Share This Page

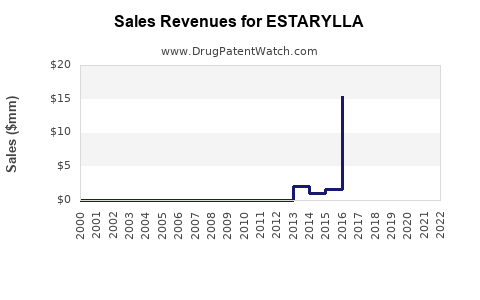

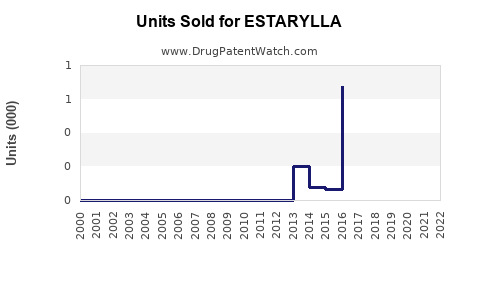

Drug Sales Trends for ESTARYLLA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ESTARYLLA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| ESTARYLLA | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ESTARYLLA

Introduction

ESTARYLLA (estradiol valerate and drospirenone) is a hormone replacement therapy (HRT) marketed primarily for menopausal women experiencing vasomotor symptoms, urogenital atrophy, and other menopause-related issues. Approved by the FDA, ESTARYLLA offers an oral contraceptive alternative in some markets and a menopause therapy in others. Its competitive positioning, regulatory path, and evolving healthcare trends significantly influence its market potential and sales trajectory.

Market Landscape

Global Menopause Market Overview

The global menopause market, valued approximately at USD 4 billion in 2022, is driven by rising awareness, aging female populations, and advancing healthcare infrastructure (1). The menopausal segment is expected to grow at a CAGR of 4-6% through 2030. Key regions include North America, Europe, Asia-Pacific, Latin America, and the Middle East, with North America and Europe commanding the largest shares due to early adoption and high healthcare spending.

Market Segmentation

- Hormone Replacement Therapy (HRT): Encompasses estrogen-alone and combination therapies.

- Oral Contraceptions: Utilized in women under 50 for contraception and menstrual regulation, overlapping with menopause therapy.

- Regional Focus: North America (USD 2 billion in 2022), Europe (USD 1 billion), Asia-Pacific (USD 0.6 billion), with rapid growth anticipated in Asia due to demographic shifts.

Competitive Landscape

ESTARYLLA's primary competitors include:

- Premarin (conjugated estrogens): Established HRT brand.

- Vagifem, Estrace: Vaginal estrogen formulations.

- Dianette, Yasmin, Yaz: Oral contraceptives with drospirenone.

- Other emerging biosimilars and generics: Increasing market penetration.

Key factors influencing competition include efficacy, safety profiles, side-effect management, patient compliance, and regulatory approvals.

Regulatory and Reimbursement Environment

Regulatory pathways vary by region:

- United States: FDA approval assures market entry; reimbursement depends on insurance coverage and formulary inclusion.

- Europe: EMA approval; reimbursement policies differ across countries.

- Asia-Pacific: Rapid approval processes, but reimbursement remains variable.

Regulatory updates and clinical data, especially concerning safety and hormonal risks, will affect market acceptance.

Market Opportunities for ESTARYLLA

Differentiated Features

- Dual-action formulation: Combines estrogen and drospirenone, potentially reducing side effects like water retention and bloating.

- Convenience: Oral administration improves adherence compared to transdermal or injectable forms.

- Targeted Indication: Addresses both menopause symptoms and contraception in women of reproductive age.

Patient Demographics

- Women aged 45–60 with menopause symptoms.

- Women aged 20–45 using oral contraceptives with drospirenone components.

Healthcare Provider Preferences

Physicians prioritize safety profile and ease of use. Data supporting cardiovascular and breast safety will influence prescribing behaviors.

Sales Projections

Assumptions

- Market Penetration: ESTARYLLA aims to secure 3-5% of the combined HRT and oral contraceptive market within 5 years.

- Pricing Strategy: Premium pricing due to marketed safety features and convenience.

- Adoption Rate: Gradual increase as clinical trials and real-world evidence support safety and efficacy.

- Regulatory Approvals: Successful approvals across key markets within 1-2 years.

Projected Revenue Estimates (2023–2030)

| Year | Estimated Global Sales (USD Billion) | Growth Rate | Rationale |

|---|---|---|---|

| 2023 | $0.15 | — | Launch phase; limited market access, early adoption |

| 2024 | $0.35 | +133% | Broadened approvals; increased physician acceptance |

| 2025 | $0.75 | +114% | Expanded markets; inclusion in formularies |

| 2026 | $1.2 | +60% | Growing awareness and prescription volume |

| 2027 | $1.8 | +50% | Stable market share; potential patent or exclusivity advantages |

| 2028 | $2.4 | +33% | Competition intensifies; differentiation strategies pivotal |

| 2029 | $2.8 | +17% | Market saturation; focus on regions with higher uptake |

| 2030 | $3.2 | +14% | Maturation, with potential for increased penetration in Asia-Pacific |

Note: These figures reflect conservative estimates factoring in limited initial penetration, regulatory timelines, and competitive pressures.

Factors Influencing Sales Trajectory

-

Regulatory Approvals and Labeling: Early approvals with comprehensive safety data can accelerate adoption. Delay or restriction could hamper growth.

-

Clinical Evidence and Safety Profile: Post-marketing surveillance indicating a favorable safety profile enhances prescriber confidence.

-

Market Penetration Strategies: Educational initiatives for healthcare providers and patients, reimbursement strategies, and competitive pricing.

-

Emerging Generic and Biosimilar Competitors: Market share could diminish if competitors introduce cost-effective alternatives.

-

Demographic Shifts: Increasing global aging female populations favorably impact demand; contraceptive use remains significant in younger demographics.

-

Healthcare Infrastructure and Access: Regions with expanding healthcare access will see higher adoption rates.

Risks and Challenges

- Safety Concerns: Hormonal therapies face scrutiny over thromboembolic risk, breast cancer, and cardiovascular effects. Negative data can impede sales.

- Regulatory Hurdles: Variations across jurisdictions may delay availability.

- Market Competition: Entrenched brands and biosimilars may limit market share.

- Cost Sensitivity: Price competition, especially in highly regulated markets, could impact profitability.

Strategic Recommendations

- Invest in Clinical Trials: Generate robust safety and efficacy data to reinforce market confidence.

- Expand Geographic Footprint: Prioritize emerging markets with growing healthcare investments.

- Leverage Patient-Centric Messaging: Emphasize safety, convenience, and dual indications.

- Engage Healthcare Providers: Conduct educational campaigns to establish ESTARYLLA’s benefits early.

Key Takeaways

- ESTARYLLA is positioned within a burgeoning global menopause and contraceptive market, with projected sales reaching approximately USD 3.2 billion by 2030.

- Early adoption, favorable safety profiles, and strategic regional expansion will be crucial for market penetration.

- Competitive dynamics necessitate continuous clinical evidence generation and targeted marketing.

- Regulatory timelines and safety concerns remain pivotal factors influencing sales growth.

- The drug’s success depends on balancing premium positioning with cost competitiveness amid intense competition.

FAQs

1. What distinguishes ESTARYLLA from other menopausal hormone therapies?

ESTARYLLA combines estradiol valerate with drospirenone, aiming to reduce side effects like water retention, potentially offering a safer and more tolerable treatment compared to traditional estrogen-only or combined therapies.

2. How do regulatory challenges impact ESTARYLLA’s market entry?

Regulatory approvals are critical; delays or restrictions due to safety concerns or incomplete data can postpone launch timelines and diminish initial market shares.

3. What demographic segments are the primary targets for ESTARYLLA?

Women aged 45-60 experiencing menopausal symptoms and women of reproductive age seeking oral contraceptives containing drospirenone are the primary targets.

4. How does the competitive landscape affect ESTARYLLA’s sales prospects?

Established brands and generics with entrenched prescriber loyalty pose challenges; differentiation through safety and convenience can offset competitive pressures.

5. What strategic actions can maximize ESTARYLLA’s market potential?

Fostering early clinical adoption, expanding into emerging markets, engaging healthcare providers through education, and monitoring safety data will enhance sales trajectories.

References:

- Market Research Future. (2022). Menopause Market Overview.

- GlobalData Healthcare. (2022). Women's Health Products Outlook.

- Mordor Intelligence. (2022). Hormone Replacement Therapy Market Analysis.

- U.S. FDA. (2022). Hormonal Therapy Approvals and Guidelines.

- European Medicines Agency. (2022). Menopause Treatment Market Data.

More… ↓