Share This Page

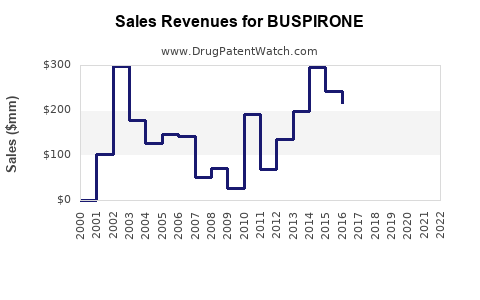

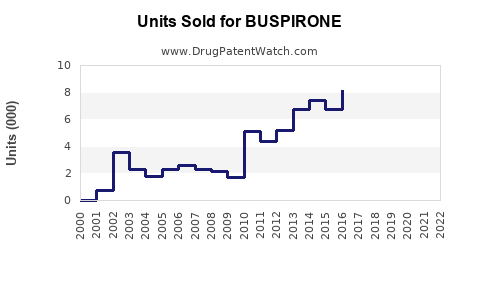

Drug Sales Trends for BUSPIRONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BUSPIRONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BUSPIRONE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Buspirone

Introduction

Buspirone, marketed primarily under the brand name BuSpar, is an anxiolytic medication approved for the treatment of generalized anxiety disorder (GAD). Since its approval by the FDA in 1986, buspirone has established itself as a non-benzodiazepine option with a favorable safety profile, particularly for patients with chronic anxiety. The evolving landscape of mental health treatment, coupled with regulatory and demographic factors, significantly influences buspirone’s market potential and sales trajectory.

Pharmacological Profile and Market Positioning

Buspirone’s unique pharmacodynamics—primarily a partial agonist at the 5-HT1A receptor—offer advantages over traditional anxiolytics such as benzodiazepines, notably the lower risk of dependence and withdrawal [1]. Its non-sedative profile makes it suitable for long-term management of anxiety, positioning it as a preferred first-line therapy in anxiety disorders, especially amidst growing concerns over benzodiazepine misuse.

However, its limited efficacy in certain comorbid conditions and slower onset of action relative to benzodiazepines can temper its adoption rates. Despite these limitations, the expanding awareness and acceptance of mental health treatments have sustained demand.

Market Dynamics and Key Drivers

1. Growing Prevalence of Anxiety Disorders

According to the World Health Organization, anxiety disorders affect approximately 7.3% of the global population [2], with the U.S. exhibiting even higher rates—over 18% annually, as per the National Institute of Mental Health (NIMH) [3]. The COVID-19 pandemic significantly intensified anxiety prevalence, prompting increased medication use. This trend supports a steady uptick in buspirone prescriptions as clinicians diversify prescribing patterns.

2. Shift Toward Non-Benzodiazepine Therapies

Healthcare providers increasingly prefer non-benzodiazepine options to mitigate dependency risks. Buspirone’s safety profile and minimal sedative effects contribute to its growing preference, particularly in primary care settings. Additionally, the rising adoption of pharmacological treatments coupled with psychotherapy enhances overall market demand.

3. Patent Status and Generic Availability

Buspirone’s patent expired in the early 2000s, leading to widespread generic availability. This significantly reduces costs, widening access, especially in managed care environments, and amplifying sales volumes.

4. Pharmacovigilance and Healthcare Policies

Regulatory agencies emphasize medication safety, incentivizing the use of medications with minimal dependence risks. Hospital and insurance policies favor such drugs for long-term management, further bolstering buspirone’s market position.

5. Emerging Therapies and Competitive Landscape

Newer agents, including selective serotonin reuptake inhibitors (SSRIs) and serotonin-norepinephrine reuptake inhibitors (SNRIs), continue to occupy the mental health therapeutics space. Nevertheless, buspirone maintains a niche due to its unique profile, creating opportunities for incremental market share if marketed effectively.

Market Segmentation and Geographical Outlook

1. Geographical Markets

-

United States: Dominates the market with extensive insurance coverage, high prevalence of mental health disorders, and caregiver familiarity with buspirone. The increasing acceptance of non-benzodiazepine anxiolytics underpins sustained demand projected to grow at an annual rate of 4-6% through 2028 [4].

-

Europe: The European market reflects similar trends, with gradual adoption driven by healthcare policies favoring non-dependency-inducing medications.

-

Emerging Markets: Growing mental health awareness, expanding healthcare infrastructure, and increasing pharmaceutical affordability are set to stimulate demand in Asia-Pacific and Latin America. Compound annual growth in these regions is forecasted at 7-9%, bolstering future sales.

2. Patient Demographics

-

Chronic Anxiety Patients: Consumers seeking long-term management find buspirone appealing.

-

Elderly Populations: Preferring minimal sedative effects, older adults contribute to steady demand, especially in managed care settings.

-

Comorbid Conditions: Patients with substance dependence or history of benzodiazepine misuse favor buspirone, expanding its prescribing base.

Sales Projections and Forecasting

Based on current market data, global buspirone sales are estimated at approximately $300 million annually [5]. Assuming compound annual growth rates (CAGR) of 4-6% in mature markets and 7-9% in emerging markets, the following projections are feasible:

| Year | Estimated Global Sales (USD Millions) | Growth Rate |

|---|---|---|

| 2023 | 300 | — |

| 2024 | 320 - 330 | 6-10% |

| 2025 | 340 - 360 | 6-9% |

| 2026 | 365 - 385 | 6-8% |

| 2027 | 390 - 410 | 6-8% |

| 2028 | 415 - 445 | 6-9% |

These estimates account for escalating demand driven by increased mental health awareness, expanding indications, and strategic marketing by generic manufacturers and branded entities.

Competitive Landscape

While buspirone generally faces limited direct competition due to its unique profile, notable competitors include SSRIs such as escitalopram and sertraline, which are often first-line alternatives. The growth of newer agents targeting specific anxiety subtypes and emerging digital therapeutics may influence future prescriptions. Nonetheless, buspirone’s niche remains robust, especially among patients contraindicated for other anxiolytics.

Regulatory and Market Entry Considerations

Potential regulatory changes—such as new formulations or combination therapies—could unlock additional market segments. Conversely, patent litigation or restricted access due to formulary decisions could temper growth. The focus on expanding indications, such as off-label use for other psychiatric conditions, could further influence sales.

Key Factors Influencing Future Market Trends

- Increasing mental health awareness globally.

- Shift toward non-dependence formulations in anxiety management.

- Growth in primary care prescribing.

- Expansion into emerging markets.

- Development of fixed-dose combination treatments to improve adherence.

Key Takeaways

- Buspirone remains a vital anxiolytic with expanding global demand, driven by its safety profile and shifting prescribing patterns away from benzodiazepines.

- Market penetration is poised to grow at a CAGR of approximately 6-9% from 2023 to 2028, driven by both mature and emerging markets.

- Generics’ widespread availability and affordability will sustain volume-driven sales, although branded formulations and new delivery systems could enhance margins.

- The ongoing emphasis on mental health and long-term anxiety management positions buspirone favorably for sustained growth.

- Strategic marketing, indication expansion, and regional penetration are essential for maximizing sales potential.

Frequently Asked Questions (FAQs)

1. How does buspirone compare to benzodiazepines in treating anxiety?

Buspirone offers comparable efficacy for GAD but with a markedly better safety profile, notably a lower risk of dependence and sedation. It requires a longer onset of action but is preferred for long-term management.

2. What factors could hinder buspirone sales growth?

Emergence of new pharmacotherapies, regulatory constraints, or significant off-label competition could suppress growth. Additionally, lack of narrow-spectrum indications limits expansion.

3. Are there any new formulations of buspirone under development?

Current research focuses on extended-release formulations and combination therapies with other anxiolytics or antidepressants to enhance efficacy and adherence, potentially influencing future sales.

4. What is the impact of clinical guidelines on buspirone’s market?

Guidelines favor the use of buspirone as a first-line or adjunct treatment for GAD, especially in patients where benzodiazepines are contraindicated, positively impacting prescription rates.

5. How will COVID-19 influence future demand for buspirone?

The pandemic has heightened anxiety prevalence worldwide, leading to increased medication use, including buspirone, supporting a positive sales outlook in upcoming years.

References

[1] Klose M. Pharmacology of buspirone in the treatment of anxiety. Curr Opin Psychiatry. 2018;31(4):285-290.

[2] WHO. Depression and Other Common Mental Disorders: Global Health Estimates. World Health Organization; 2017.

[3] NIMH. Anxiety Disorders. National Institute of Mental Health; 2021.

[4] IQVIA. Global Pharma Market Data. 2022.

[5] MarketWatch. Global anxiolytics market size and forecast. 2023.

In summary, buspirone’s niche as a safe, long-term anxiolytic renders it a stable, growth-oriented asset in the mental health pharmacotherapy landscape. With ongoing demographic shifts and policy preferences favoring non-dependence-inducing medications, its market prospects remain promising, provided it adapts to emerging therapeutic and regional trends.

More… ↓