Last updated: July 28, 2025

Introduction

Fluticasone, a potent synthetic corticosteroid, is extensively prescribed for managing allergic rhinitis, asthma, and other inflammatory respiratory conditions. Its diverse formulations—nasal sprays, inhalers, and topical applications—have secured a substantial share in respiratory and allergy treatment markets globally. This report offers a detailed market analysis and sales forecasts, emphasizing key drivers, competitive landscape, regional dynamics, and future growth opportunities.

Product Overview

Fluticasone works by reducing inflammation and immune response in the airways and nasal passages. Its efficacy, safety profile, and multiple administration routes have facilitated widespread adoption. Major products include Flonase (nasal spray), Flovent (inhaler), and Cutivate (topical), among others. Market success hinges on its proven therapeutic benefits, minimal systemic absorption, and favorable side effect profile, aligning with regulatory standards across regions.

Market Dynamics

1. Therapeutic Demand Drivers

-

Rising Prevalence of Respiratory and Allergic Conditions: The World Allergy Organization estimates over 300 million individuals suffer from allergic rhinitis worldwide, with asthma affecting approximately 262 million [1]. Urbanization, pollution, and climate change have exacerbated these conditions, fueling demand.

-

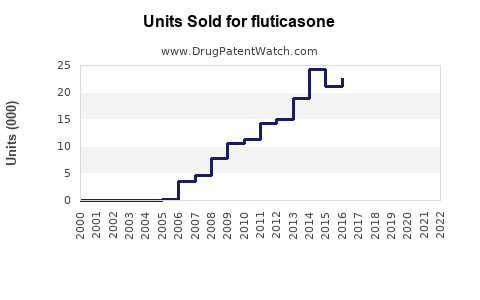

Increased Awareness and Prescription Rates: Enhanced diagnosis, better healthcare access, and rising awareness about allergy management contribute to higher prescription volumes.

-

Chronic Disease Management: Fluticasone’s role in long-term control of asthma and allergic rhinitis aligns with global shifts towards chronic disease management, ensuring recurrent demand.

2. Competitive Landscape

-

Market Players: Key manufacturers include GlaxoSmithKline (GSK), Teva, Mylan, and Cipla, with GSK leading globally through its Flovent and Flonase brands.

-

Patent Landscape: Several key patents expired between 2015-2020, paving the way for generic entrants that have increased market penetration and reduced prices. However, brand loyalty, formulation patents, and controlled-release technologies sustain premium sales for pioneer brands.

-

Product Innovation: Development of improved delivery devices, combination therapies, and formulations tailored for specific populations sustains competitive advantage.

3. Regional Market Insights

-

North America: Largest market, driven by high prevalence of respiratory allergies, robust healthcare infrastructure, and high prescription rates. The US alone accounts for over 50% of global inhaled corticosteroid sales [2].

-

Europe: Mature market with steady growth, influenced by stringent regulatory standards and high healthcare spending.

-

Asia-Pacific: Fastest-growing region due to rising allergy and asthma prevalence, expanding healthcare access, and increasing disposable income. China and India are key growth engines.

-

Latin America and Middle East & Africa: Emerging markets with potential, driven by urbanization and increasing awareness.

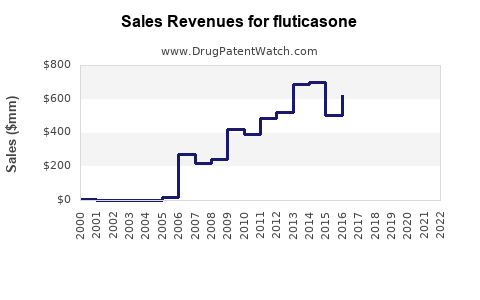

Sales Projections and Market Size Estimation

The global corticosteroid market, including fluticasone, was valued at approximately USD 6.8 billion in 2022, with a compound annual growth rate (CAGR) of 4.3% projected until 2030 [3].

Specific projections for fluticasone include:

-

2023-2025: Moderate growth driven by patent expiries of some formulations and increased adoption of generics. Sales estimates forecast to reach USD 4.2 billion by the end of 2025, growing at ~5% annually.

-

2026-2030: Steady growth sustained by product innovations and expanding markets, with sales reaching approximately USD 5.6 billion by 2030, reflecting a CAGR of ~6%.

The inhaler segment is expected to remain dominant, constituting about 50-55% of total fluticasone sales. Nasal sprays are also experiencing accelerated growth, owing to expanded indications and improved compliance.

Market Opportunities and Future Trends

-

Combination Therapies: Integration of fluticasone with bronchodilators and antihistamines in single devices offers improved patient adherence and market share expansion.

-

Biotechnology Innovations: Nano-formulations and targeted delivery systems may optimize efficacy and reduce side effects, attracting premium pricing.

-

Personalized Medicine: Pharmacogenomics could refine therapy selection, enhancing outcomes and fostering brand differentiation.

-

Regulatory Landscape: Maintaining compliance and navigating patent landscapes remain critical to sustain market share.

-

Digital Health Integration: Smart delivery devices and mobile health monitoring stand to improve adherence rates, thereby boosting sales.

Challenges and Risk Factors

-

Pricing and Reimbursement Constraints: Cost pressures and reimbursement restrictions, especially in public healthcare systems, could impact revenue.

-

Competitive Pressures: Entry of generics and biosimilars may dilute sales of branded products.

-

Regulatory Scrutiny: Stringent approval processes and safety evaluations could slow product launches.

-

Side Effect Perception: Concerns over corticosteroid-related adverse effects necessitate ongoing patient education and market reassurance.

Strategic Recommendations

-

Diversify Formulations: Developing new delivery methods and combination therapies to extend product lifecycle and market penetration.

-

Expand Geographically: Focus on emerging markets with rising disease prevalence and improving healthcare infrastructure.

-

Invest in R&D: Enhance product efficacy, safety, and patient adherence through technological advancements.

-

Strengthen Competitive Positioning: Leverage patent portfolios, brand reputation, and partnerships to fend off generics.

Conclusion

Fluticasone remains a cornerstone in respiratory and allergic disease management, with a resilient market outlook. The interplay of clinical demand, technological innovation, and regional expansion will shape its trajectory through 2030. Companies that adapt strategically—embracing innovation, expanding access, and safeguarding intellectual property—are poised to capitalize on substantial growth opportunities.

Key Takeaways

-

The global fluticasone market is projected to reach over USD 5.6 billion by 2030, driven by rising respiratory and allergy conditions.

-

North America and Europe will remain dominant markets due to established healthcare infrastructure, with rapid growth in Asia-Pacific.

-

Patent expiries and increased generic competition necessitate innovation and portfolio diversification.

-

Advances in combination therapies and delivery technologies will boost market share.

-

Emerging markets offer significant growth potential, contingent on investments in healthcare access and disease awareness.

FAQs

1. What are the main indications for fluticasone?

Fluticasone is primarily indicated for allergic rhinitis, allergic conjunctivitis, and asthma, including persistent and moderate-to-severe cases.

2. How does patent expiry influence fluticasone sales?

Patent expiries facilitate generic entry, reducing prices and increasing access, but also intensify competition, potentially impacting branded sales.

3. Which regions are expected to see the fastest growth in fluticasone sales?

Asia-Pacific is anticipated to experience the fastest growth, driven by increasing prevalence and expanding healthcare infrastructure.

4. What are the key innovations driving fluticasone's market?

Development of combination therapies, improved delivery devices, and targeted formulations are critical innovation areas.

5. What risks could hinder future sales growth of fluticasone?

Pricing pressures, regulatory hurdles, adverse perception of corticosteroid side effects, and competitive generic markets pose risks.

References

[1] World Allergy Organization. "Global Prevalence of Allergic Rhinitis." 2021.

[2] IQVIA. "Global Prescription Medicine Sales Data," 2022.

[3] MarketsandMarkets. “Corticosteroids Market by Type, Application, and Region,” 2022.