Last updated: July 28, 2025

Introduction

Diclofenac sodium is a nonsteroidal anti-inflammatory drug (NSAID) widely used for managing pain, inflammation, and swelling associated with conditions such as arthritis, musculoskeletal disorders, and postoperative pain. As one of the most prescribed NSAIDs globally, its market dynamics are influenced by factors including patent status, regulatory environment, competitive landscape, and evolving medical guidelines. This report provides an in-depth analysis of the current market landscape and forecasts future sales trajectories for diclofenac sodium, emphasizing revenue potential, key regional trends, and strategic considerations.

Global Market Landscape

Market Overview

The global NSAID market was valued at approximately USD 14.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.2% from 2023 to 2030, driven primarily by increasing prevalence of chronic inflammatory conditions and aging populations [1]. Diclofenac sodium constitutes a significant share owing to its widespread efficacy, availability in multiple formulations, and affordable price point.

Key Players and Market Shares

Leading pharmaceutical companies such as Novartis (Voltaren), Mylan, and Teva dominate the diclofenac sodium market, offering various formulation options, including oral tablets, topical gels, and injections. The patent expirations of several formulations have resulted in increased generic competition, reducing prices and expanding access globally.

Regulatory Landscape

Regulatory authorities, including the FDA and EMA, have implemented stricter safety guidelines for NSAIDs due to cardiovascular and gastrointestinal risks. These regulations influence prescribing patterns and drive demand for specific formulations like topical applications with improved safety profiles.

Regional Market Dynamics

North America

North America remains the largest market, driven by high healthcare expenditure, widespread NSAID familiarity, and supportive reimbursement policies. The U.S. accounted for approximately 35% of the global NSAID sales in 2022. Sales are aided by continued use in osteoarthritis, rheumatoid arthritis, and post-surgical pain management, despite safety concerns leading to some shifts toward alternative therapies [2].

Europe

Europe holds a substantial share, characterized by an aging demographic and high prevalence of musculoskeletal conditions. European regulatory agencies actively monitor NSAID safety, influencing formulation preferences, with topical and lower-dose options gaining favor.

Asia-Pacific

The Asia-Pacific region exhibits the highest CAGR (around 6%), attributed to increasing urbanization, expanding healthcare infrastructure, and the large burden of arthritis and pain-related conditions. Countries like India and China have rising generic sales, though regulatory and reimbursement frameworks are less mature compared to Western markets.

Latin America and Middle East & Africa

Growing healthcare access and evolving prescription practices are boosting market penetration, albeit from a lower baseline. Price sensitivity remains a critical factor influencing sales growth.

Market Drivers

- Prevalence of Chronic Pain Conditions: Increasing rates of osteoarthritis, rheumatoid arthritis, and other inflammatory disorders are primary growth drivers.

- Expansion of Formulations: Development of topical gels and patches providing targeted delivery with fewer systemic side effects expands market reach.

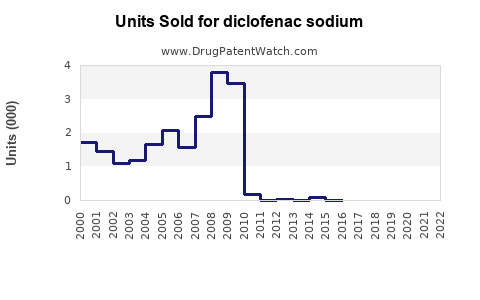

- Generic Drug Penetration: Patent expirations facilitate entry of generics, reducing costs, and increasing accessibility.

- Expanding Healthcare Infrastructure: Particularly in emerging economies, supports broader distribution and prescription of diclofenac sodium.

Market Constraints

- Safety Concerns: Cardiovascular and gastrointestinal risks associated with NSAIDs have led to cautious prescribing, especially in high-risk populations.

- Regulatory Restrictions: Stringent safety regulations may limit use or necessitate reformulations, impacting market growth.

- Availability of Alternatives: Increasing use of COX-2 inhibitors (e.g., celecoxib), opioids, and non-pharmacologic therapies influence diclofenac sodium sales.

Sales Projections (2023–2030)

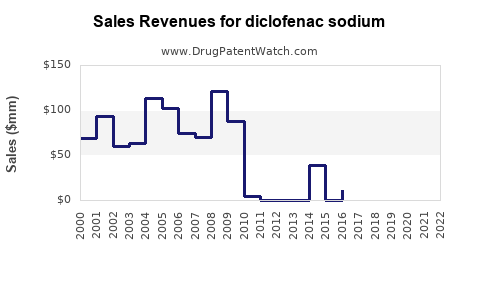

Methodology

Projections incorporate historical sales data, patent expiry timelines, regulatory impacts, epidemiological trends, and ongoing developments in drug formulations and delivery systems. Market models assume a moderate CAGR of 4%, aligning with industry estimates, adjusted for regional variations.

Projected Market Size

By 2030, the global diclofenac sodium market is forecasted to reach USD 8.5–9.5 billion, representing a cumulative CAGR of approximately 3.8–4.2%. Key regional markets will follow different growth patterns:

- North America: Growth stabilizes around 2–3% due to market saturation and safety-driven shifts to alternatives.

- Europe: Slight deceleration (~2–3%) driven by regulatory constraints.

- Asia-Pacific: Leading growth at approximately 6%, propelled by demographic shifts and increasing healthcare access.

- Emerging Markets: Rapid expansion with CAGR exceeding 7% in select countries, contingent on market liberalization and infrastructure development.

Formulation-Specific Trends

- Topical Preparations: Growing preference for gels and patches with improved safety profiles may boost sales by 10–15% annually in specific markets.

- Injectable Forms: Utilized mainly in hospital settings for acute pain; market growth depends on procedural volume increases.

Strategic Considerations for Stakeholders

- Innovation in Formulations: Developing safer, targeted delivery options can mitigate safety concerns and open new market segments.

- Regulatory Engagement: Proactive compliance and pharmacovigilance can facilitate market access and sustain sales.

- Geographic Expansion: Investing in emerging markets with rising prevalence of pain conditions offers considerable future growth.

- Brand Differentiation: Emphasizing safety profiles and effective delivery mechanisms enhances competitive positioning.

Conclusion

Diclofenac sodium continues to hold a prominent position within the NSAID segment, with steady growth projected over the next decade. Its future success hinges on addressing safety concerns, embracing innovative formulations, and capturing emerging market opportunities. Both leading pharmaceutical firms and generics manufacturers should prioritize safety innovation, regional expansion, and responsiveness to evolving regulatory landscapes to optimize sales trajectories.

Key Takeaways

- Persistent Relevance: Despite safety debates, diclofenac sodium remains a top NSAID globally due to efficacy and affordability.

- Regional Divergence: North America and Europe face growth constraints, whereas Asia-Pacific and emerging markets present substantial upside.

- Formulation Innovation: Topical and targeted delivery systems will be instrumental in expanding market share.

- Regulatory Environment: A proactive approach to safety guidelines and pharmacovigilance determines sustained market access.

- Growth Outlook: The global market is expected to reach USD 8.5–9.5 billion by 2030, with regional variations influencing sales trajectories.

FAQs

1. How has patent expiration affected diclofenac sodium sales?

Patent expirations have facilitated the entry of generics, significantly reducing prices and increasing accessibility, especially in developing countries. This has expanded market volume but exerted downward pressure on revenue per unit.

2. What safety concerns impact diclofenac sodium's market?

The primary risks involve cardiovascular events (e.g., heart attack, stroke) and gastrointestinal bleeding. These concerns have led to regulatory restrictions and shifts toward alternative therapies in certain patient populations.

3. Which formulations are expected to drive future growth?

Topical formulations, including gels and patches, are anticipated to see increased adoption due to better safety profiles and patient compliance.

4. How do regulatory policies influence diclofenac sodium sales in different regions?

Regulations mandating safety warnings, dosage limitations, and contraindications can limit prescribing, while supportive policies and approval of alternative formulations can enhance sales.

5. What strategies should pharmaceutical companies adopt to capitalize on this market?

Focusing on developing safer formulations, engaging actively with regulators, expanding into emerging markets, and differentiating products through innovation are key strategies for sustained growth.

Sources:

[1] Market Research Future, "NSAID Market Analysis," 2022.

[2] GlobalData Healthcare Reports, "Pain Management Drugs Market," 2023.