Share This Page

Drug Sales Trends for hydrogen peroxide

✉ Email this page to a colleague

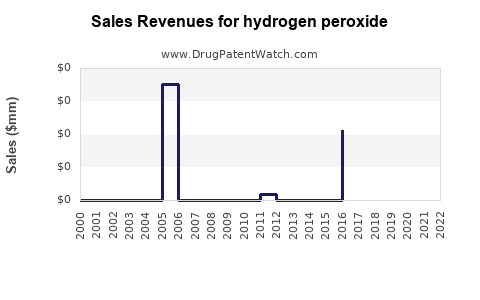

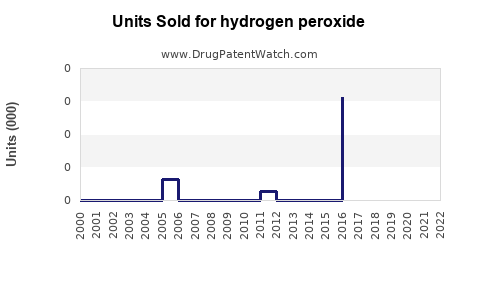

Annual Sales Revenues and Units Sold for hydrogen peroxide

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| HYDROGEN PEROXIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| HYDROGEN PEROXIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| HYDROGEN PEROXIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| HYDROGEN PEROXIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| HYDROGEN PEROXIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Hydrogen Peroxide

Introduction

Hydrogen peroxide (H₂O₂) is a versatile chemical compound used across pharmaceutical, industrial, agricultural, and consumer sectors. Its economic importance is driven by its applications as an antiseptic, disinfectant, bleaching agent, and oxidizer. As global demand for sterilization, water treatment, and consumer cleaning products escalates, understanding the market landscape and establishing accurate sales forecasts become critical for stakeholders. This analysis provides a comprehensive overview of the hydrogen peroxide market, current trends, competitive dynamics, and future sales projections.

Market Overview

Global Market Size and Growth Dynamics

The global hydrogen peroxide market valued approximately USD 1.8 billion in 2022, with projections indicating a compound annual growth rate (CAGR) of around 6.2% between 2023 and 2030 (Source: MarketsandMarkets[1]). This growth stems from increasing demand in diverse sectors, notably healthcare, pulp and paper, textile bleaching, and water purification.

Key Market Drivers

-

Healthcare and Disinfection: Rising awareness of infection control, especially accelerated by the COVID-19 pandemic, has boosted demand for hydrogen peroxide as a disinfectant in hospitals, clinics, and household products.

-

Water Treatment: Stringent environmental regulations have increased the adoption of hydrogen peroxide for municipal and industrial water purification, reducing reliance on chlorine-based disinfectants.

-

Industrial and Pulp & Paper Industry: Its use as a bleaching agent in papermaking remains substantial, supported by demand for eco-friendly bleaching alternatives.

-

Agricultural Sector: Application in soil disinfection and crop protection is expanding, driven by the push for residue-free agricultural practices.

Market Challenges

-

Safety and Handling: Hydrogen peroxide’s reactive nature requires stringent safety protocols, influencing manufacturing and distribution costs.

-

Competitive Landscape: The presence of multiple producers and the commoditized nature of the product exert pressure on pricing and margins.

-

Environmental and Regulatory Concerns: Regulations governing transportation and disposal impact market dynamics, potentially limiting growth in certain regions.

Market Segmentation

Product Type

- 65-85% Concentration: Primarily used in industrial applications such as pulp bleaching and water treatment.

- 3-35% Concentration: For disinfection, healthcare, and consumer use.

Application Areas

- Healthcare and Antiseptics

- Water and Wastewater Treatment

- Pulp and Paper Industry

- Chemical Manufacturing

- Textile and Leather Bleaching

- Household and Consumer Cleaning

Regional Outlook

- Asia-Pacific: Dominates with approximately 40% of market share; driven by China, India, and Southeast Asia’s expanding industrial base.

- North America: Significant growth owing to stringent health standards and water treatment needs.

- Europe: Focus on eco-friendly products and stringent regulations bolster demand.

- Latin America and Middle East: Emerging markets with increasing investments in infrastructure contribute to growth.

Competitive Landscape

Major global players include AkzoNobel, Ecolab, Sekisui Chemical, Hydroperoxide LLC, and Kemira. These companies compete on product purity, technological innovation, capacity expansion, and regional presence.

Recent trends reveal strategic investments in sustainable production processes, capacity enhancements, and product diversification to serve varied application needs. The shift toward environmentally friendly formulations and biodegradable disinfectants also shapes R&D priorities.

Sales Projections (2023-2030)

Baseline Scenario

Applying a CAGR of 6.2% from 2023 to 2030, the hydrogen peroxide market is projected to reach approximately USD 3.4 billion by 2030.

Segment-wise Growth

- Industrial Applications: Leading segment with an estimated CAGR of 6.0%; driven by ongoing infrastructure development and manufacturing intensification.

- Healthcare and Disinfection: Anticipated to grow at approximately 7.0%, reflecting the sustained focus on sanitation and infection control.

- Water Treatment: Expected CAGR of about 6.8%, as regulatory policies favor non-chlorine disinfectants.

Regional Outlook

- Asia-Pacific: Expected to maintain the highest growth rate (~6.5%), driven by industrial expansion and urbanization.

- North America and Europe: Projected at ~5.8% CAGR, supported by environmental regulations and technological advancements.

- Emerging Economies: Latin America and the Middle East forecast a CAGR of around 6.0%, aided by infrastructure investment.

Factors Influencing Future Sales

- Increased application of hydrogen peroxide-based disinfectants post-pandemic.

- Advancements in green and sustainable chemical manufacturing.

- Expansion of water treatment infrastructure in developing regions.

- Potential regulatory restrictions on certain industrial processes, possibly affecting supply chains.

Strategic Opportunities and Risks

Opportunities

- Development of high-purity formulations for pharmaceutical use.

- Expansion into new markets such as agriculture and specialty chemicals.

- Investment in sustainable manufacturing processes aligning with environmental standards.

- Strategic partnerships and capacity expansion to meet rising demand.

Risks

- Fluctuations in raw material prices, notably for oxygen and other inputs.

- Stringent safety regulations increasing compliance costs.

- Market saturation in mature regions could limit growth.

- Environmental concerns related to waste disposal and greenhouse gas emissions from manufacturing.

Conclusion

The hydrogen peroxide market exhibits robust growth prospects driven by widespread applications in healthcare, water treatment, and industrial processing. Rising global health standards, ecological regulations, and infrastructural investments underpin demand growth, particularly in Asia-Pacific. Companies that focus on product innovation, sustainable manufacturing, and regional expansion will be well-positioned to capitalize on this trajectory.

Key Takeaways

- The global hydrogen peroxide market is projected to reach USD 3.4 billion by 2030, growing at approximately 6.2% CAGR.

- The industrial sector, especially water treatment and pulp bleaching, remains the primary demand driver.

- Healthcare and disinfection applications are gaining prominence post-pandemic, fueling new growth avenues.

- Asia-Pacific remains the dominant and fastest-growing region, with emerging markets poised for substantial expansion.

- Market players should prioritize sustainability, safety, and regional strategies to mitigate risks and seize growth opportunities.

FAQs

1. What are the primary drivers of hydrogen peroxide demand globally?

Demand is chiefly driven by applications in water treatment, pulp and paper bleaching, healthcare disinfection, and industrial oxidation processes, all propelled by regulatory standards and health-conscious consumer behavior.

2. How is the market for hydrogen peroxide expected to evolve over the next decade?

The market is forecasted to grow steadily at a CAGR of around 6.2%, propelled by increasing adoption across various sectors, technological advancements, and demand for environmentally friendly chemicals.

3. Which regions offer the most promising opportunities for hydrogen peroxide producers?

Asia-Pacific leads both in current demand and growth potential, followed by North America and Europe, where regulatory pressures and infrastructure development support ongoing expansion.

4. What challenges could hinder market growth?

Safety and handling concerns, regulatory restrictions, price volatility of raw materials, and environmental regulations may pose significant hurdles.

5. How can firms differentiate themselves in the competitive hydrogen peroxide market?

Focusing on sustainable production methods, high-purity formulations, regional market expansion, and strategic partnerships will provide competitive advantages.

Sources:

[1] MarketsandMarkets, "Hydrogen Peroxide Market," 2022.

More… ↓