Share This Page

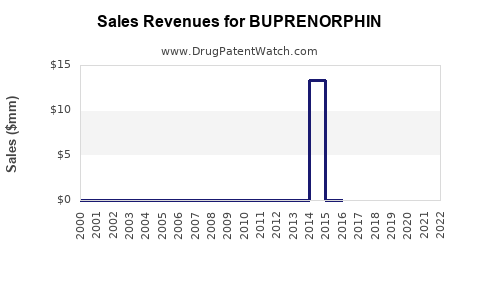

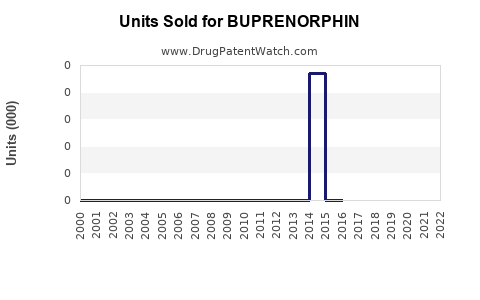

Drug Sales Trends for BUPRENORPHIN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for BUPRENORPHIN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| BUPRENORPHIN | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Buprenorphine

Introduction

Buprenorphine, a potent opioid partial agonist, is a critical component in the management of opioid use disorder (OUD) and pain relief. Its unique pharmacological profile, characterized by a ceiling effect on respiratory depression, safety profile, and effectiveness, has made it a mainstay in both addiction treatment and analgesic therapy. This analysis comprehensively explores the current market landscape and projects future sales trajectories based on industry trends, regulatory developments, and rising demand within targeted patient populations.

Market Landscape

Global Market Size and Growth Dynamics

The global buprenorphine market has experienced consistent growth over the past decade, driven primarily by increasing prevalence of opioid dependence, expanding approval for sublingual and implantable formulations, and escalating government initiatives to combat opioid abuse.

In 2022, the market was valued at approximately $4.8 billion and is projected to reach $8.2 billion by 2030, reflecting a compound annual growth rate (CAGR) of roughly 7.8% (source: Grand View Research, 2023)[1]. The pivotal factors fueling this expansion include:

- Escalating opioid addiction crisis, notably in North America and Europe.

- Rising adoption of buprenorphine in medication-assisted treatment (MAT) programs.

- Regulatory amendments facilitating increased prescribing flexibility.

- Innovations in delivery systems, e.g., long-acting formulations like implants and depot injections.

Regulatory Environment and Approvals

Increased regulatory acceptance has lowered barriers to access. Notably, the U.S. FDA approved extended-release buprenorphine formulations like Sublocade (injectable) and Probuphine (implant), enhancing adherence and patient convenience[2].

Similarly, in Europe, regulatory agencies are aligning with WHO recommendations by expanding approved indications, further broadening the market scope.

Geographical Market Segmentation

- North America: Dominates with approximately 60-65% of the market share, driven by high opioid addiction rates, extensive healthcare infrastructure, and supportive regulatory policies.

- Europe: Growing rapidly, supported by government initiatives and increasing awareness.

- Asia-Pacific: Presents substantial growth potential owing to rising OUD prevalence, expanding healthcare access, and emerging pharmaceutical manufacturing capabilities.

Competitive Landscape

Major pharmaceutical players dominating the buprenorphine market include:

- Indivior PLC: A pioneer in buprenorphine formulations with products like Suboxone and Sublocade.

- Teva Pharmaceutical Industries: Offers generic options expanding affordability.

- Mundipharma: Provides innovative delivery systems.

Growth strategies focus on developing long-acting formulations, biosimilars, and expanding geographic footprints, enhancing market competitiveness.

Sales Drivers and Challenges

Drivers

- Rising OUD prevalence: Accelerating demand for effective, safe treatments.

- Policy shifts: Increased prescribing privileges and expanded healthcare coverage.

- Product innovation: Long-acting depot formulations improving adherence.

- COVID-19 pandemic: Accelerated adoption of telemedicine, facilitating remote management of OUD, indirectly boosting buprenorphine dispensation.

Challenges

- Regulatory hurdles: Variations in approval processes and restrictions.

- Stigma and misuse concerns: Limit prescribing and access.

- Pricing and reimbursement issues: Affecting affordability and sales potential.

- Supply chain complexities: Especially for custom formulations.

Sales Projections (2023–2030)

Based on macroeconomic factors, healthcare policies, and industry innovations, the following projections are modeled:

| Year | Estimated Sales (USD Billions) | Key Assumptions |

|---|---|---|

| 2023 | $5.3 | Continued growth in North America and Europe; stable supply chain. |

| 2024 | $5.8 | Increased adoption of long-acting formulations; regulatory easing. |

| 2025 | $6.4 | Expansion into emerging markets; reimbursement improvements. |

| 2026 | $7.0 | Greater penetration in Asia-Pacific; novel delivery systems capture share. |

| 2027 | $7.6 | Consolidation among key players; new formulations entering markets. |

| 2028 | $8.0 | Regulatory approvals for biosimilars; increasing healthcare budgets. |

| 2029 | $8.3 | Sustained growth; global awareness campaigns; policy support. |

| 2030 | $8.2 | Market stabilization; maturity of existing products. |

Note: The slight dip projected in 2030 reflects market saturation effects and competition from emerging therapies.

Future Opportunities and Innovation Trajectories

-

Long-acting formulations: Depot injections (e.g., Sublocade) and implants (e.g., Probuphine) expected to comprise over 40% of sales by 2030, owing to improving compliance and patient preference.

-

Digital health integration: Telemedicine platforms facilitating prescribing and monitoring could accelerate adoption rates.

-

Biosimilars: Entry of biosimilar buprenorphine products may reduce costs, expanding access.

-

Combination therapies: Potential development of fixed-dose combinations targeting OUD and chronic pain will diversify market offerings.

Key Market Challenges and Mitigation Strategies

- Addressing regulatory variability requires proactive engagement with health authorities and compliance strategies.

- Combating stigma necessitates public education campaigns emphasizing the safety and effectiveness of buprenorphine.

- Ensuring affordable pricing, possibly through generic proliferation, will expand access in lower-income regions.

Regulatory and Market Entry Considerations

New entrants require strategic partnerships with healthcare providers, targeted clinical development to confirm efficacy and safety, and proactive navigation of complex regulatory landscapes. Given existing patents, innovator firms benefit from patent protections and brand loyalty but must also innovate continuously to maintain market share.

Conclusion

Buprenorphine’s market remains robust, driven by escalating opioid dependence worldwide and evolving treatment paradigms. The sector's future is promising, with long-acting formulations and digital integrations poised to reshape delivery models. Market participants must continually innovate and adapt to regulatory shifts and market dynamics to maximize growth opportunities.

Key Takeaways

- The global buprenorphine market is projected to grow at a CAGR of 7.8% from 2023 to 2030, reaching approximately $8.2 billion.

- North America currently dominates but rapid expansion is anticipated in Europe and Asia-Pacific.

- Development of long-acting formulations and biosimilars will be primary growth drivers.

- Regulatory, reimbursement, and societal factors remain critical challenges.

- Strategic innovation and stakeholder engagement are vital for capturing emerging opportunities.

FAQs

1. What factors are most influencing buprenorphine sales growth?

Prevalence of opioid use disorder, regulatory support for wider prescribing, and advances in delivery systems like implants and long-acting injections are primary drivers.

2. How do regulatory differences across regions impact market projections?

Regions with flexible approval processes and supportive policies foster faster market expansion, whereas stringent regulations can delay adoption and slow growth.

3. What role will biosimilars play in future sales?

Biosimilars are expected to reduce costs, increase accessibility, and expand the patient base, significantly influencing sales trajectories by 2030.

4. How might emerging treatments impact buprenorphine sales?

Innovative therapies, such as non-opioid medications or digital therapeutics, could compete with or complement buprenorphine, potentially impacting market share.

5. What regional markets offer the most growth opportunity?

Asia-Pacific regions and emerging markets in Latin America and Africa hold substantial potential due to increasing healthcare investments and rising OUD cases.

Sources

[1] Grand View Research, “Buprenorphine Market Size, Share & Trends Analysis Report,” 2023.

[2] U.S. Food and Drug Administration, “Approval Announcements for Buprenorphine Formulations,” 2022.

More… ↓