, despite rising competition from newer agents.

- Price erosion due to generic competition remains a significant factor, emphasizing the need for value-added formulations.

- Regulatory scrutiny concerning cognitive safety influences prescribing trends, creating both challenges and opportunities for formulation innovation.

FAQs

1. How does formulation type influence oxybutynin market sales?

Transdermal patches and topical gels offer improved safety profiles with fewer systemic side effects, increasing patient acceptance, especially among the elderly. This diversification in formulations drives sales growth beyond traditional oral tablets.

2. What factors could inhibit oxybutynin’s market expansion?

Emerging therapies like mirabegron, concerns over anticholinergic cognitive effects, and increased generic competition leading to price reductions can restrain market growth.

3. Which regions are experiencing the fastest growth in oxybutynin sales?

The Asia-Pacific region exhibits the highest growth potential, driven by demographic shifts and increasing healthcare infrastructure, with estimated CAGR of 6-7%.

4. How will regulatory trends impact oxybutynin sales?

Enhanced regulatory scrutiny over long-term cognitive risks may limit prescriptions in certain populations, prompting the development of safer formulations or alternative agents.

5. What strategic opportunities exist for pharmaceutical companies in this market?

Innovating delivery systems, expanding indications, enhancing safety profiles, and forming strategic partnerships can bolster market share amidst competition.

Sources:

[1] Global Data, Overactive Bladder Market Report, 2022.

[2] IQVIA, Healthcare Market Analysis, 2022.

[3] Urological Society Publications, Overactive Bladder Prevalence, 2021.

[4] FDA and EMA regulatory updates on anticholinergic agents, 2022.

[5] MarketWatch, Pharmaceutical Industry Sales Forecasts, 2023.

More… ↓