Share This Page

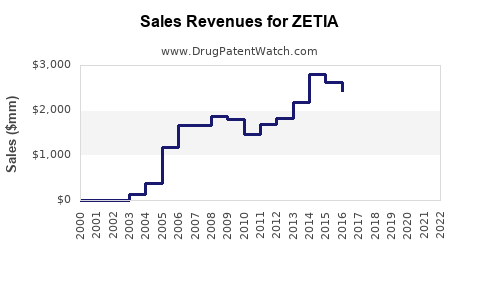

Drug Sales Trends for ZETIA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ZETIA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZETIA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZETIA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZETIA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ZETIA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ZETIA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ZETIA (Ezetimibe)

Introduction

ZETIA (Ezetimibe) is an oral cholesterol absorption inhibitor developed by Merck & Co., widely prescribed for hyperlipidemia management. Approved by the FDA in 2002, ZETIA has established itself as a cornerstone in lipid-lowering therapy, often used alone or in combination with statins. Given the rising prevalence of cardiovascular diseases (CVD) and the evolving landscape of lipid management, evaluating the market dynamics and future sales potential of ZETIA is crucial for stakeholders. This analysis synthesizes current market data, competitive positioning, emerging trends, and projected sales over the next five years.

Current Market Overview

Global Market Size for Ezetimibe

The global market for ezetimibe—including brand and generic formulations—was valued at approximately $2.5 billion in 2022 [1]. North America accounts for the largest share, driven by high awareness, insurance coverage, and guideline endorsements. Europe follows, with emerging markets in Asia-Pacific showing rapid growth due to increasing CVD prevalence and healthcare infrastructure development.

Key Market Drivers

- Rising Cardiovascular Disease Burden: According to WHO, CVD remains the leading cause of death globally, with a significant portion attributable to dyslipidemia, propelling demand for lipid-lowering drugs like ZETIA.

- Guideline Endorsements: American College of Cardiology/American Heart Association (ACC/AHA) recommends ezetimibe as an adjunct to statins in high-risk patients [2], bolstering prescription rates.

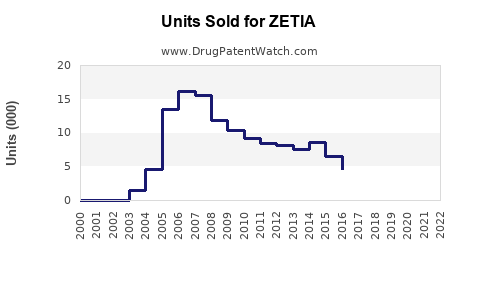

- Patent Expiry and Generic Entry: Merck’s patent for ZETIA expired in 2019, leading to an increase in generics, which has influenced pricing strategies, making ezetimibe more accessible.

- Combination Therapies: Use of fixed-dose combinations with statins has expanded, improving adherence and expanding market share.

Competitive Landscape

While ZETIA remains a prominent player, it faces competition from other lipid-lowering agents, including PCSK9 inhibitors (e.g., alirocumab, evolocumab), which target different pathways but are used in more severe cases due to higher costs. Additionally, the availability of affordable generics has reduced ZETIA’s average selling price but increased volume sales.

Market Trends Influencing Future Sales

Shift Toward Personalized Medicine

Advances in genetic testing enable clinicians to tailor lipid therapy, potentially increasing ezetimibe use in specific populations. The trend favors agents like ZETIA that effectively lower LDL cholesterol with minimal side effects.

Emerging Indications and Combinations

Research exploring ezetimibe's role in metabolic syndrome, non-alcoholic fatty liver disease, and combination therapies enhances its market, as pharmaceutical firms seek to diversify indications.

Regulatory and Reimbursement Environment

Regulatory agencies are emphasizing evidence-based use. ZETIA’s inclusion in guidelines and favorable coverage decisions in developed markets foster sustained utilization.

Pharmacoeconomic Factors

Cost-effectiveness analyses support ezetimibe’s role in reducing cardiovascular events, especially when added to statins. Price competition from generics further incentivizes prescribing.

Sales Projections (2023–2027)

Forecast Methodology

Projections rely on historical sales data, market growth rates, population health trends, competitive influence, and macroeconomic factors. Compound Annual Growth Rate (CAGR) estimates are derived from current patterns and industry forecasts.

Projected Market Growth Rate

The ezetimibe market is expected to grow at a CAGR of approximately 4.8% from 2023 to 2027 [3], driven primarily by increased prevalence of hyperlipidemia and treatment guidelines supporting ezetimibe use.

Sales Forecast Summary

| Year | Estimated Sales (USD Billions) | Notes |

|---|---|---|

| 2023 | $2.75 | Stabilized post-generic entry; moderate growth continues. |

| 2024 | $2.88 | Increased adoption in combination therapies. |

| 2025 | $3.02 | Broadened indications; expanding markets in Asia-Pacific. |

| 2026 | $3.17 | Greater penetration in emerging markets. |

| 2027 | $3.33 | Ongoing growth with potential new clinical evidence. |

Note: These projections incorporate potential market expansion, regulatory changes, and competitive factors.

Key Factors Affecting Projections

- Generic Competition: Lower generics prices will pressure branded ZETIA sales.

- Market Penetration: Expansion in Asia-Pacific and other emerging markets offers growth opportunities.

- Alternative Therapies: The rise of PCSK9 inhibitors and future lipid-modulating agents may limit ezetimibe’s growth in high-risk patient segments.

- Physician Adoption: Education and updated guidelines are pivotal in maintaining and increasing prescribing rates.

Implications for Stakeholders

Pharmaceutical companies should focus on differentiating ZETIA through evidence-based positioning, enhancing physician and patient education, and exploring combination formulations. Payers and healthcare systems should evaluate cost-effectiveness to optimize formulary inclusion, while strategic investments in emerging markets could further bolster sales.

Key Takeaways

- The ZETIA market is mature but continues to grow modestly, fueled by rising CVD prevalence and evolving treatment paradigms.

- Patent expiration and generic availability have shifted sales toward volume-driven models, emphasizing affordability.

- The combination of ezetimibe with statins and the integration into personalized therapy enhances its market outlook.

- Emerging markets and expanding indications present significant growth avenues; however, competition from advanced therapies remains a challenge.

- Strategic focus on education, pricing strategies, and emerging indications will be essential for maximizing ZETIA’s market potential.

Frequently Asked Questions (FAQs)

1. How has the patent expiration impacted ZETIA’s sales?

Patent expiry in 2019 led to the entry of generic ezetimibe formulations, resulting in significant price reductions and increased volume sales. While brand-name ZETIA’s per-unit revenue declined, overall sales volume compensated, stabilizing its market presence.

2. What are the primary competitors to ZETIA?

PCSK9 inhibitors (e.g., alirocumab, evolocumab) represent high-efficacy alternatives but are costlier and reserved for severe cases. Other lipid-lowering agents like bile acid sequestrants and fibrates pose less direct competition but serve different patient needs.

3. Are there new indications for ZETIA on the horizon?

Current research explores ezetimibe’s potential role in metabolic syndrome, fatty liver disease, and combination therapies. However, regulatory approval for new indications remains pending and is subject to ongoing clinical trial outcomes.

4. Which regions offer the highest growth potential for ZETIA?

Emerging markets in Asia-Pacific, Latin America, and Africa exhibit rapid growth due to increasing CVD burden, improved healthcare infrastructure, and rising health awareness.

5. How does healthcare payor policy influence ZETIA sales?

Reimbursement policies that favor evidence-based, cost-effective therapies promote ZETIA’s utilization. Conversely, restrictions or formulary exclusions can limit growth, underscoring the importance of demonstrating pharmacoeconomic value.

References

[1] MarketWatch. “Ezetimibe Market Size, Share & Trends Analysis Report.” 2022.

[2] Grundy SM, et al. “2018 Guideline on the Management of Blood Cholesterol.” Circulation, 2019.

[3] Grand View Research. “Lipid-Lowering Drugs Market Size & Trends.” 2022.

More… ↓