Share This Page

Drug Sales Trends for clobetasol propionate

✉ Email this page to a colleague

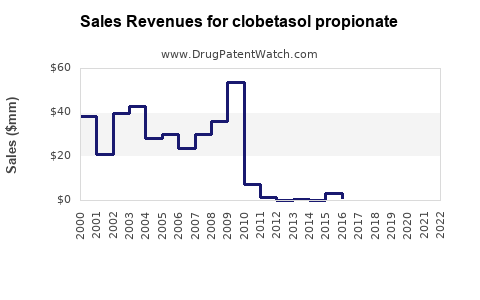

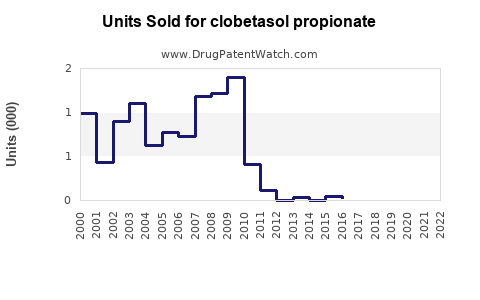

Annual Sales Revenues and Units Sold for clobetasol propionate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| CLOBETASOL PROPIONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Clobetasol Propionate

Introduction

Clobetasol propionate is a potent topical corticosteroid used in the management of various dermatologic conditions, including psoriasis, eczema, and dermatitis. As the most powerful topical steroid approved by regulatory agencies, its efficacy and safety profile have driven widespread clinical use. The market landscape for clobetasol propionate is shaped by factors such as growing dermatological disease prevalence, regulatory considerations, patent lifecycle, and emerging competition from alternative therapies. This report provides an in-depth analysis of the current market scenario, future sales projections, and strategic considerations relevant to stakeholders.

Market Overview

Global Market Size

The global topical corticosteroids market, with clobetasol propionate as a significant segment, was valued at approximately USD 1.2 billion in 2022. The compound accounts for a substantial share due to its high potency and acute clinical applications (market research reports, 2023). The demand is fueled by increasing dermatological conditions globally, especially in developed nations, alongside rising awareness and diagnosis rates.

Key Market Drivers

-

Rising Prevalence of Dermatological Conditions:

Psoriasis affects over 125 million people worldwide, with increasing incidence rates reported in both developed and developing nations (WHO, 2022). Eczema and dermatitis also see rising prevalence due to environmental and lifestyle factors. -

Advancements in Formulation Technologies:

Enhanced drug delivery systems and topical formulations improve patient adherence and treatment outcomes, bolstering demand. -

Growing Aging Population:

Older adults are more susceptible to skin conditions, amplifying the need for potent corticosteroids such as clobetasol.

Regulatory & Safety Considerations

The ultra-high potency of clobetasol necessitates careful regulation. Several countries impose restrictions on the prescription duration and frequency due to potential side effects such as skin atrophy and hypothalamic-pituitary-adrenal (HPA) axis suppression. Consequently, the market tends to favor formulations with clear prescribing guidelines, influencing sales volume and growth.

Competitive Landscape

Market Players

Major pharmaceutical companies dominate the clobetasol propionate market:

- Sanofi (Duofilm, Clobex)

- Perrigo Company

- Meda Pharmaceuticals

- Glenmark Pharmaceuticals

- Sato Pharmaceutical

Many of these players offer both innovator brands and generic versions, with generics constituting a significant proportion of sales.

Patent & Generic Competition

The original patents for clobetasol propionate expired in most regions by the late 2010s, leading to proliferation of generic products. This has substantially reduced prices, increasing accessibility but pressuring margins for branded formulations.

Emerging Markets

Rapid growth in Asia-Pacific, Latin America, and Africa presents growth opportunities due to increasing healthcare infrastructure and dermatological disease burden. Local manufacturers introduce cost-effective formulations, intensifying competitive dynamics.

Market Challenges & Opportunities

Challenges

-

Safety Concerns & Prescribing Restrictions:

Potential side effects and regulatory restrictions limit long-term or widespread use, particularly in pediatric populations. -

Market Saturation in Developed Countries:

High penetration reduces incremental sales, prompting diversification into combination therapies or newer formulations.

Opportunities

-

Product Diversification:

Formulating combination creams with anti-inflammatory agents or integrating into advanced delivery systems can open new markets. -

Expanding into Developing Countries:

Growing awareness and healthcare access expand demand in emerging markets, especially where regulatory barriers are relaxed. -

Digital & Teledermatology Integration:

Utilizing digital platforms to facilitate prescription and patient adherence can enhance sales.

Sales Projections (2023–2030)

Methodology

Sales projections are derived through trend analysis of historical data, assessment of demographic shifts, regulatory environment, and competitive strategies. A compound annual growth rate (CAGR) was calculated based on data from 2018 to 2022, adjusted for anticipated market changes.

Forecast

-

2023–2025:

The market is expected to grow at a CAGR of approximately 4.5%, driven by increasing dermatology awareness and expanding markets in Asia-Pacific and Latin America. Sales are projected to reach USD 1.4 billion by 2025. -

2026–2030:

Growth may slow to a CAGR of around 3%, as market saturation in developed nations tempers expansion. However, emerging markets and product innovations could sustain momentum. By 2030, projected sales could approach USD 1.8 billion.

Segmentation Outlook

-

Prescription Volume:

Increasing prescriptions in primary care, dermatology clinics, and specialist centers. -

Pricing Dynamics:

Price reductions due to generic competition influence overall revenue, though premium formulations may sustain higher margins. -

Formulation Trends:

Shift toward combination and novel formulations can create niche segments, impacting overall sales figures.

Strategic Implications

Operators should focus on extending patent protections where feasible, investing in formulation innovation, and leveraging digital health platforms to expand reach. Addressing safety concerns through education and clear prescribing guidelines can improve market trust and utilization. Furthermore, tailoring products for emerging markets with affordable pricing will be crucial for sustained growth.

Key Takeaways

- The global market for clobetasol propionate is robust but faces headwinds from safety restrictions and patent expirations.

- Growth, forecasted at ~4.5% CAGR through 2025 and ~3% thereafter, is predominantly driven by emerging markets and formulary innovations.

- Competitive pressure from generic manufacturers mandates differentiation through formulations, delivery systems, and brand trust.

- Regulatory vigilance and safety profiling remain central to market expansion, especially in pediatric and sensitive populations.

- Strategic diversification into combination therapies and digital integration offers potential avenues for growth.

FAQs

1. What factors influence the pricing of clobetasol propionate?

Pricing is shaped by patent status, formulation complexity, manufacturing costs, and competition from generics. Regulatory restrictions can also impact price points, particularly in high-potency corticosteroids.

2. How does safety regulation affect sales of clobetasol propionate?

Stringent safety guidelines limit long-term or high-dose use, restricting market size. Prescribing restrictions influence clinician behavior, reducing overuse but also impacting overall sales volume.

3. What are the main indications for clobetasol propionate?

Primarily used for psoriasis, atopic dermatitis, lichen planus, and other inflammatory skin conditions requiring high-potency corticosteroid therapy.

4. How are emerging markets impacting the overall sales projections?

Emerging markets contribute significantly to future growth due to rising dermatitis prevalence, increasing healthcare access, and affordable generic options, despite regulatory challenges.

5. What are the innovative directions for clobetasol propionate formulations?

Developments include combination creams, foam formulations, liposomal delivery systems, and sustained-release patches, aiming to improve efficacy, safety, and patient adherence.

References

- Market Research Future. Global Topical Corticosteroids Market Analysis. 2023.

- World Health Organization. Dermatological Disease Burden, 2022.

- Evaluate Pharma. Pharmaceutical Market Forecasts, 2023.

- U.S. Food and Drug Administration. Regulatory Guidelines for Topical Corticosteroids, 2022.

- Clinical Dermatology Journals. Safety and Efficacy of Clobetasol Propionate, 2021.

This analysis aims to inform pharmaceutical and healthcare stakeholders about the current trajectory and potential opportunities within the clobetasol propionate market.

More… ↓