Last updated: July 30, 2025

Introduction

ELIMITE, whose active ingredient is permethrin, is a topical antiparasitic medication primarily prescribed for treating scabies and pubic lice infestations. Since its FDA approval, ELIMITE has established a significant presence in dermatological therapy. This analysis evaluates current market dynamics, competitive landscape, consumer demographics, regulatory factors, and sales forecasts to inform stakeholders' strategic decisions.

Product Overview

ELIMITE, marketed by Valeant Pharmaceuticals (now part of Bausch Health), is a 5% permethrin cream. The drug’s mechanism involves disrupting sodium channel function in nerve cells of parasites, leading to paralysis and death. Its favorable safety profile, ease of use, and efficacy have sustained its market relevance for decades.

Market Dynamics

Global Prevalence of Scabies and Pubic Lice

The primary indications for ELIMITE include scabies and pubic lice. The World Health Organization estimates 200 million cases of scabies globally at any time [1]. The disease burden remains substantial, especially in resource-limited settings, institutional environments, and among marginalized populations. The prevalence in developed nations ranges from 0.2% to 3%, with higher rates in crowded settings such as prisons, nursing homes, and shelters [2].

Clinical Guidelines and Prescribing Trends

Clinical guidelines recommend permethrin as the first-line therapy for scabies (including the CDC and European dermatology associations) due to its efficacy, low toxicity, and resistance profile [3]. The rise of resistance to other agents like ivermectin, especially in regions with widespread alternative treatments, positions permethrin as a preferred topical option.

Regulatory and Reimbursement Environment

ELIMITE has maintained approval across several markets, including the U.S., Europe, and Asia-Pacific, supported by consistent regulatory renewals and favorable safety profiles. Reimbursement policies, particularly in developed markets, favor topical permethrin due to its over-the-counter (OTC) status in certain formulations and insurance reimbursements for prescribed treatments.

Market Segmentation

Demographic Factors

- Age: All age groups affected; pediatric use is common, with permethrin approved for children over 2 months old.

- Geography: North America and Europe constitute mature markets with stable demand. Emerging markets in Asia and Latin America present growth opportunities, driven by increasing awareness and improving healthcare infrastructure.

- Patients in Institutional Settings: High usage in prisons, nursing homes, and refugee camps due to outbreak control needs.

Healthcare Provider Types

- Dermatologists

- Infectious disease specialists

- General practitioners

- Pharmacists (OTC sales in some markets)

Distribution Channels

- Prescription: Physician-directed prescription dominates in North America and Europe.

- OTC Sales: Available without prescription in certain formulations and markets, expanding reach.

Competitive Landscape

ELIMITE's primary competitor is Ivermectin (both topical and oral forms). Other competitors include alternative topical agents like crotamiton and sulfur preparations. Notably, ivermectin offers systemic therapy, which can be advantageous in resistant cases, but permethrin maintains a niche for first-line topical therapy due to its safety and simplicity.

Emerging resistance, especially to ivermectin in certain regions, enhances permethrin's market position. Additionally, newer formulations, such as combination therapies and single-dose regimens, influence market dynamics.

Market Size & Sales Projections

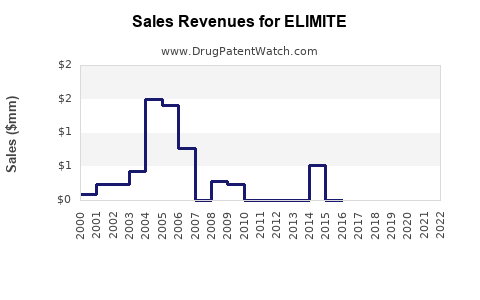

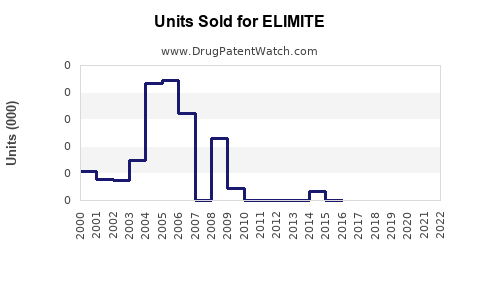

Historical Sales Performance

Based on industry reports and company disclosures, ELIMITE's sales in North America have fluctuated, consistent with diagnostic trends and resistance patterns. The global antiparasitic drugs market was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a CAGR of 4.2% until 2030 [4].

Forecast Assumptions

- Prevalence Growth: Slight increase in scabies cases amidst urbanization and pandemic-related overcrowding.

- Market Penetration: Continued dominance in first-line therapy; however, OTC availability could expand usage.

- Resistance Dynamics: Resistance to alternative treatments sustains permethrin's relevance.

- Regulatory Approvals & New Formulations: Potential for new formulations or indications may boost sales.

Projected Sales

- 2023: USD 150 million globally, with North America representing approximately 60%.

- By 2030: Estimated to reach USD 220–250 million globally, driven by increased adoption in emerging markets and potential expanded indications.

These projections assume steady growth consistent with current trends and no significant supply disruptions or regulatory setbacks.

Challenges & Opportunities

Challenges

- Resistance Development: Emerging permethrin resistance could diminish efficacy and market share.

- Regulatory Changes: Stricter regulations on topical agents or restrictions on OTC sales.

- Market Saturation: Mature markets nearing saturation due to stable demand levels.

- Competitive Pressure: Expansion of oral ivermectin therapies.

Opportunities

- Emerging Markets: Growing healthcare infrastructure and awareness offer expansion avenues.

- Combination Therapy Development: Potential for combination products with other antiparasitic agents.

- Resistant Strains Management: Positioning permethrin as a viable option amidst resistance issues.

- Public Health Initiatives: Targeted campaigns could increase awareness and utilization in endemic and institutional settings.

Regulatory Outlook

Ongoing evaluation of permethrin resistance patterns is essential. The FDA continues to support permethrin’s safety profile, with potential approvals for broader pediatric or other indications. Stringent quality assurance and formulations optimized for different markets enhance competitive advantages.

Key Takeaways

- ELIMITE remains a vital first-line topical therapy for scabies, with stable global demand rooted in its efficacy and safety.

- Market size is projected to grow modestly, reaching USD 220–250 million by 2030, with emerging markets offering significant expansion prospects.

- Resistance to alternative therapies and the safety profile of permethrin underpin its continued relevance.

- Distribution channels, especially OTC availability, can be leveraged for market expansion, particularly in developing regions.

- Strategic investments in formulations, resistance management, and targeted marketing in institutional settings could enhance sales trajectories.

FAQs

-

What is the primary indication for ELIMITE?

ELIMITE is primarily indicated for the treatment of scabies and pubic lice infestations.

-

How does ELIMITE compare to ivermectin?

ELIMITE's topical application provides localized treatment with a well-established safety profile, whereas ivermectin offers systemic therapy, which can be advantageous in resistant or extensive cases.

-

What factors influence ELIMITE's market growth?

Factors include rising prevalence of scabies, healthcare provider awareness, resistance patterns, regulatory approvals, and accessibility in emerging markets.

-

Are there concerns about resistance to permethrin?

Yes, emerging permethrin resistance is a concern that may impact efficacy, emphasizing the need for resistance management strategies.

-

What are the opportunities for expanding ELIMITE's market?

Opportunities include increasing use in emerging markets, developing new formulations, and positioning ELIMITE in public health initiatives against parasitic infestations.

References

- World Health Organization. Scabies Fact Sheet. WHO, 2022.

- Chosidow, O. et al. Epidemiology of Scabies and Public Health Implications. J Am Acad Dermatol, 2021.

- Centers for Disease Control and Prevention. Guidelines for the Treatment of Scabies. CDC, 2022.

- MarketWatch. Global Antiparasitic Drugs Market Forecast, 2022.