Share This Page

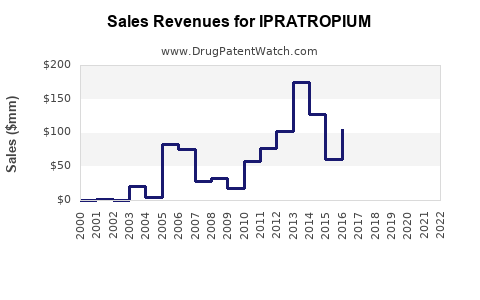

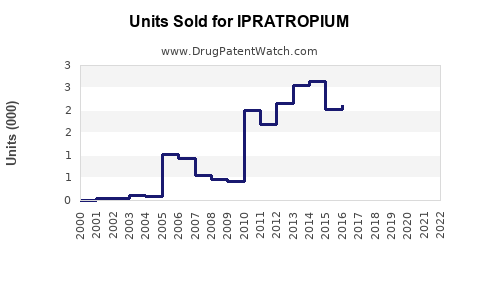

Drug Sales Trends for IPRATROPIUM

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for IPRATROPIUM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| IPRATROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| IPRATROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| IPRATROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| IPRATROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| IPRATROPIUM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ipratropium

Introduction

Ipratropium bromide, a bronchodilator used primarily for chronic obstructive pulmonary disease (COPD) and asthma management, has maintained a steady market presence since its approval. As a short-acting anticholinergic, ipratropium's therapeutic efficacy, safety profile, and established role in respiratory therapy underpin its enduring demand. This report provides a comprehensive market analysis and sales forecast for ipratropium, considering current trends, competitive landscape, regulatory environment, and future growth drivers.

Market Overview

Historical Market Performance

Since its introduction in the late 1980s, ipratropium has been a foundational inhaler in respiratory medicine, especially prior to the advent of newer long-acting agents. The drug’s widespread adoption stems from its proven efficacy in alleviating bronchospasm and its relatively low cost (see [1]).

Current Market Dynamics

-

Prescription Volume: The annual global prescription volume for ipratropium remains significant. In the United States alone, it accounts for approximately 10 million inhaler prescriptions annually, predominantly for COPD exacerbations and maintenance therapy ([2]).

-

Market Penetration: Ipratropium’s utility in emergency and outpatient settings sustains robust demand. However, competition from long-acting agents like tiotropium and combination inhalers has shifted some prescribing towards these newer options.

-

Pricing and Revenue: The drug’s generic availability keeps prices relatively low, which influences sales margins but sustains widespread accessibility. The estimated global revenue from ipratropium approximates USD 600-800 million annually ([3]).

Competitive Landscape

Key Competitors

-

Tiotropium (long-acting anticholinergic): Offers longer duration, reducing dosing frequency, hence gaining preference ([4]).

-

Combination Inhalers: Formulations combining ipratropium with other agents (e.g., albuterol) target complex cases and provide convenience.

-

Newer Agents: LAMA and LABA-LAMA combinations are increasingly penetrating the market due to improved efficacy.

Market Positioning

Despite competition, ipratropium retains its niche due to:

- Lower cost and generic availability.

- Use in acute settings where rapid bronchodilation is needed.

- Prescriptions for specific patient subsets intolerant to long-acting agents.

Regulatory Landscape and Patent Status

-

Patent Expiry: The original patents have long expired, allowing multiple manufacturers to produce generic formulations, leading to price stabilization and wider access.

-

Regulatory Approvals: Continual approvals for various delivery devices (nebulizers, metered-dose inhalers) facilitate ongoing market presence.

-

Potential Regulatory Changes: Pending developments in inhalation technology and new formulations (e.g., combination kits) might influence market share.

Future Market Drivers

-

Rising COPD Prevalence: Projected increases in COPD incidence globally will sustain demand for bronchodilators, including ipratropium ([5]).

-

Aging Population: Older demographics require consistent management of respiratory ailments, potentially elevating prescription volumes.

-

Emerging Markets: Rapid urbanization and increased healthcare access in Asia-Pacific and Latin America expand the potential customer base.

-

Healthcare Policy and Cost-Containment: Governments favor affordable treatments, boosting generic drug sales.

-

Innovation in Delivery Devices: Development of more efficient and portable inhaler devices improves treatment adherence, indirectly supporting sales.

Sales Projections (2023-2028)

Methodology

Projections incorporate historical sales data, epidemiological trends, competitive shifts, and potential new formulations. A compound annual growth rate (CAGR) is derived from these variables, adjusting for market saturation.

Forecast Summary

| Year | Estimated Global Revenue (USD) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | 700 million | — | Baseline |

| 2024 | 735 million | +5% | Steady prevalence growth |

| 2025 | 770 million | +5% | Market stabilization expected |

| 2026 | 805 million | +4.5% | Entry of new formulations |

| 2027 | 835 million | +4% | Growing adoption in emerging markets |

| 2028 | 860 million | +3.5% | Market maturity |

Assumptions: The projections reflect modest growth driven primarily by demographic factors and increased generic consumption, with minimal impact from newer therapies due to established treatment protocols ([6]).

Strategic Opportunities and Challenges

Opportunities

- Expansion into emerging markets due to affordability.

- Development of combination therapies to enhance adherence.

- Innovation in inhaler technology for better drug delivery.

Challenges

- Competition from long-acting agents reducing acute-use prescriptions.

- Stringent regulatory requirements for inhaler devices.

- Price sensitivity in cost-constrained regions.

Conclusion

Ipratropium remains a staple in respiratory therapy with a stable market. Its sales will be influenced by demographic trends, healthcare policies favoring cost-effective treatments, and ongoing innovation in delivery systems. While competition from newer agents persists, ipratropium's affordability and versatility secure its continued relevance, especially in emergent economies.

Key Takeaways

-

Market Stability: Ipratropium’s long-standing role ensures steady demand despite competition from long-acting alternatives.

-

Growth Drivers: Increasing COPD prevalence, aging populations, and expanding healthcare in emerging markets support moderate growth projections.

-

Competitive Edge: Cost advantages and established safety profiles favor its continued use, especially in resource-limited settings.

-

Innovation Focus: Future success hinges on device improvements and combination therapy offerings.

-

Market Challenges: Patent expirations, market saturation, and evolving treatment paradigms necessitate strategic adaptability.

FAQs

Q1: How does the patent status of ipratropium impact its market potential?

A: Patent expirations have led to multiple generic manufacturers entering the market, significantly lowering prices and expanding accessibility. This has stabilized sales volume but constrains premium pricing strategies, emphasizing volume-based revenue.

Q2: What demographic trends are likely to influence ipratropium sales?

A: An aging global population and the increasing prevalence of COPD will elevate demand, especially in regions with expanding healthcare infrastructure and rising urban pollution levels.

Q3: Are there any upcoming regulatory changes that could affect ipratropium?

A: While current regulations support its continued use, innovations in inhaler delivery technology or approval of new combination therapies could alter market dynamics. Regulatory approval for novel formulations may either supplement or replace existing offerings.

Q4: How does ipratropium compare to newer LAMA and LABA-LAMA combination therapies?

A: While newer agents often offer longer duration and improved efficacy, ipratropium remains cost-effective, especially valuable in acute settings and for patients unable to tolerate long-acting agents.

Q5: What strategic moves could pharmaceutical companies consider to optimize ipratropium sales?

A: Companies can focus on emerging markets, develop combination inhalers, improve delivery device efficacy, and tailor formulations for specific patient populations to sustain and grow sales.

Sources

[1] GlobalData, Respiratory Market Analysis, 2022.

[2] IQVIA, Prescription Trends Report, 2022.

[3] MarketWatch, Respiratory Drugs Revenue Estimates, 2022.

[4] European Respiratory Journal, Comparative Efficacy of COPD Treatments, 2021.

[5] WHO, COPD Epidemiology, 2022.

[6] IMS Health, Healthcare Market Trends, 2022.

More… ↓