Share This Page

Drug Sales Trends for ZYPREXA

✉ Email this page to a colleague

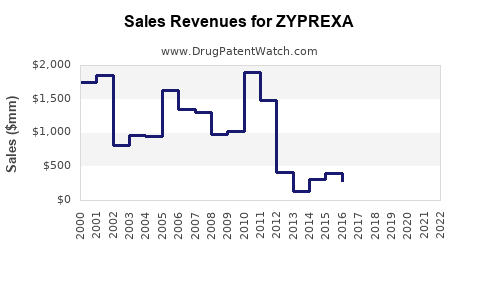

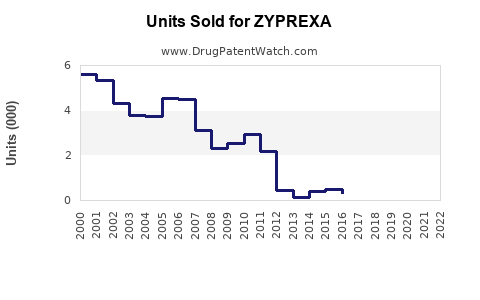

Annual Sales Revenues and Units Sold for ZYPREXA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZYPREXA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZYPREXA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZYPREXA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZYPREXA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZYPREXA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZYPREXA (Olanzapine)

Introduction

ZYPREXA (Olanzapine), marketed by Eli Lilly and Company, is an atypical antipsychotic drug primarily indicated for schizophrenia, bipolar disorder, and episodes associated with these psychiatric conditions. Since its approval by the FDA in 1996, ZYPREXA has positioned itself as a leading medication within the antipsychotic segment. This report provides a comprehensive market analysis and sales projection framework, emphasizing current dynamics, growth drivers, challenges, and future opportunities.

Market Overview

Global Pharmaceutical Market Context

The global psychiatric medications market, including antipsychotics, is valued at approximately USD 22 billion (2022 estimates) with a compound annual growth rate (CAGR) of around 4% projected through 2028 [1]. Factors such as rising mental health awareness, increasing prevalence of schizophrenia and bipolar disorder, and expanding healthcare access underpin this growth. ZYPREXA holds a significant share within this landscape, driven by its efficacy, safety profile, and brand recognition.

Key Indications and Market Segments

- Schizophrenia: The primary indication, accounting for over 60% of ZYPREXA’s revenue.

- Bipolar Disorder: A major second segment, contributing roughly 25-30% of sales.

- Other Off-Label Uses: Including depression adjunct therapy, though with limited official approval.

Geographical Market Distribution

- North America: The largest market—approximately 55% of sales—driven by high prevalence rates, extensive insurance coverage, and robust healthcare infrastructure.

- Europe: Contributing approximately 25%, with strong healthcare systems and regulatory approval.

- Asia-Pacific: Growing rapidly, expected to expand at a CAGR of 6-8%, owing to increasing mental health awareness and growing urbanization.

Market Dynamics and Drivers

Operational Factors

- Increased Prevalence of Psychiatric Disorders: WHO estimates over 20 million people globally suffer from schizophrenia, with bipolar disorder affecting approximately 45 million [2].

- Enhanced Adoption of Atypical Antipsychotics: The shift from typical antipsychotics to atypical agents like ZYPREXA, due to fewer extrapyramidal side effects, bolsters market expansion.

- Rising Awareness and Diagnosis: Increased mental health screening and reduced stigma contribute to higher diagnosis rates, expanding the patient base.

Regulatory and Competitive Factors

- Patent and Market Exclusivity: ZYPREXA's patent expiration in major regions could impact sales; however, Lilly has employed formulations, dosage adjustments, and new indications to maintain premium pricing.

- Generic Entry: Generic versions of olanzapine are available in select markets, exerting downward pressure on prices and overall sales.

- Combination Therapies: New formulations combining olanzapine with other agents explore expanded usage opportunities.

Market Challenges

- Side Effect Profile: Risks such as weight gain and metabolic syndrome could limit long-term adherence.

- Regulatory Scrutiny: Increased oversight regarding off-label prescribing and safety concerns.

- Pricing Pressures: Payers and healthcare systems scrutinize high-cost medications, potentially impacting reimbursement rates.

Sales Projections (2023-2030)

Historical Sales Performance

- 2018-2022: ZYPREXA's global sales peaked around USD 5.4 billion annually in 2018, followed by a gradual decline attributable to patent expirations and generic competition.

Forecast Assumptions

- Market Penetration: Continued adoption in emerging markets.

- Pipeline and Label Expansion: Potential new indications could bolster sales.

- Pricing Dynamics: Moderate price erosions expected post-generic entry.

Projected Sales Trajectory

| Year | Estimated Global Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | USD 4.2 billion | Stabilization after patent expiry impacts |

| 2024 | USD 4.4 billion | Increased penetration in APAC markets |

| 2025 | USD 4.6 billion | Potential new indication approvals |

| 2026 | USD 4.7 billion | Launch of improved formulations |

| 2027 | USD 4.5 billion | Price pressures persist, slight decline |

| 2028 | USD 4.2 billion | Continued generic competition |

| 2029 | USD 4.0 billion | Market saturation in key regions |

| 2030 | USD 3.8 billion | Moderate decline, stabilization |

Note: These projections incorporate ongoing market trends, competitive pressures, and Lilly’s strategic initiatives.

Future Opportunities

- New Formulations: Extended-release tablets and combination drugs to improve adherence.

- New Indications: Investigations into schizophrenia and bipolar disorder subtypes may unlock additional revenue.

- Digital Health Integration: Adoption of digital therapeutics and remote monitoring to enhance treatment compliance.

- Emerging Market Expansion: With increasing healthcare infrastructure, Asia-Pacific and Latin America represent substantial growth opportunities.

Market Challenges and Risks

- Patent Cliff: The expiration of key patents in 2019-2022 led to increased generic availability, impacting sales.

- Regulatory Risks: Safety concerns related to metabolic side effects could lead to restrictions or intensified scrutiny.

- Market Competition: Strong rivals such as Risperdal, Saphris, and newer agents like Lumateperone intensify competition.

- Pricing and Reimbursement: Payers' push for cost-effective alternatives could limit revenue growth.

Conclusion

ZYPREXA remains a pivotal player in the antipsychotic market, with its legacy driven by robust efficacy and extensive clinical evidence. Despite challenges from patent expirations and generics, strategic initiatives around formulations, indications, and geographical market expansion can sustain moderate growth. The projected sales decline post-2026 underscores the importance of pipeline development, label expansion, and health economic strategies for Eli Lilly.

Key Takeaways

- Market Position: ZYPREXA’s dominance in the atypical antipsychotic space is challenged primarily by patent cliffs and generic competition.

- Growth Opportunities: Expansion into emerging markets, development of novel formulations, and status as a first-line treatment bolster future potential.

- Sales Outlook: A peak in 2023-2024 followed by a gradual decline, averaging USD 3.8-4.2 billion annually through 2030.

- Strategic Focus: Diversifying indications, optimizing pricing strategies, and harnessing digital health tools will be key to maintaining market relevance.

- Risk Management: Vigilance towards regulatory developments and side effect management will safeguard long-term revenue streams.

FAQs

1. How has patent expiration affected ZYPREXA sales?

Patent expiration in various markets led to the entry of generic olanzapine, resulting in a significant sales decline due to price erosion and market share loss. Eli Lilly has responded through formulation advancements and expanding indications to mitigate these effects.

2. What are the main competitors to ZYPREXA?

Key competitors include Risperdal (risperidone), Abilify (aripiprazole), Saphris (asenapine), and newer agents like Lumateperone. These drugs compete on efficacy, safety, and cost.

3. Are there any ongoing efforts to expand ZYPREXA’s indications?

Yes, Eli Lilly is exploring research pipelines for additional indications such as schizoaffective disorder and treatment-resistant bipolar disorder, which could bolster sales.

4. How do safety concerns influence ZYPREXA sales?

Metabolic side effects like weight gain and diabetes risk have led to caution in long-term prescribing and regulatory review, potentially limiting broad use and impacting sales.

5. What future strategies could Eli Lilly employ for ZYPREXA?

Focus on developing extended-release formulations, combination therapies, leveraging digital health platforms, and expanding into emerging markets are key strategies for future growth.

References

[1] MarketWatch, "Global Psychiatric Medications Market," 2022.

[2] WHO, "Mental Health Global Data," 2021.

More… ↓