Last updated: August 2, 2025

Introduction

MOTRIN, a leading over-the-counter (OTC) analgesic and antipyretic, primarily containing ibuprofen, has maintained a significant position within the global non-prescription pain relief market. Recognized for its efficacy in reducing pain, inflammation, and fever, MOTRIN’s brand strength, consumer loyalty, and regulatory status underpin its enduring market presence. This analysis examines current market dynamics, competitive positioning, regulatory environment, and forecasted sales trajectories, providing a comprehensive perspective for stakeholders and industry analysts.

Market Overview

Global OTC Pain Relief Market Landscape

The OTC pain management market, valued at approximately USD 20 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 5-6% through 2028 ([1]). Factors fueling this expansion include increasing prevalence of chronic pain conditions, aging populations, rising healthcare costs, and consumer preference for self-medication.

Position of MOTRIN in the Market

MOTRIN, owned by Johnson & Johnson, is one of the most recognized brands within the NSAID (Non-Steroidal Anti-Inflammatory Drugs) category. Its market dominance stems from:

- Brand Equity: High consumer trust established over decades.

- Formulation Variety: Available in tablets, chewables, suspensions, and topical formulations.

- Global Distribution: Widespread availability across pharmacies, supermarkets, and online channels.

In the United States, MOTRIN commands an estimated market share of 20-25% among OTC NSAIDs ([2]). European markets show similar brand recognition, though local competitors like Nurofen (Reckitt Benckiser) and Advil (Pfizer) remain strong.

Market Drivers and Challenges

Drivers

- Rising Incidence of Chronic Pain: Conditions such as osteoarthritis and dental pain boost OTC NSAID sales.

- Consumer Preference for OTC Medications: Increasing desire for quick, accessible symptom relief spurs OTC market growth.

- Product Line Expansion: Introduction of new formulations, including targeted delivery systems and combination products, enhances consumer appeal.

- E-commerce Growth: Online availability expands reach beyond traditional retail outlets.

Challenges

- Safety Concerns and Regulatory Scrutiny: Risks associated with NSAID overuse—such as gastrointestinal bleeding—prompt regulatory alerts and consumer caution.

- Competitive Intensity: Brands like Nurofen, Advil, and Aleve vie aggressively for market share.

- Generic Competition: Patent expiration and the proliferation of generic ibuprofen formulations pressure pricing strategies.

- Healthcare Policy Changes: Initiatives promoting prescription drug use for certain conditions can influence OTC sales pathways.

Regulatory Environment

The regulatory landscape for OTC NSAIDs like MOTRIN is stringent, particularly pertaining to safety warnings and labeling. The U.S. Food and Drug Administration (FDA) mandates clear indications, contraindications, and dosage instructions to mitigate adverse events. Internationally, regulatory agencies such as the European Medicines Agency (EMA) enforce similar standards, shaping product formulations and marketing.

Recent regulatory updates have focused on:

- Labeling Enhancements: Emphasizing gastrointestinal and cardiovascular risks.

- Usage Limitations: Restrictions on maximum daily doses.

- Monitoring and Pharmacovigilance: Post-market surveillance to ensure safety.

Compliance with these regulations influences manufacturing costs, marketing strategies, and ultimately, sales volume.

Sales Projections (2023-2028)

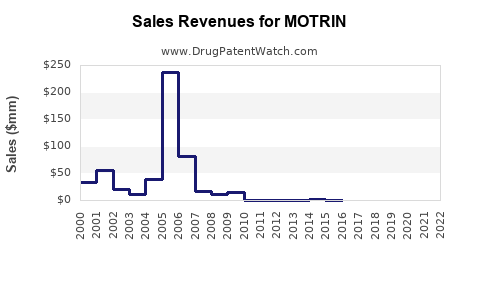

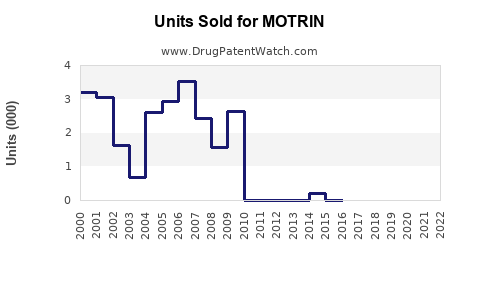

Historical Performance

MOTRIN has exhibited steady sales, with global revenues approximating USD 1.5-2 billion annually over the past five years ([3]). North American markets constitute roughly 60% of total sales, followed by Europe and Asia-Pacific regions.

Projected Growth Factors

- Market Penetration: Existing brand loyalty and expansion into emerging markets stimulate growth.

- Product Innovation: Launch of new formulations or dosage forms can open additional revenue streams.

- E-commerce Expansion: Online sales avenues are poised to contribute significantly, particularly post-pandemic.

Forecast

Based on current market trends and strategic initiatives, MOTRIN’s global sales are projected to grow at a CAGR of 4-5% through 2028, reaching USD 2.5 billion by 2028. Key regional drivers include:

- North America: Steady market share retention amid socio-demographic shifts.

- Europe: Growth driven by increased awareness and healthcare access.

- Asia-Pacific: Emerging markets showing rapid OTC analgesic adoption, potentially doubling sales volumes, especially in India and China.

Impact of Competition and Innovation

While generic ibuprofen options are exerting downward pressure on prices, brand loyalty and product differentiation enable MOTRIN to sustain premium positioning. Innovative formulations, such as rapid-dissolving tablets and combination products for targeted pain relief, are expected to contribute to incremental sales growth.

Competitive and Strategic Analysis

Strengths:

- Established brand with high consumer recognition.

- Broad product lineup catering to diverse consumer needs.

- Strong global distribution network.

Weaknesses:

- Dependence on mature markets with slow growth.

- Regulatory risks associated with NSAID safety concerns.

Opportunities:

- Expansion into emerging markets.

- Development of specialized formulations.

- Digital marketing and direct-to-consumer channels.

Threats:

- Intensifying generic competition.

- Regulatory restrictions on NSAID use.

- Market shifts favoring alternative pain management therapies.

Conclusion

MOTRIN’s market position remains robust amid competitive pressures and evolving regulatory standards. Its sales are expected to maintain moderate growth through 2028, driven by regional expansion, product diversification, and increased consumer demand for OTC pain relief solutions. Strategic investments in innovation and market penetration are essential to safeguarding its market share and optimizing revenue streams.

Key Takeaways

- Stable Market Share: MOTRIN continues to dominate its segment due to its strong brand recognition and diversified product portfolio.

- Projected Growth: Anticipated sales to reach approximately USD 2.5 billion globally by 2028, with a CAGR of 4-5%.

- Regional Opportunities: Emerging markets, particularly in Asia-Pacific, offer significant growth potential.

- Competitive Edge: Brand loyalty, distribution reach, and product innovation are critical to sustaining sales amid generic competition.

- Regulatory Impact: Ongoing safety concerns and compliance obligations necessitate vigilant monitoring to mitigate market threats.

FAQs

1. How does MOTRIN differentiate itself from competitors?

MOTRIN leverages its longstanding brand reputation, broad formulation options, and global distribution network to maintain a competitive edge. Its focus on consumer trust and innovation in product delivery also distinguishes it from generic competitors.

2. What factors could threaten MOTRIN’s future sales?

Safety concerns associated with NSAIDs, regulatory restrictions, rising generic competition, and shifting consumer preferences towards alternative therapies could impact sales trajectories.

3. Are there emerging markets that present growth opportunities for MOTRIN?

Yes. Rapid urbanization and increasing healthcare awareness in countries like India, China, and Southeast Asian nations provide substantial opportunities for increasing OTC analgesic sales.

4. How might regulatory changes affect MOTRIN’s market performance?

Enhanced safety warnings and usage restrictions could temper sales growth; however, compliance with evolving regulations also stabilizes consumer trust and brand integrity.

5. What strategic actions can bolster MOTRIN’s market position?

Investing in product innovation, expanding e-commerce channels, entering emerging markets, and conducting targeted marketing campaigns are essential strategies for sustaining and growing sales.

References

[1] MarketDataForecast, “Global OTC Pain Relief Market Forecast,” 2022.

[2] Euromonitor International, “Over-the-counter Analgesics Market Share,” 2022.

[3] Johnson & Johnson Annual Report, 2022.