Share This Page

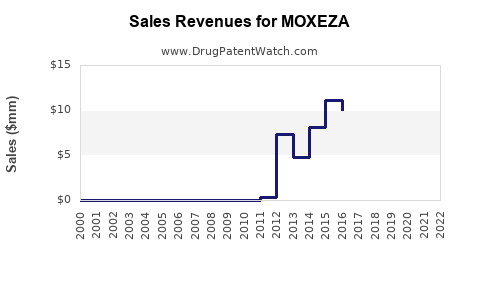

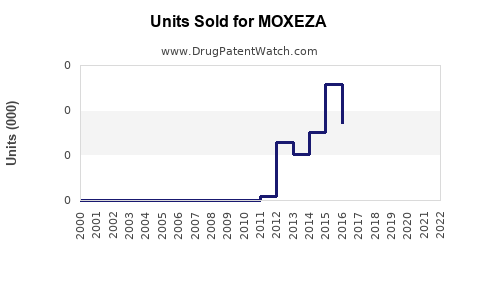

Drug Sales Trends for MOXEZA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MOXEZA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| MOXEZA | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for MOXEZA (Moxifloxacin ophthalmic)

Introduction

MOXEZA, a branded ophthalmic solution containing moxifloxacin, is prescribed for bacterial conjunctivitis and other ocular infections. As a novel dispensed formulation, understanding its market potential and sales trajectory requires a comprehensive analysis of the ophthalmic antibiotic landscape, competitive positioning, regulatory environment, and potential adoption rates.

Market Overview

Global Ophthalmic Antibiotics Market

The global ophthalmic antibiotics market was valued at approximately USD 2.1 billion in 2022, with expectations to reach USD 3.0 billion by 2030, growing at a CAGR of about 4.3% [1]. This growth is driven by increasing prevalence of ocular infections, aging populations, and advancements in drug delivery systems.

Key Drivers for MOXEZA

- Indication Specificity: Approved for bacterial conjunctivitis, a common ocular infection affecting millions annually.

- Favorable Pharmacokinetics: Rapid bactericidal activity with once or twice daily dosing.

- Regulatory Approvals: Approved by FDA (2015) and EMA, confirming safety and efficacy.

- Market Gap: Provides a targeted, preservative-free treatment option with convenience advantages over traditional drops.

Market Segments

- By Indication: Bacterial conjunctivitis, keratitis, and other ocular bacterial infections.

- By Geography: North America dominates due to high prevalence and established healthcare infrastructure; EMEA and APAC show growth opportunities, especially with expanding access to ophthalmic care.

Competitive Positioning

Key Competitors

- Vigamox (moxifloxacin 0.5%): Market leader, offering a broad-spectrum fluoroquinolone.

- Besivance (besifloxacin): Another topical fluoroquinolone with similar indications.

- Off-label Uses of Topical Antibiotics: Limited due to specificity and side-effect profiles.

Differentiators for MOXEZA

- Formulation: Preservative-free ophthalmic solution enhances tolerability.

- Dosing Regimen: Once or twice daily dosing improves compliance.

- Brand Recognition: Backed by a strong pharmaceutical firm with marketing campaigns targeting ophthalmologists.

Challenges

- High competition: Established generics and off-label antibiotics.

- Pricing Pressures: Price sensitivity due to over-the-counter generic options.

- Limited Indication Expansion: Currently approved for bacterial conjunctivitis; growth depends on expanding approved indications.

Regulatory & Market Access Factors

- Reimbursement: Largely covered by insurance in developed markets, facilitating prescriptions.

- Physician Adoption: Driven by clinical efficacy, ease of use, and safety profile.

- Market Penetration: Growth depends on targeted marketing and physician education.

Sales Projections

Short-term Forecast (2023–2025)

- Initial Adoption: Moderate growth as clinicians become familiar with MOXEZA, capturing approximately 10-15% of the bacterial conjunctivitis market in early years.

- Estimated Revenue: Starting around USD 100 million in 2023, with an annual growth rate of 10–12%, reaching approximately USD 120–130 million by 2025.

Long-term Outlook (2026–2030)

- Market Expansion: With increased awareness and potential approvals for additional ocular indications, sales could see accelerated growth.

- Market Share Growth: Potential to capture 20–25% of the bacterial conjunctivitis market, particularly in North America and Europe.

- Revenue Projection: By 2030, annual sales could surpass USD 250 million, driven by expanded indications, increased patient awareness, and new formulation developments.

Factors Influencing Sales

- Patient Adherence: Improved dosing regimens will positively impact sales.

- Clinical Efficacy and Safety: Data supporting broader use encourage physicians to favor MOXEZA.

- Competitive Innovations: Development of combination therapies or prolonged-release formulations may influence market share.

- Regulatory Approvals: Approval for additional indications, such as keratitis, could exponentially boost sales.

Strategic Opportunities

- Pipeline Expansion: Developing formulations for other ocular infections or sustained-release options.

- Geographic Expansion: Accelerating entry into emerging markets with growing ophthalmic care infrastructure.

- Physician Education: Enhancing awareness campaigns to promote prescribing behavior.

- Partnerships: Collaborations with ophthalmology clinics and healthcare providers for direct distribution.

Risks and Mitigation Strategies

- Generic Competition: Sustaining clinical superiority and emphasizing safety profiles.

- Market Saturation: Differentiating through patient-centric features and strong clinical data.

- Pricing Pressures: Offering value-driven pricing models and reimbursement strategies.

Key Takeaways

- MOXEZA holds a solid position within the ophthalmic antibiotic market, with growth driven by its targeted formulation and regulatory approvals.

- Short-term sales are projected to hover around USD 100–130 million, expanding significantly by 2030 with broader indications and increased market penetration.

- Competition from established generics and off-label alternatives remains a challenge, necessitating strong marketing and ongoing clinical evidence.

- Strategic expansion into emerging markets and pipeline innovations are critical for maintaining growth momentum.

- Patient adherence and physician adoption are primary drivers that will influence long-term sales success.

FAQs

1. What are the main factors influencing MOXEZA’s market penetration?

Market penetration hinges on physician awareness, clinical efficacy perception, reimbursement policies, and patient adherence. Differentiators like preservative-free formulation and dosing convenience give MOXEZA an edge.

2. How does MOXEZA compare to its main competitors?

Compared to Vigamox, MOXEZA offers a preservative-free formulation with similar efficacy. Its dosing schedule and safety profile may improve patient compliance, although brand recognition and price factors play roles in market share.

3. What are the opportunities for expanding MOXEZA’s indications?

Potential extension into keratitis or other bacterial ocular infections could multiply its sales. However, such approvals depend on clinical trial success and regulatory pathways.

4. How do regional differences impact MOXEZA’s global sales?

North America leads due to higher prevalence and healthcare infrastructure, whereas growth in EMEA and APAC depends on market access, local regulations, and clinical adoption. Emerging markets represent substantial long-term growth opportunities.

5. What strategies can boost MOXEZA’s market share?

Developing new formulations, entering emerging markets, enhancing physician education, and expanding indications are key strategies. Leveraging clinical data to reinforce efficacy and safety claims will bolster physician confidence.

References:

[1] MarketResearch.com, “Global Ophthalmic Antibiotics Market Report,” 2022.

More… ↓