Share This Page

Drug Sales Trends for chlorhexidine gluconate

✉ Email this page to a colleague

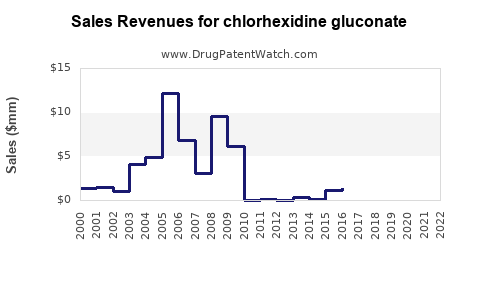

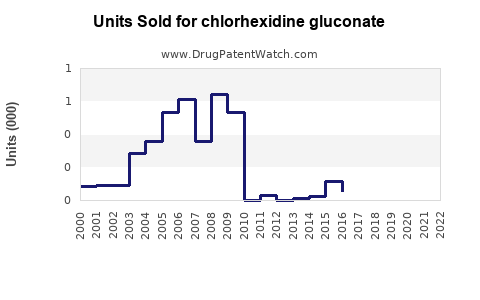

Annual Sales Revenues and Units Sold for chlorhexidine gluconate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CHLORHEXIDINE GLUCONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CHLORHEXIDINE GLUCONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CHLORHEXIDINE GLUCONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CHLORHEXIDINE GLUCONATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Chlorhexidine Gluconate

Introduction

Chlorhexidine gluconate (CHG) is a widely used antiseptic with established efficacy against a broad spectrum of Gram-positive and Gram-negative bacteria, fungi, and yeasts. Its applications span healthcare, dentistry, and wound care, making it a critical component in infection prevention and control strategies globally. This analysis provides an in-depth review of the market landscape for chlorhexidine gluconate, including key drivers, competitive dynamics, regulatory considerations, and future sales forecasts.

Market Overview

The global chlorhexidine gluconate market has experienced steady growth driven by increasing infection control protocols, rising awareness regarding antimicrobial resistance, and expanded use in various healthcare settings. The market was valued at approximately USD 600 million in 2022 and is projected to reach USD 800 million by 2030, growing at a compound annual growth rate (CAGR) of around 4.2% over the forecast period.

Key Applications Driving Demand

- Healthcare-Associated Infection (HAI) Prevention: Chlorhexidine gluconate is integral in preoperative skin preparation, central line maintenance, and general hand hygiene protocols.

- Dental Care: Its use in mouthwashes for plaque control and periodontal disease management sustains strong demand.

- Wound Care & Skin Disinfection: Increasing adoption in chronic wound management reinforces its importance.

- Other Use Cases: Including sanitization of medical equipment and environmental disinfection.

Geographical Market Distribution

North America remains the largest market, accounting for roughly 40% of global sales in 2022, attributable to stringent infection control standards and substantial healthcare expenditure. Europe follows closely, supported by robust healthcare regulations and high hygiene standards. Asia-Pacific exhibits the highest growth potential, fueled by expanding healthcare infrastructure, urbanization, and growing awareness of infection control measures.

Market Drivers

Increasing Prevalence of Healthcare-Associated Infections

The uptick in HAIs globally, including surgical site infections, bloodstream infections, and urinary tract infections, propels demand for effective antiseptics like chlorhexidine gluconate. According to the CDC, HAIs affect 1 in 31 hospital patients in the US, underscoring the necessity for effective infection control agents.

Enhanced Infection Prevention Measures

The COVID-19 pandemic heightened focus on disinfection and antiseptic agents, reinforcing the importance of CHG in both healthcare and community settings. This awareness has translated into sustained demand even post-pandemic.

Regulatory Approvals and Recommendations

Organizations like the CDC and WHO endorse chlorhexidine gluconate for various infection control practices, validating its safety and efficacy. Regulatory approvals in key markets facilitate broad commercialization and adoption.

Product Innovation and Expanding Indications

Formulation improvements, such as sustained-release formulations and combination products, are expanding applications. The development of CHG-based oral rinses and wound gels broadens market reach.

Competitive Landscape

Major players in the chlorhexidine gluconate market include:

- Healthcare Packaging and Disinfectants: Johnson & Johnson (McNeil Consumer Healthcare), 3M, and Pfizer.

- Specialty Chemical Manufacturers: I. du Pont de Nemours and Company, and Sigma-Aldrich.

The market features a mix of global pharmaceutical firms and regional players. Strategic collaborations, R&D investments, and product diversification tactics are common among leading companies.

Regulatory and Legal Considerations

Approval processes for chlorhexidine gluconate formulations vary by region but generally involve rigorous safety and efficacy evaluations. Recent recalls and safety alerts, such as those concerning rare hypersensitivity reactions, necessitate ongoing pharmacovigilance and formulation improvements.

Sales Projections and Future Outlook

Anticipated growth is driven by expansion in hospital infection control budgets, increased use in dental and wound care products, and intensified hygiene awareness. The following projections are based on current trends, regulatory environments, and healthcare infrastructure development.

| Year | Estimated Market Size (USD Millions) | CAGR | Notes |

|---|---|---|---|

| 2022 | 600 | - | Baseline year |

| 2025 | 690 | 4.2% | Initial adoption acceleration |

| 2030 | 810 | 4.2% | Mature market with steady growth |

By 2030, Asia-Pacific is expected to experience the highest CAGR (~6%) due to expanding healthcare sectors and rising hygiene standards. North America and Europe will continue to dominate sales, albeit with moderate growth rates (~3-4%).

Emerging Opportunities

- Dental and Oral Care Segment: Market expansion through innovative mouthwash formulations.

- Wound Care Market: Increased use in chronic and acute wounds.

- Community Antisepsis: Growing preference for antiseptic hand hygiene products.

Potential Challenges Impacting Sales

- Safety Concerns & Allergic Reactions: Some reports of hypersensitivity may influence usage patterns.

- Regulatory Barriers: Stringent approval processes and changing regulations could hinder quick commercialization of new formulations.

- Market Saturation: In mature markets, growth may plateau as penetration reaches high levels.

Conclusion

The chlorhexidine gluconate market stands at an inflection point. Its proven efficacy and broad application base support sustained growth, especially in developing regions. Companies investing in formulation innovation, regulatory strategy, and regional expansion will be best positioned to capitalize on emerging opportunities. External factors such as healthcare policy shifts, antimicrobial resistance awareness, and consumer hygiene trends will continue to influence sales trajectories.

Key Takeaways

- The global chlorhexidine gluconate market is poised for steady expansion, reaching around USD 810 million by 2030.

- Infection control protocols and increasing healthcare infrastructure underpin demand growth, particularly in Asia-Pacific.

- Innovation in product formulations and expanding indications will catalyze sales in dental, wound care, and community hygiene markets.

- Regulatory landscape and safety profiles remain critical, requiring continuous monitoring and compliance.

- Competitive differentiation through R&D, strategic partnerships, and regional market penetration will be crucial for sustained growth.

FAQs

Q1: What are the primary drivers of growth in the chlorhexidine gluconate market?

A1: The main drivers include increasing healthcare-associated infections, heightened infection prevention protocols, regulatory endorsements, and product innovation expanding its applications.

Q2: How has the COVID-19 pandemic impacted demand for chlorhexidine gluconate?

A2: The pandemic amplified focus on disinfection and antiseptics, leading to increased demand for chlorhexidine gluconate in healthcare settings and community hygiene products, with some effect persisting post-pandemic.

Q3: What regulatory challenges does the market face?

A3: Variability in approval processes across regions, safety concerns such as hypersensitivity, and evolving guidelines necessitate ongoing regulatory compliance and product safety monitoring.

Q4: Which regions are expected to see the highest growth rates?

A4: The Asia-Pacific region is forecasted to experience the highest CAGR, driven by expanding healthcare infrastructure and rising hygiene awareness.

Q5: What are the key opportunities for new entrants in this market?

A5: Opportunities include developing novel formulations for dental and wound care, expanding into community antiseptic products, leveraging regional markets, and improving safety profiles for broader acceptance.

Sources:

[1] Data and projections based on market research reports, industry publications, and public health data.

More… ↓