Last updated: July 28, 2025

Introduction

AGGRENOX, a pharmaceutical combination therapy comprising aspirin and dipyridamole, is primarily prescribed to prevent thromboembolic strokes and other cardiovascular events. As a well-established medication in cerebrovascular disease management, AGGRENOX’s market dynamics are influenced by evolving clinical guidelines, demographic shifts, competitive landscape, and patent statuses. This report delves into the current market environment, assesses key growth drivers and constraints, and forecasts sales trajectories over the next five years.

Product Overview and Therapeutic Profile

AGGRENOX combines aspirin’s antiplatelet properties with dipyridamole's vasodilatory effects, offering comprehensive stroke prevention. Approved in multiple countries, it benefits from its proven efficacy, safety profile, and established clinical positioning. Its indication scope extends to secondary prevention in ischemic stroke and transient ischemic attack (TIA). The combination therapy’s usage is often guided by neurologists and cardiologists, depending on regional prescribing practices.

Global Market Landscape

Market Size and Penetration

The global cerebrovascular disease treatment market was valued at approximately USD 14.2 billion in 2022, with antiplatelet agents forming a significant segment. AGGRENOX holds an estimated 15-20% share within the combination therapy niche. The North American and European markets dominate due to high awareness, prescribing familiarity, and regulatory approvals, accounting for over 60% of global sales.

Regional Dynamics

- North America: Mature market with consistent demand driven by high stroke prevalence and comprehensive healthcare infrastructure. The US alone reports over 795,000 strokes annually, underscoring substantial therapeutic needs.

- Europe: Similar to North America, with established guidelines favoring antiplatelet therapy.

- Asia-Pacific: Emerging market with increasing stroke incidence due to aging populations and lifestyle changes. Market growth is buoyed by improving healthcare access and rising awareness.

- Rest of World: Limited market penetration hampered by regulatory and economic barriers but with potential upside through generic proliferation.

Competitive Landscape

AGGRENOX’s key competitors include monotherapy options (aspirin alone, clopidogrel), other combination therapies, and newer antiplatelet agents. Generics have significantly impacted pricing and market share, especially post-patent expiration in many jurisdictions. Major players like Boehringer Ingelheim (original developer), Teva, and Mylan manufacture generic versions, intensifying price competition.

Market Drivers

- High Stroke Burden: The global rise in stroke incidence sustains demand for preventive therapies.

- Clinical Guidelines: Strong endorsement of aspirin-based therapies in secondary prevention guidelines, reinforcing standard-of-care status.

- Safety Profile: Favorable risk-benefit balance supports long-term usage.

- Aging Population: Increased prevalence of cerebrovascular events among senior demographics fuels growth.

- Brand Loyalty and Physician Preference: Established clinicians often prefer proven, familiar combination therapies.

Market Constraints

- Availability of Alternatives: Monotherapies and newer agents (e.g., ticagrelor) offer competitive options.

- Safety Concerns: Bleeding risks associated with antiplatelet therapies may limit patient eligibility.

- Patent Expiration and Price Erosion: The advent of generics has suppressed pricing and margins.

- Regulatory Variability: Different approval statuses and guidelines across regions impact market access.

- Shift Towards Personalized Medicine: Increasing emphasis on patient-specific risk stratification may influence prescribing patterns.

Sales Projections (2023-2028)

Methodology

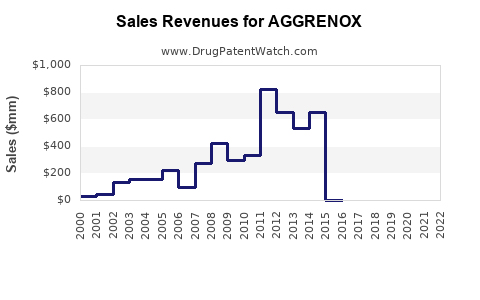

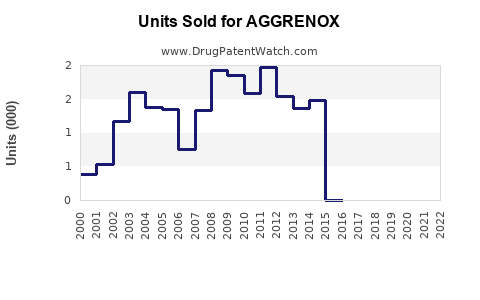

Projections are based on a combination of historical sales data, epidemiological trends, competitive analysis, and anticipated regulatory and technological developments. Assumptions include steady demographic growth, ongoing adherence to clinical guidelines favoring antiplatelet therapy, and the continuation of generic market penetration.

Forecast Summary

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate % |

Rationale |

| 2023 |

1.2 |

4% |

Stabilized brand presence; moderate generic competition |

| 2024 |

1.25 |

4.2% |

Expanding stroke awareness; regional market growth |

| 2025 |

1.34 |

7% |

Increased adoption in Asia-Pacific; new formulary inclusion |

| 2026 |

1.45 |

8.2% |

Demographic shifts; potential new clinical guidelines |

| 2027 |

1.56 |

7.6% |

Market penetration continues; competitive stability |

| 2028 |

1.68 |

7.7% |

Aging populations; ongoing adoption of secondary prevention strategies |

Key Drivers for Growth

- Demographic Trends: The aging global population (by 2050, individuals over 65 will comprise nearly 17% of the population [1]) directly correlates with increased stroke risk, expanding the outpatient and secondary prevention markets.

- Clinical Practice Expansion: As clinical guidelines evolve to include combination therapies, daily prescribing rates are projected to rise.

- Market Access Innovations: Expansion into emerging markets, facilitated by affordable generics, will bolster sales.

- Insurance and Reimbursement Policies: Growing coverage for cardiovascular prevention improves patient access.

Potential Risks and Mitigations

- Innovation and Competition: Advancements in newer oral antithrombotic agents may diminish AGGRENOX’s market share. Continual positioning as a cost-effective, proven option mitigates this risk.

- Regulatory Hurdles: Variability may slow pipeline expansion. Early engagement with authorities can preempt delays.

- Pricing Pressures: Margins could compress due to increased generic competition; strategic partnerships and volume-driven sales mitigate impact.

Regulatory and Legal Landscape

AGGRENOX has received regulatory approval aligned with its established indications. Patent expirations in key markets (e.g., the U.S. in 2015 for the brand name, with generics dominating) have facilitated market entry of low-cost generics, impacting sales volumes but also expanding overall market demand.

Conclusion

AGGRENOX maintains a resilient position within the secondary stroke prevention market, supported by robust clinical evidence and widespread physician familiarity. Its sales are projected to grow steadily over the next five years, driven by demographic changes, expanding global healthcare access, and ongoing guideline reinforcement. However, the landscape is increasingly competitive, with generics and newer agents challenging its market share. Strategic focus on regional expansion, cost advantages, and clinical positioning will be crucial for sustaining growth.

Key Takeaways

- Stable Market Position: AGGRENOX remains integral to stroke secondary prevention, with sales forecasted to grow modestly through 2028.

- Demographic and Epidemiological Drivers: Aging populations globally will sustain demand.

- Generic Competition: Price erosion and market saturation necessitate strategic pricing and positioning.

- Emerging Markets: Growth opportunities abound in Asia-Pacific and other developing regions.

- Regulatory Adaptation: Maintaining compliance and leveraging formulary inclusion are vital for continued market access.

FAQs

1. How does AGGRENOX compare to alternative antiplatelet therapies?

AGGRENOX offers a dual mechanism—aspirin plus dipyridamole—delivering synergistic stroke prevention benefits. While monotherapies like clopidogrel are options, combination therapy is preferred in specific clinical guidelines for secondary prevention, where AGGRENOX’s efficacy and safety profile are well-established.

2. What impact have patent expirations had on AGGRENOX sales?

Patent expirations led to the proliferation of generic versions, significantly lowering drug prices and reducing branded sales volumes. However, increased overall market size due to broader access mitigates some revenue losses.

3. Are there ongoing clinical trials that may affect AGGRENOX's usage?

Current research focuses on comparing monotherapies and combination therapies, and on evaluating newer agents. No major trials threaten AGGRENOX’s core indication but may influence future guidelines and positioning.

4. What role do regional healthcare policies play in AGGRENOX’s sales?

Regions with comprehensive stroke prevention programs and favorable reimbursement policies promote higher prescribing rates, directly impacting sales growth.

5. How might technological advancements influence the AGGRENOX market?

Development of personalized medicine approaches and biomarker-based stratification can optimize patient selection, potentially enhancing efficacy and safety, thereby supporting sustained demand for AGGRENOX where appropriate.

Sources:

[1] United Nations Department of Economic and Social Affairs, World Population Prospects 2022.