Last updated: July 29, 2025

Introduction

Furosemide, a potent loop diuretic, is widely prescribed for fluid retention and hypertension management. Its global market landscape is shaped by the prevalence of cardiovascular diseases, regulatory environments, manufacturing dynamics, and emerging therapeutic applications. This report provides an in-depth market analysis and sales forecast for Furosemide through 2030, catering to pharmaceutical companies, investors, and healthcare strategists seeking data-driven insights.

Market Overview

Therapeutic Indications and Usage

Furosemide primarily treats edema associated with congestive heart failure, liver cirrhosis, and renal disease. Its efficacy in reducing pulmonary congestion makes it a frontline diuretic in cardiology. Additionally, off-label uses include hypertensive crises and certain nephrotic syndromes, although these constitute a smaller market segment.

Regulatory Status

Furosemide is off-patent globally, classified as a generic medication. This status fosters widespread availability but constrains profitability growth for branded formulations. Regulatory agencies such as the FDA (U.S.) and EMA (Europe) facilitate market entry but impose quality standards critical for manufacturing and distribution.

Manufacturing & Supply Chain Dynamics

The global production landscape is competitive, with key players including Novartis, Teva Pharmaceuticals, Sandoz, and local generics manufacturers. Supply chain resilience impacts availability, especially amid global disruptions like the COVID-19 pandemic, influencing market stability.

Market Drivers

- Rising prevalence of hypertension and heart failure.

- Growing aging populations globally.

- Increased healthcare expenditurenacted on cardiovascular diseases.

- Adoption of Furosemide in hospital and outpatient settings.

Market Restraints

- Availability of alternative diuretics with favorable safety profiles.

- Limited patent protection curbing innovation-driven growth.

- Concerns over side effects like electrolyte imbalance, limiting off-label uses.

Global Market Analysis

Regional Market Dynamics

North America

Dominates due to high cardiovascular disease burdens and extensive healthcare infrastructure. The U.S. accounts for roughly 40% of the global market, driven by aging demographics and large-volume prescribing.

Europe

Displays mature but steady growth, with robust healthcare systems and stringent regulatory environments. Generics comprise a significant portion of sales.

Asia-Pacific

Emerging as a high-growth region owing to rapid urbanization, increasing cardiovascular disease incidence, and expanding healthcare access. Countries like China and India are witnessing substantial production and consumption increases.

Latin America & Middle East

Moderate markets with distinctive growth opportunities stemming from improving healthcare systems and increasing disease prevalence.

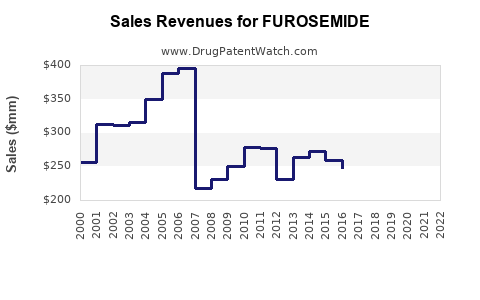

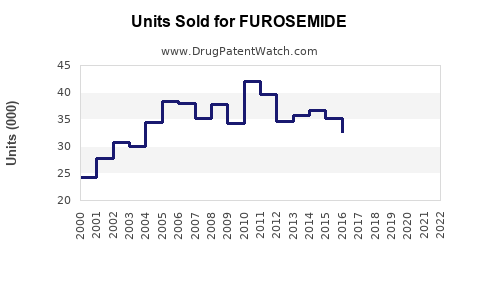

Market Size and Trends

The global Furosemide market was valued at approximately USD 1.7 billion in 2022. It is projected to grow at a compound annual growth rate (CAGR) of approximately 3.5% from 2023 to 2030, reaching USD 2.2 billion by 2030. Factors influencing this growth include the aging demographic, rising chronic disease rates, and expanding outpatient prescription trends.

Competitive Landscape

Major players focus on manufacturing capacity optimization, quality assurance, and cost leadership. Price competition is intense due to the generic nature. Strategic alliances and regional manufacturing expansions are common to penetrate emerging markets.

Sales Projections (2023–2030)

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

Key Influencing Factors |

| 2023 |

1.75 |

— |

Post-pandemic stabilization, steady prescription rates |

| 2024 |

1.81 |

3.4 |

Increased cardiovascular disease burden |

| 2025 |

1.89 |

4.4 |

Aging population accelerates demand |

| 2026 |

1.97 |

4.2 |

Expanded use in hospital and outpatient settings |

| 2027 |

2.05 |

4.0 |

Growing markets in Asia-Pacific |

| 2028 |

2.12 |

3.4 |

Intensified marketing and manufacturing capacity in emerging markets |

| 2029 |

2.16 |

2.0 |

Market saturation in developed regions |

| 2030 |

2.20 |

1.9 |

Stabilization and potential off-label use expansion |

Assumptions: The projection assumes consistent healthcare infrastructure development, ongoing demand for diuretics, and monotonic pressure on generic pricing.

Market Challenges and Opportunities

Challenges

- Pricing pressures due to drug commoditization.

- Regulatory hurdles impacting manufacturing standards.

- Patient safety concerns leading to prescription restrictions.

Opportunities

- Development of combination therapies incorporating Furosemide.

- Formulation innovations, including sustained-release tablets.

- Entry into emerging markets with tailored pricing and distribution strategies.

- Leveraging digital health tools for optimal prescribing practices.

Conclusions

The Furosemide market remains a stable, mature segment driven by broad clinical utility and an aging global populace. While patent expirations limit innovation, strategic focus on manufacturing efficiency, regional expansion, and formulation improvements can sustain growth. Continuous monitoring of regulatory shifts and emerging therapeutic alternatives is crucial for stakeholders aiming to optimize market positioning.

Key Takeaways

- The global Furosemide market is projected to reach USD 2.2 billion by 2030, growing at a CAGR of roughly 3.5%.

- North America leads the market, but Asia-Pacific offers high-growth opportunities.

- The market’s maturity limits aggressive revenue expansion; innovation focuses on formulations and combination therapies.

- Competitive dynamics favor cost-efficient manufacturing, with local generic producers increasing market share.

- Regulatory frameworks and safety concerns necessitate vigilant compliance and pharmacovigilance.

FAQs

1. How does the patent landscape affect Furosemide market sales?

Since Furosemide is off-patent globally, the market predominantly comprises generic formulations, resulting in price competition but limiting growth driven by new branded products.

2. What are the key factors influencing regional sales differences?

Prevalence of cardiovascular diseases, healthcare infrastructure, regulation stringency, and regional manufacturing capabilities shape regional sales. North America and Europe dominate due to higher ADMs, while Asia-Pacific offers growth prospects owing to increasing disease burden and expanding healthcare access.

3. How might emerging diabetes and hypertension management therapies impact Furosemide demand?

The advent of novel antihypertensives and diuretics with improved safety profiles may shift prescribing patterns, potentially reducing dependence on traditional Furosemide, particularly if newer options demonstrate better tolerability.

4. What is the expected impact of formulation innovations on future sales?

Innovations such as sustained-release formulations and combination pills could enhance patient compliance, expand off-label uses, and open new market segments, positively influencing sales.

5. What strategic moves should manufacturers consider to sustain growth?

Manufacturers should focus on expanding in emerging markets, optimizing supply chains, investing in formulation R&D, and establishing strategic alliances to capitalize on regional needs and healthcare trends.

Sources

- MarketWatch, "Global Furosemide Market Size, Status and Forecast 2022-2030."

- WHO Global Health Statistics, 2022.

- IQVIA Reports, "Cardiovascular Pharmaceutical Market Dynamics," 2022.

- European Medicines Agency (EMA).

- US FDA Approved Drugs Database, 2023.