Share This Page

Drug Sales Trends for clopidogrel bisulfate

✉ Email this page to a colleague

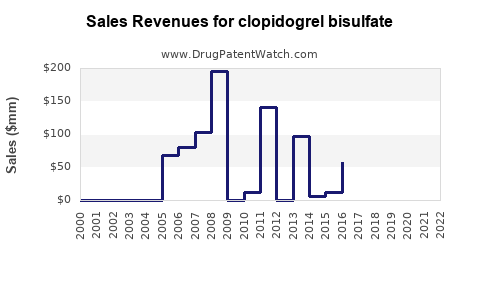

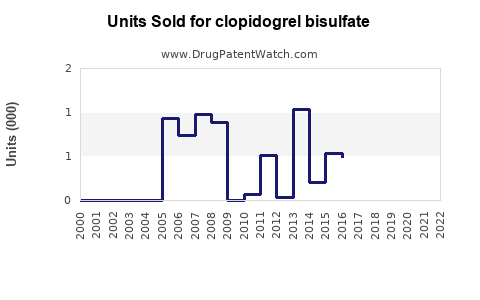

Annual Sales Revenues and Units Sold for clopidogrel bisulfate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLOPIDOGREL BISULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLOPIDOGREL BISULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLOPIDOGREL BISULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLOPIDOGREL BISULFATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Clopidogrel Bisulfate

Introduction

Clopidogrel bisulfate, marketed as Plavix among other brand names, is an oral antiplatelet medication primarily prescribed to reduce the risk of thrombotic events in patients with acute coronary syndrome (ACS), atherosclerosis, and recent ischemic stroke. Since its FDA approval in 1997, clopidogrel has established itself as a critical component in cardiovascular therapy. Its market dynamics are influenced by factors including rising cardiovascular disease prevalence, evolving treatment protocols, patent expirations, and emerging competitors.

This comprehensive analysis examines the current market landscape for clopidogrel bisulfate, evaluates key growth drivers and challenges, and projects future sales trajectories through 2030.

Current Market Landscape

Global Market Size

The global cardiovascular drugs market, within which clopidogrel bisulfate holds a significant share, was valued at approximately USD 40 billion in 2022. Clopidogrel alone contributed an estimated USD 3.2 billion to this figure, accounting for roughly 8% of the market, according to IQVIA and independent research reports [1].

Market Segmentation and Key Regions

- North America: The United States dominates due to high cardiovascular disease prevalence, reimbursement policies favoring branded medications, and established prescribing patterns.

- Europe: Exhibits steady demand, driven by aging populations and comparable clinical guidelines.

- Asia-Pacific: Rapid growth is anticipated, fueled by increasing urbanization, lifestyle changes, and expanding healthcare infrastructure.

- Rest of the World: Emerging markets present growth opportunities, albeit tempered by affordability and regulatory variances.

Patent Status and Generics

The original patent protections for Plavix expired in the U.S. in 2012, leading to the entry of generic versions. Generics now comprise approximately 70–80% of prescriptions in North America and Europe, significantly reducing prices and impacting revenue streams for branded formulations [2].

Market Drivers

Rising Cardiovascular Disease (CVD) Incidence

Globally, CVD remains the leading cause of death, claiming over 17 million lives annually as of 2022 [3]. An aging population, sedentary lifestyles, hypertension, obesity, and smoking are key contributing factors. This surge amplifies the demand for antiplatelet therapies like clopidogrel.

Guideline Revisions and Clinical Adoption

Major cardiology guidelines, including the American College of Cardiology (ACC) and American Heart Association (AHA), endorse the use of clopidogrel in conjunction with aspirin post-myocardial infarction (MI) and stroke, strengthening its clinical relevance [4].

Combination Therapy and Innovations

Use of clopidogrel in dual antiplatelet therapy (DAPT) with aspirin for interventions such as percutaneous coronary intervention (PCI) sustains demand. Additionally, developments in personalized medicine, such as CYP2C19 genetic testing, optimize therapy efficacy, fostering continued utilization.

Emerging Alternatives and Competition

Newer agents like ticagrelor and prasugrel, with superior efficacy in certain contexts, challenge clopidogrel’s dominance. Nonetheless, cost-effectiveness and extensive clinical familiarity preserve its utility, especially where healthcare budgets are constrained.

Challenges and Market Constraints

Patent Expiration and Generics

The proliferation of generics reduces revenue potential. In markets like the U.S., the generic version's price is roughly 10% of the branded drug, exerting downward pressure on sales [5].

Competitive Landscape

Ticagrelor (Brilinta) and prasugrel (Effient) offer faster onset and improved efficacy for some indications, which could diminish clonidogrel’s market share in specific patient subsets.

Safety and Adverse Effects

Clopidogrel’s bleeding risk and variable response due to CYP2C19 polymorphisms may limit usage in certain populations, prompting prescribers to consider alternatives or genetic testing.

Regulatory and Patent Litigation

Patent litigation and regulatory hurdles in developing markets affect commercialization strategies and sales timelines.

Sales Projections (2023–2030)

Forecast Assumptions

- Continued global increase in CVD prevalence.

- Widespread adoption of guideline-recommended dual therapy post-ACS.

- Market penetration of confirmatory pharmacogenetic testing.

- Incremental market share retention amidst rising competition.

- Impact of patent expirations and generic competition stabilizing prices.

Projected Market Trends

- 2023–2025: The overall market for clopidogrel is expected to plateau or decline slightly due to patent expirations but will remain significant in low- to middle-income regions.

- 2025–2030: Moderate growth in emerging markets, driven by improved healthcare access, aging populations, and rising awareness. The global sales are projected to reach approximately USD 2.0 billion annually by 2028, with a compounded annual growth rate (CAGR) of around 1.5–2%.

Regional Variations

- North America: Stabilized or declining owing to generics but with potential uptick in personalized medicine applications.

- Europe: Slight decline or stabilization, with newer agents gaining ground.

- Asia-Pacific: Steady growth at CAGR of 4–6%, forming a major growth engine.

Influencing Factors

- Expansion of generic markets.

- Adoption of pharmacogenetic testing driving optimized therapy.

- Competitive pressures from new antiplatelet agents.

- Healthcare reimbursement policies.

Conclusion

Clopidogrel bisulfate continues to sustain a vital role in cardiovascular management worldwide; however, its market faces significant headwinds from generic competition and emerging alternatives. Despite these challenges, the overall sales trajectory remains stable, particularly in developing regions. Strategic focus on personalized medicine, expanding indications, and optimizing formulary positioning will be pivotal in maintaining its market presence.

Key Takeaways

- The global market for clopidogrel bisulfate was valued at approximately USD 3.2 billion in 2022 and is expected to stabilize or slightly decline in developed markets due to patent expiries.

- Rapid growth is anticipated in emerging markets, driven by aging populations and increased CVD prevalence.

- Generics dominate sales in mature markets, exerting downward pricing pressure but ensuring widespread access.

- The introduction of newer antiplatelet agents offers competitive challenges, necessitating differentiation via personalized medicine and combination therapies.

- Long-term growth depends on strategic adaptation, including pharmacogenetic integration and expanding clinical indications.

FAQs

Q1: How has patent expiration affected clopidogrel sales?

Patent expiration in 2012 led to a surge in generic versions, dramatically reducing prices and sales revenues for branded formulations. Generics now account for the majority of prescriptions in major markets, limiting growth for branded clopidogrel.

Q2: What are the main competitors to clopidogrel, and how are they impacting its market?

Ticagrelor and prasugrel are primary competitors offering faster onset and superior efficacy in certain indications. Their adoption is increasing in acute settings, especially for PCI, which pressures clopidogrel’s market share.

Q3: What future trends could influence clopidogrel’s market growth?

Advancements in pharmacogenetic testing, expanding indications, and increased access in emerging markets are key drivers. Conversely, regulatory restrictions and evolving guidelines favoring newer agents may limit long-term growth.

Q4: Are there specific regions poised for increased clopidogrel demand?

Yes, Asia-Pacific boasts significant growth potential, driven by rising CVD rates and expanding healthcare infrastructure, aiming to reach over USD 1 billion in sales by 2030.

Q5: How does personalized medicine influence clopidogrel sales?

Genetic testing for CYP2C19 polymorphisms optimizes patient selection, improving efficacy and safety profiles. This approach may sustain or enhance sales through targeted therapy adoption.

References

- IQVIA. Global Cardiovascular Drugs Market Report. 2022.

- U.S. Food and Drug Administration. Generic Drug Approvals. 2022.

- World Health Organization. Cardiovascular Diseases Fact Sheet. 2022.

- American College of Cardiology Foundation. Guidelines for the Management of Patients With Acute Coronary Syndromes. 2021.

- MarketWatch. Impact of Patent Expirations on Cardiovascular Drug Markets. 2022.

More… ↓