Last updated: July 27, 2025

Introduction

ACTOS (pioglitazone), developed by Takeda Pharmaceuticals, is an oral anti-diabetic medication classified as a thiazolidinedione, primarily prescribed for managing type 2 diabetes mellitus (T2DM). Since its approval by the FDA in 1999, ACTOS has been a pivotal player in the anti-diabetic drug market. This report provides an in-depth market analysis and sales forecast, considering recent trends, competitive dynamics, regulatory landscape, and potential future growth.

Market Overview

The global diabetes drug market was valued at approximately USD 57 billion in 2022 and is projected to reach USD 88 billion by 2030, expanding at a compound annual growth rate (CAGR) of around 5.2% (1). The rising prevalence of T2DM, driven by factors like obesity, sedentary lifestyles, and aging populations, underpins this growth.

ACTOS, as a long-established drug, occupies a significant niche within this market. Its mechanism—enhancing insulin sensitivity—makes it an essential option among oral hypoglycemics, especially in combination therapies. However, safety concerns such as potential associations with bladder cancer and heart failure have influenced its market dynamics.

Market Penetration and Current Position

Historical Sales Data and Market Share

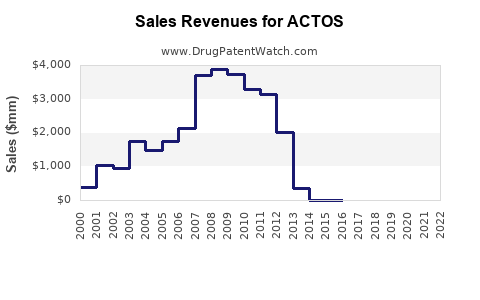

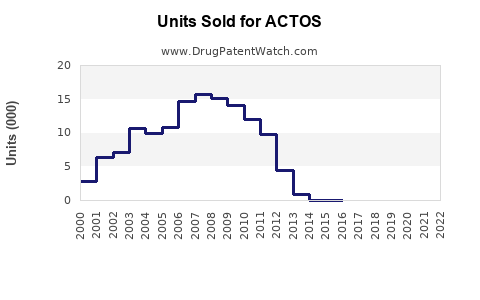

From 2000 through 2010, ACTOS experienced rapid adoption, reaching peak global sales of approximately USD 3.5 billion, primarily in the US, Japan, and Europe. Post-2011, sales declined sharply in the US following FDA warnings linking pioglitazone with increased bladder cancer risk (2). Despite these challenges, ACTOS maintains a presence globally, especially in markets with less stringent regulatory environments and in combination therapy regimens.

Competitive Landscape

The anti-diabetic market features several major classes:

- DPP-4 inhibitors (e.g., sitagliptin)

- SGLT2 inhibitors (e.g., empagliflozin)

- GLP-1 receptor agonists (e.g., liraglutide)

- Insulin analogs

ACTOS has been increasingly overshadowed by newer agents with superior safety profiles, particularly SGLT2 inhibitors and GLP-1 receptor agonists, which also demonstrate cardiovascular benefits.

Regulatory and Safety Impact

The safety concerns regarding bladder cancer led to decreased prescriptions in several markets:

- United States: The FDA issued warnings in 2011, significantly reducing US sales.

- European Union: Regulatory agencies mirrored these concerns, restricting use.

- Japan and Asia: More permissive regulatory environments have preserved some market share.

The evolving safety profile has spurred the development of newer glitazone derivatives and alternative therapies, impacting ACTOS intake.

Market Opportunities and Challenges

Opportunities:

- Combination Therapy: ACTOS’s ability to be combined with metformin and insulin sustains demand, particularly in regions where newer drugs are cost-prohibitive.

- Emerging Markets: Rapid urbanization and increasing T2DM incidence support expansion in Asia, Africa, and Latin America.

Challenges:

- Safety Perceptions: Ongoing regulatory concerns limit usage.

- Market Competition: The blockbuster dominance of newer drug classes reduces ACTOS's standing.

- Patent Situation: Patent expirations have led to generic manufacturing, exerting price pressure.

Sales Projections (2023-2030)

Assumptions:

- Global sales decline from historic peaks, stabilizing in certain regions due to persistent use in combination therapy.

- Market penetration remains highest in Asia-Pacific regions, where regulatory barriers are lower and affordability is crucial.

- Regulatory constraints will persist in North America and Europe, further suppressing growth.

Forecast Summary:

| Year |

Estimated Global Sales (USD Billion) |

Notes |

| 2023 |

0.8 |

Post-regulatory impact, moderate sales in Asia & emerging markets |

| 2024 |

0.75 |

Slight decline due to safety concerns & competition |

| 2025 |

0.7 |

Steady state, with continued growth in non-Western markets |

| 2026 |

0.72 |

Slight rebound with increased combination usage |

| 2027 |

0.75 |

Market stabilization, potential new formulations |

| 2028 |

0.75 |

Plateau phase, no significant growth expected |

| 2029 |

0.7 |

Marginal decline predicted due to market saturation |

| 2030 |

0.65 |

Further decline, unless new indications emerge |

Summary:

Over the forecast period, annual sales are projected to decline gradually from their previous peak, stabilizing around USD 0.65-0.75 billion, primarily driven by Asian markets and combination usage in low- to middle-income regions.

Future Market Dynamics

Innovations in T2DM therapies, such as dual-incretin agents and beta-cell regenerative approaches, may further diminish ACTOS’s relevance. Nevertheless, its long-term presence in formulary options, especially in cost-sensitive markets, ensures a base-level demand.

Furthermore, if ongoing research clarifies the safety profile of pioglitazone and addresses regulatory uncertainties, it could foster renewed confidence and recovery in sales. Conversely, if safety signals continue to dominate regulatory agencies' risk assessments, further market contraction is expected.

Conclusion

While ACTOS has historically been a significant anti-diabetic drug, its market share has diminished substantially due to safety concerns and stiff competition from newer agents. Nevertheless, in emerging economies where affordability and combination therapy preferences persist, ACTOS retains a meaningful, though declining, market position.

The overall sales trajectory from 2023 to 2030 indicates a gradual decline, stabilizing at lower levels. Strategic considerations should involve leveraging its compatibility with combination regimens, targeting markets with less regulatory restriction, and monitoring evolving safety data to inform future positioning.

Key Takeaways

- Declining Market Share: Post-safety concerns and regulatory restrictions contributed to reduced sales, especially in North America and Europe.

- Emerging Market Potential: Asia-Pacific and other emerging economies offer growth opportunities due to rising T2DM prevalence and affordability considerations.

- Competitive Landscape: The emergence of SGLT2 and GLP-1 therapies limits ACTOS’s growth prospects but sustains demand in combination regimens.

- Regulatory Impact: Ongoing safety evaluations heavily influence market access; positive safety updates could bolster sales.

- Forecast Outlook: Expect a gradual decline in global sales, stabilizing around USD 0.65-0.75 billion by 2030 unless new indications or formulations are introduced.

References

- Grand View Research. "Diabetes Drugs Market Size, Share & Trends Analysis." 2022.

- U.S. Food and Drug Administration. "Notice Regarding Pioglitazone and Bladder Cancer," 2011.