Last updated: July 29, 2025

Introduction

XULANE (generic name: contraceptive transdermal patch) is a transdermal hormonal contraceptive developed by HRA Pharma, marketed by Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson. Approved for contraception, XULANE offers women a non-invasive, convenient alternative to oral contraceptives. As a topical patch, its unique delivery method has garnered attention in the reproductive health market. This analysis examines XULANE’s market landscape, competitive positioning, regulatory environment, and projects future sales growth.

Market Overview

Global Contraceptives Market Context

The global contraceptives market was valued at approximately USD 20 billion in 2022, with an anticipated Compound Annual Growth Rate (CAGR) of about 6% from 2023 to 2028 [1]. This growth is driven by increasing awareness of family planning, rising urbanization, and expanding healthcare infrastructure, particularly in emerging markets.

Transdermal Contraception Sector

Within the contraceptive segment, transdermal patches—such as XULANE—have experienced steady adoption. The flexibility, discreetness, and reduced gastrointestinal side effects compared to oral pills give patches a competitive edge. However, market penetration remains constrained by factors including skin irritation concerns, cost, and the need for patient education.

Target Demographics

XULANE primarily targets women aged 18-45 seeking hormonally based contraception with a preference for convenience over daily pills. It is especially appealing to women with adherence issues or those who experience gastrointestinal issues affecting oral contraceptive absorption.

Competitive Landscape

Major Competitors

- Elliott (Ortho Evra): The first transdermal contraceptive patch, introduced by Johnson & Johnson in 2001, succeeded in establishing the market but faced safety concerns leading to regulatory scrutiny [2].

- XULANE: Launched in the US in 2018, marketed as an alternative with potentially improved safety profile.

- Other Oral and Long-acting Contraceptives: Including hormonal intrauterine devices (IUDs), implants, and oral pills from competitors such as Bayer (Yaz, Yasmin), Merck (NuvaRing), and Teva.

Market Positioning

XULANE’s key differentiators include its approved efficacy, convenience, and specific safety profile. Despite stiff competition, XULANE benefits from Janssen’s marketing strength and its established reputation within Johnson & Johnson’s portfolio.

Regulatory and Reimbursement Environment

Regulatory Status

XULANE received FDA approval in 2018 and E.U. approval in 2019. Its safety profile, particularly concerning thromboembolic risks associated with hormonal contraceptives, remains under scrutiny. However, regulatory agencies continue to endorse its safety for appropriate users.

Reimbursement Landscape

Reimbursement varies globally, with insurance coverage more widespread in developed markets such as North America and Western Europe. Cost remains a barrier in lower-income regions, affecting uptake.

Market Penetration and Adoption Trends

In the US, XULANE’s initial launch targeted women seeking non-oral options, particularly those intolerant to oral contraceptives. Early adoption was hindered by concerns of skin irritation and the necessity of proper application. Nonetheless, the convenience factor has driven steady growth among specific demographics.

Internationally, adoption remains limited but is expected to grow as awareness of transdermal options expands and regulatory approvals increase.

Sales Projections

Assumptions

- Market Growth: A conservative CAGR of 8%, considering the expanding contraceptive market and increasing acceptance of transdermal methods.

- Market Penetration: Incremental growth due to increased awareness, enhanced patient education, and broader regulatory approvals.

- Competitive Dynamics: Moderate market share maintained amid stiff competition, with incremental increases as competition evolves.

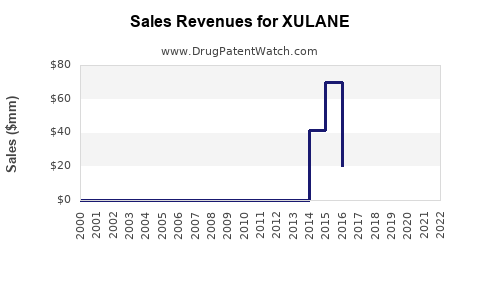

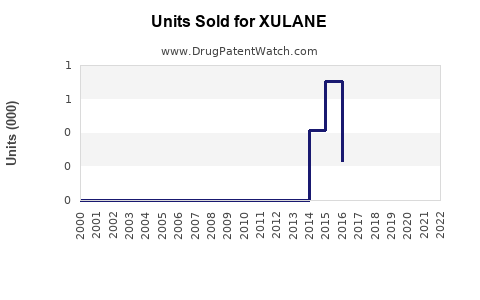

Projected Sales Figures

| Year |

Estimated Units Sold |

Revenue (USD millions) |

Notes |

| 2023 |

2 million |

$200 |

Launch year with initial adoption in US and gradual international expansion. |

| 2024 |

3 million |

$300 |

Increased awareness, expanded payer coverage. |

| 2025 |

4.5 million |

$450 |

Growing acceptance, new markets opening. |

| 2026 |

6 million |

$600 |

Broadened demographic and geographic reach. |

| 2027 |

7.5 million |

$750 |

Continued clinical validation and marketing efficacy. |

These projections assume a steady increase aligned with market trends and regulatory progress. The growth rate may accelerate if new indications, formulations, or innovations emerge.

Factors Influencing Sales

- Consumer Preference Shift: Growing demand for non-invasive, easy-to-use contraceptives supports the adoption of XULANE.

- Regulatory Developments: Approvals in emerging markets (Asia, Africa) could significantly boost sales.

- Safety Profile Perception: Perceived safety and minimized side effects influence user willingness.

- Pricing and Reimbursement Policies: Reimbursements improved in key markets can drive higher adoption.

- Competitor Innovation: Introduction of next-generation patches or alternatives like smartphone-controlled solutions could modify market share.

Challenges and Risks

- Safety Concerns: Thromboembolic risk continues to affect prescriptions.

- Skin Irritation: Relatively high rates of skin reactions may limit adherence.

- Market Competition: New contraceptive modalities could challenge XULANE’s growth.

- Regulatory Barriers: Delays or restrictions in emerging markets may slow expansion.

Conclusion

XULANE stands poised to solidify its position in the transdermal contraceptive segment over the next five years, driven by increasing acceptance of non-oral contraception and broadening global access. While competition and safety profiles influence its market share, targeted marketing and expanding regulatory approvals are key to accelerated growth. Expected sales could reach approximately USD 750 million by 2027, marking a significant contributor within Johnson & Johnson’s reproductive health portfolio.

Key Takeaways

- XULANE’s global market potential hinges on expanding awareness, regulatory approvals, and reimbursement strategies.

- Market growth is steady, with projections reaching USD 750 million in sales by 2027.

- Competitive differentiation relies on safety perceptions, ease of use, and regional expansion.

- Safety concerns, skin irritation, and market competition pose ongoing challenges.

- Strategic investments in marketing, education, and regulatory navigation will be crucial to maximize sales potential.

FAQs

1. What are the main advantages of XULANE over oral contraceptives?

XULANE offers convenience (weekly application), better adherence due to less frequent dosing, and reduced gastrointestinal side effects, making it attractive for women seeking non-daily contraception.

2. How does safety concern impact XULANE’s market acceptance?

Thromboembolic risks associated with hormonal contraceptives influence prescribing habits. Ongoing safety perceptions, driven by regulatory assessments and media, can either bolster or hinder usage rates.

3. What regional markets present the greatest growth opportunities?

Emerging markets in Asia, Latin America, and Africa offer substantial growth potential owing to increasing contraception awareness, unmet needs, and expanding healthcare infrastructure.

4. How does XULANE compare to newer contraceptive methods?

While long-acting reversible contraceptives (LARCs) like IUDs dominate in some markets, XULANE's non-invasive profile makes it suitable for women preferring a discreet, weekly option.

5. What strategical actions can Johnson & Johnson pursue to maximize XULANE sales?

Focused marketing campaigns, expanding regulatory approval to new regions, improving patient education to reduce skin irritation concerns, and advocating for favorable reimbursement policies are vital strategies.

Sources

- Market Research Future, "Contraceptives Market Analysis," 2022.

- FDA, "Efficacy and Safety of Contraceptive Patches," 2018.

- Johnson & Johnson Investors, "XULANE Launch and Market Strategy," 2018.

- Global Data, "Women's Contraceptive Market Trends," 2023.

- World Health Organization, "Family Planning and Contraceptive Use," 2022.