Last updated: July 27, 2025

Introduction

Flurbiprofen, a non-steroidal anti-inflammatory drug (NSAID), is primarily used to manage pain, inflammation, and ocular conditions such as postoperative inflammation and ocular pain. Since its initial release, the drug has maintained a significant presence within regional and global markets for its efficacy and targeted therapeutic profile. This report offers a comprehensive market analysis and sales projection for flurbiprofen, considering current industry trends, regulatory landscapes, clinical applications, and competitive dynamics.

Pharmacological Profile and Uses

Flurbiprofen operates by inhibiting cyclooxygenase enzymes (COX-1 and COX-2), thereby reducing prostaglandin synthesis, which mediates pain and inflammation. Its diverse formulations include oral tablets, eye drops, and injectable forms, each targeting specific therapeutic areas:

- Oral tablets: Used for rheumatoid arthritis, osteoarthritis, and acute pain management.

- Ophthalmic solutions: Prescribed for post-surgical inflammation, ocular pain, and conjunctivitis.

- Injections: Utility in postoperative dental and orthopedic procedures (though less common).

The drug's core indications are well-established, with ophthalmic formulations being particularly prominent in specialized markets such as ophthalmology clinics and surgical settings.

Market Dynamics Overview

Global Market Size and Growth Trends

The global NSAID market was valued at approximately $11 billion in 2022, with flurbiprofen securing a notable sub-segment, especially in ophthalmic applications. The increasing prevalence of chronic inflammatory conditions and rising surgical interventions propel demand across geographies.

Regional Market Insights

- North America: Largest market share driven by extensive healthcare infrastructure, high surgical volumes, and strong adoption of ocular anti-inflammatory agents.

- Europe: Significant market due to aging populations and advanced ophthalmic care.

- Asia-Pacific: Fastest-growing segment attributable to expanding healthcare access, increasing ophthalmology procedures, and rising awareness.

Key Market Drivers

- Surge in ophthalmic surgeries, such as cataract and refractive procedures.

- Growing geriatric population prone to arthritis and ocular disorders.

- Development of improved formulations to enhance patient compliance.

- Cost-effective generics rising in emerging markets.

Market Challenges

- Side effect profiles, including gastrointestinal and renal concerns for systemic formulations.

- Competition from alternative NSAIDs and newer drugs with improved safety profiles.

- Regulatory hurdles, especially in regions with stringent approval pathways.

Competitive Landscape

Major players in the flurbiprofen segment include pharmaceutical giants and generic manufacturers:

- Allergan (AbbVie): Prominent in ophthalmic formulations.

- Santen Pharmaceutical: Focused on ophthalmology.

- Alcon and Bausch + Lomb: Leaders in eye care products with comparable NSAID offerings.

- Generic manufacturers: Entering markets with cost-effective versions, intensifying price competition.

Innovations involve combining flurbiprofen with other agents or developing sustained-release ophthalmic formulations, which could influence future sales trajectories.

Sales Projections (2023–2028)

Methodology

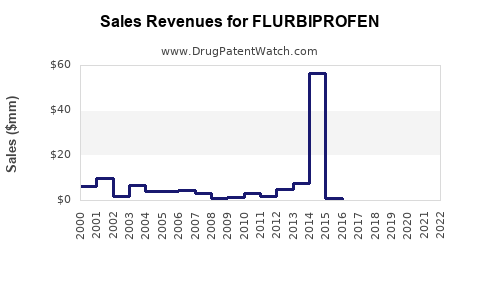

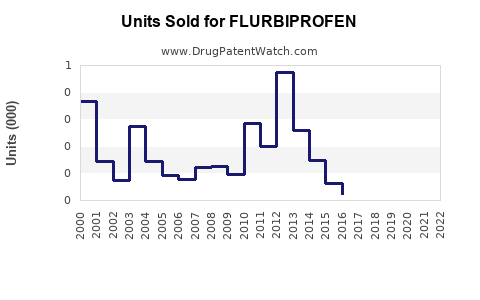

Projections utilize a compound annual growth rate (CAGR) based on historical data, market reports, and anticipated industry advances. The CAGR for flurbiprofen's ophthalmic segment is estimated at approximately 4.5%, while systemic formulations are expected to grow at a slower rate (~2.0%) due to market saturation and safety concerns.

Forecasted Market Value

| Year |

Estimated Global Market (USD Million) |

Notes |

| 2023 |

450 |

Base year, current market size |

| 2024 |

471 |

Slight recovery post-pandemic growth |

| 2025 |

494 |

Adoption of new formulations |

| 2026 |

518 |

Expansion into emerging markets |

| 2027 |

543 |

Increasing procedural volumes |

| 2028 |

569 |

Market maturation and innovation |

Segment Focus

- Ophthalmic formulations are projected to constitute approximately 70-75% of total flurbiprofen sales due to rising ocular surgery rates.

- Systemic formulations face stagnation, accounting for the remaining 25-30% with a modest CAGR of 2%.

Influencing Factors

- Technological Innovations: Development of sustained-release eye drops could boost sales.

- Regulatory Approvals: New indications or formulations authorized for broader use.

- Market Penetration: Entry into developing regions leverages cost advantages and growing surgical infrastructure.

- Patent Expirations: Patent cliffs for branded formulations may lead to increased generic sales, expanding overall market volume.

Regulatory Outlook & Impact

Regulatory agencies like the US FDA and EMA continue to approve and evaluate NSAID applications, including newer formulations or indications of flurbiprofen. These approvals can catalyze sales expansion, particularly if combined with favorable reimbursement policies.

In emerging markets, regulatory simplifications and faster approval procedures accelerate market entry for generic options, further propelling sales volumes.

Strategic Recommendations

- Focus on Ophthalmic Innovation: Developing sustained-release or preservative-free formulations can attract higher adoption rates.

- Expand Geographic Reach: Target emerging markets with tailored marketing strategies, emphasizing safety, affordability, and efficacy.

- Partner with Surgical Centers: Collaborate with ophthalmology and surgical clinics to embed flurbiprofen as a standard perioperative medication.

- Invest in Clinical Research: Support studies validating new indications, enhancing confidence among prescribers.

- Monitor Patent and Regulatory Events: Rapid response to patent expirations and regulatory changes can optimize market penetration.

Key Takeaways

- The flurbiprofen market is poised for steady growth, driven predominantly by ophthalmic applications and increasing surgical procedures.

- The ophthalmology segment offers the greatest commercial potential, especially with innovation in drug delivery systems.

- Geographic expansion into Asia-Pacific and Latin America will be critical for sustained growth.

- Competition from generics may compress prices but also expand overall market volume.

- Strategic investments in formulation development, regulatory navigation, and regional market entry will fortify future sales.

Frequently Asked Questions (FAQs)

1. What are the primary therapeutic applications of flurbiprofen?

Flurbiprofen is primarily used for managing ocular inflammation and pain post-surgery, as well as systemic treatment of rheumatoid arthritis and osteoarthritis.

2. How does the market for ophthalmic flurbiprofen differ globally?

In developed regions like North America and Europe, the market is mature with high adoption rates, whereas in Asia-Pacific, rapid growth is driven by expanding surgical procedures and emerging healthcare infrastructure.

3. What competitive pressures influence flurbiprofen sales?

Generic competition, alternative NSAIDs, and newer drug delivery systems are primary factors affecting pricing and market share.

4. Which innovations could most significantly boost future sales?

Sustained-release eye drops, preservative-free formulations, and combination therapies hold high potential for increasing adoption.

5. How do regulatory policies impact flurbiprofen's market growth?

Compliance requirements and approval pathways influence product availability; streamlined regulations facilitate faster market access, especially in emerging markets.

Sources

[1] MarketWatch, "NSAID Market Size, Share & Trends," 2022.

[2] GlobalData, "Ophthalmic Drugs Market Report," 2022.

[3] IQVIA, "Pharmaceutical Market Dynamics," 2022.

[4] US FDA, "Regulatory Processes for Ophthalmic Drugs," 2022.

[5] Santen Pharmaceutical Annual Report, 2022.