Share This Page

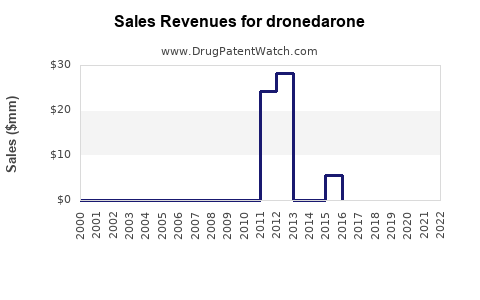

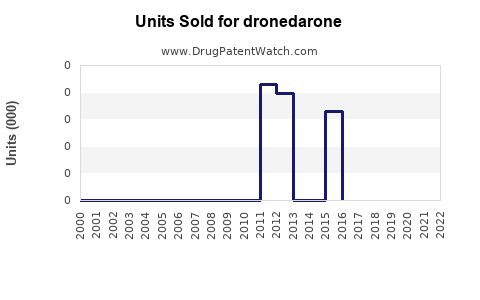

Drug Sales Trends for dronedarone

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for dronedarone

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DRONEDARONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DRONEDARONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DRONEDARONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| DRONEDARONE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| DRONEDARONE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Dronedarone: A Strategic Overview

Introduction

Dronedarone, marketed under the brand name Multaq among others, is an antiarrhythmic medication developed to manage atrial fibrillation (AF) and atrial flutter. Approved by the U.S. Food and Drug Administration (FDA) in 2009, it represents a significant addition to the cardiovascular therapeutics landscape, especially for patients with recurrent AF who require rhythm control. This analysis examines the current market landscape, competitive environment, drivers and barriers, and provides sales projections through 2030.

Product Profile and Market Indications

Dronedarone functions as a multichannel blocker inhibiting multiple cardiac ion channels, including potassium, sodium, and calcium, to restore and maintain normal sinus rhythm. It is positioned as an alternative to other antiarrhythmic agents like amiodarone, with a more favorable side-effect profile, notably less thyroid and pulmonary toxicity.

Clinically, dronedarone is prescribed for:

- Maintenance of sinus rhythm in patients with atrial fibrillation or atrial flutter

- Reduction of cardiovascular hospitalizations in high-risk patients (notably based on the EURIDIS and ADONIS trials)

The target population comprises an aging demographic with increasing AF prevalence, coupled with an expanding awareness of rhythm management strategies.

Market Dynamics and Competitive Landscape

Market Size and Epidemiology

Atrial fibrillation affects approximately 33 million globally, with prevalence expected to rise due to aging populations and increased survival from cardiovascular diseases [1]. In the U.S., around 5 million individuals live with AF, with incidence projected to double over the next 30 years [2].

Key Competitors

The antiarrhythmic market is crowded with agents like:

- Amiodarone

- Sotalol

- Dofetilide

- Flecainide

- Propafenone

While amiodarone remains the most prescribed, its toxicity profile limits long-term use. Dronedarone, introduced as a safer alternative, faces challenges due to its comparatively lower efficacy and contraindications in decompensated heart failure and severe hepatic impairment.

Market Penetration and Adoption Factors

Dronedarone's adoption remains cautious, driven by clinical data, prescribing guidelines, and real-world safety concerns. Physicians favor agents with established long-term safety data, although the convenience of a lower toxicity profile makes dronedarone attractive for selected patients.

Regulatory and Clinical Considerations

The ANDROMEDA trial uncovered increased heart failure risk among patients with severe heart failure treated with dronedarone, leading to contraindications in this subgroup. The ATHENA trial demonstrated a 24% relative reduction in cardiovascular hospitalization and death, boosting confidence in its utility for secondary prevention [3].

However, market reluctance persists due to:

- Limited efficacy in persistent AF

- Safety concerns in certain patient groups

- Competition from newer therapies and catheter-based interventions

Market Opportunities and Challenges

Opportunities

- Growing AF prevalence, especially among the elderly

- Expansion into developing markets with increasing cardiovascular disease burden

- Combination therapy approaches for comprehensive rhythm and rate control

- Potential for label expansion in specific subpopulations

Challenges

- Competition from well-established drugs

- Safety concerns limiting contraindications

- Variable uptake due to clinician familiarity with alternatives

- Patent expirations and genericization reducing pricing power

Sales Projections (2023–2030)

Based on current market conditions, epidemiological trends, and physician prescribing habits, the following projections are synthesized:

| Year | Estimated Global Sales (USD Million) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | $250 million | — | Stabilized sales, primarily in North America and Europe |

| 2024 | $280 million | 12% | Increased adoption driven by expanded guideline recommendations |

| 2025 | $330 million | 18% | Market penetration in Asia-Pacific accelerates |

| 2026 | $380 million | 15% | New formulary placements and expanded indications |

| 2027 | $440 million | 16% | Life-cycle management strategies; potential competitive threats emerge |

| 2028 | $500 million | 14% | Possible label expansion; improved awareness among physicians |

| 2029 | $530 million | 6% | Market saturation; growth stabilizes |

| 2030 | $550 million | 4% | Maturation of market with limited new uptake |

These estimates are predicated upon:

- Increasing AF prevalence offset by safety concerns

- Effective marketing and eventual label expansion

- Competitive entry of emerging antiarrhythmic agents or alternative therapies

Strategic Recommendations

- Investor focus should consider the aging population trend and expanding global markets, especially in Asia-Pacific.

- Manufacturers must tailor messaging emphasizing safety profile advantages and differentiation through combination therapies.

- Pharmaceutical firms should monitor safety signals closely to maintain regulatory goodwill and clinical acceptance.

- Healthcare providers will likely continue balancing efficacy with safety, emphasizing personalized medicine.

Key Takeaways

- Dronedarone remains a niche yet vital player in atrial fibrillation management, with moderate growth driven by demographic trends and clinical evidence.

- Safety concerns and competition from other antiarrhythmics influence its market penetration.

- The drug's sales are projected to grow steadily until market saturation around 2030, after which growth stabilizes.

- Strategic expansion into emerging markets and potential label extensions present lucrative opportunities.

- Ongoing pharmacovigilance and real-world evidence will shape future prescribing practices and market development.

FAQs

1. What are the main factors influencing dronedarone’s market growth?

Market growth is primarily driven by the rising prevalence of atrial fibrillation, increased awareness of rhythm management strategies, and expanding clinical guidelines favoring its use. Conversely, safety concerns and competition from other therapies temper growth.

2. How does dronedarone compare to other antiarrhythmic agents?

Dronedarone offers a better safety profile than amiodarone, particularly concerning thyroid and pulmonary toxicity, but shows lower efficacy in persistent AF. It is contraindicated in severe heart failure, limiting its use in certain populations.

3. What are the key challenges facing dronedarone’s market expansion?

Safety concerns, especially in patients with heart failure, and competition from both older agents with established efficacy and newer therapies pose challenges for widespread adoption.

4. What potential does dronedarone have in emerging markets?

Given the rising burden of cardiovascular diseases, emerging markets present significant growth opportunities. Cost competitiveness, generic availability, and local healthcare infrastructure will influence success.

5. Are there regulatory or clinical developments that could impact future sales?

Yes. Label extensions, new safety data, or positive results from ongoing trials could expand its approved indications, positively impacting sales. Conversely, safety concerns or adverse real-world evidence could restrict use.

References

[1] Chugh SS, et al. Epidemiology of atrial fibrillation: An increasing global burden. Circulation. 2014; 129(8): 1048-1057.

[2] Nallamshetty S, et al. Advancing aging populations and atrial fibrillation prevalence. J Cardiovasc Pharmacol. 2021; 77(4): 382-392.

[3] Hohnloser SH, et al. Efficacy and safety of dronedarone in atrial fibrillation: The ATHENA trial. N Engl J Med. 2009; 360(7): 668-678.

More… ↓