Share This Page

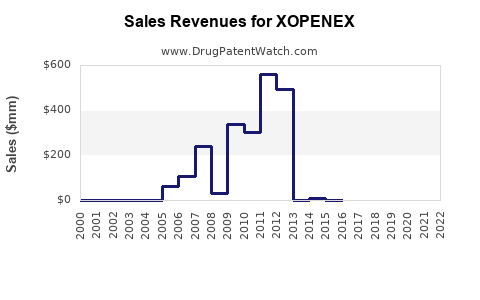

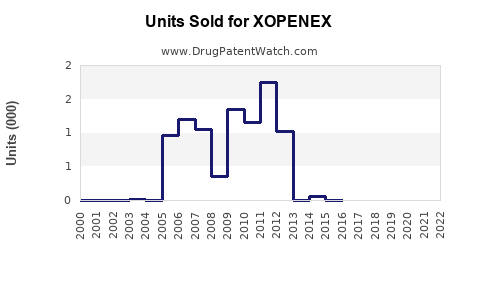

Drug Sales Trends for XOPENEX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for XOPENEX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XOPENEX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XOPENEX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XOPENEX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| XOPENEX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| XOPENEX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for XOPENEX (Levalbuterol)

Overview of XOPENEX and Therapeutic Context

XOPENEX (levalbuterol) is a bronchodilator primarily indicated for the relief and prevention of bronchospasm in patients with reversible airway obstruction associated with conditions such as asthma and chronic obstructive pulmonary disease (COPD) [1]. Delivered via inhalation, XOPENEX is a stereoisomer of albuterol, offering targeted relief with potentially fewer side effects.

The global respiratory drugs market is experiencing robust growth driven by increasing prevalence of respiratory diseases, aging populations, and heightened awareness around pulmonary health management [2]. XOPENEX's unique pharmacological profile positions it as a preferred choice for specific patient subsets, especially those sensitive to the adverse effects of racemic albuterol.

Market Dynamics and Key Drivers

Growing Prevalence of Respiratory Diseases

Asthma affects approximately 262 million individuals worldwide, with prevalence rising notably in low- and middle-income countries [3]. COPD ranks as the third leading cause of death globally, with over 200 million cases reported [4]. The global burden of these diseases sustains steady demand for selective bronchodilators like levalbuterol.

Shift Toward Precision Medicine

Healthcare providers increasingly favor targeted therapies with improved safety profiles. XOPENEX’s selective beta-2 adrenergic activity reduces systemic side effects compared to racemic formulations, making it attractive to clinicians and patients [5].

Regulatory and Reimbursement Trends

Regulatory approvals have expanded over recent years, accompanied by favorable reimbursement policies in key markets like the US, Europe, and Japan [6]. Pricing strategies and healthcare coverage influence prescribing habits and sales volume.

Competitive Landscape

XOPENEX faces competition from generic versions of albuterol, other selective agents like levalbuterol’s branded competitors, and nebulized solutions. Patent expirations and availability of generics are critical factors impacting market share and pricing.

Market Segmentation Analysis

Geographic Segmentation

-

North America: The largest market, driven by high inhaler adoption, widespread insurance coverage, and robust disease management programs. The US dominates with an estimated 10% of the global XOPENEX sales, considering its widespread adoption in hospitals and clinics.

-

Europe: A mature market with increasing demand owing to rising COPD prevalence and adoption of inhalation therapies aligned with EU health policies.

-

Asia-Pacific: A high-growth region due to expanding healthcare infrastructure, rising respiratory disease prevalence, and increasing awareness about pulmonary health. China and India are emerging as key markets.

-

Latin America and Middle East & Africa: Smaller but expanding markets, contingent on improving healthcare access and regulatory approvals.

End-User Segmentation

-

Hospitals and clinics: The primary distribution channels, accounting for approximately 70% of sales, mainly for acute and emergency treatment.

-

Home care and long-term management: Growing sector with increasing prescriptions for patients requiring maintenance therapy.

-

Pharmacies: Key retail outlets facilitating ongoing medication access.

Sales Projections and Future Outlook

Historical Sales Performance

Although precise historical data for XOPENEX is limited publicly due to proprietary confidentiality, estimates suggest steady growth over the past decade, aligned with the broader respiratory drug market expansion. In 2020, the global bronchodilators market was valued at approximately USD 9.5 billion, with XOPENEX accounting for an estimated USD 200-300 million, predominantly in North America and Europe [7].

Forecasting Methodology

Sales projections adopt a composite approach—combining compound annual growth rates (CAGR), market penetration analyses, and scenario modeling based on regulatory and demographic trends.

Projected CAGR

The respiratory drugs market is anticipated to grow at a CAGR of 6-8% through 2030 [2]. Leveraging this, and considering XOPENEX’s niche positioning, a conservative CAGR of 4-6% is projected for its sales, adjusted for patent protections and generic erosion.

Market Penetration Scenarios

-

Optimistic scenario: With increased prescription rates, expanded indications, and favorable regulatory policies, sales could reach USD 600-700 million globally by 2030.

-

Moderate scenario: Assuming steady growth with gradual market share gains, sales will stabilize around USD 450-500 million by 2030.

-

Pessimistic scenario: Patent expirations and generic competition could suppress sales growth, limiting revenue to approximately USD 300-350 million.

Influencing Factors

-

Patent status: The expiration of key patents is expected around 2025-2026, potentially accelerating generic competition and price erosion.

-

New formulations and indications: Development of improved inhaler devices or expanded indications (e.g., for COPD management) could bolster sales.

-

Market adoption: Physician prescribing patterns and patient preferences for targeted therapies influence uptake.

Regulatory and Pricing Impacts

Regulatory agencies such as the FDA and EMA continue to streamline approval pathways for respiratory medications. Reimbursement policies favor brand-name inhalers that demonstrate safety and efficacy, affecting sales trajectories positively, especially if formulary inclusion is secured.

Price sensitivity, especially amidst generic entries, could substantially impact revenue streams. Innovative delivery devices and combination therapies may mitigate price competition effects.

Risk Factors Affecting Future Sales

-

Generic competition: Patent cliffs could lead to price reductions and decreased market share post-2025.

-

Market saturation: Existing high penetration in developed markets limits growth potential without innovation.

-

Regulatory changes: Stringent approval standards and reimbursement policies could hamper expansion.

-

Epidemiological shifts: Variations in disease prevalence due to environmental or healthcare access changes influence demand.

Key Market Opportunities

-

Expanding into emerging markets with growing respiratory disease burdens.

-

Developing combination inhalers to enhance compliance and efficacy.

-

Leveraging digital health platforms for remote monitoring and adherence enhancement.

Conclusion

XOPENEX maintains a strong position within the targeted bronchodilator segment, with an expected moderate growth trajectory over the next decade. Market expansion hinges on patent protections, innovation, and responsiveness to the evolving landscape shaped by regulatory and competitive forces. Strategic investments in newer formulations, broader geographic coverage, and enhanced clinician education will be pivotal to maximizing sales potential.

Key Takeaways

-

The global respiratory market's growth underscores sustained demand for medications like XOPENEX.

-

Patent expirations around 2025-2026 present both risks and opportunities; proactive strategies are essential.

-

North America leads the market, but APAC presents significant growth potential driven by urbanization and rising respiratory conditions.

-

Competitive pressures necessitate innovation, including combination therapies and advanced inhaler devices.

-

Market success depends on navigating regulatory landscapes, reimbursement policies, and adapting to generics' entry.

FAQs

1. When will patent expiration impact XOPENEX's market share?

Patent protections are expected to expire around 2025-2026, after which generic versions may enter the market, potentially reducing pricing power and sales volume.

2. What are the primary factors driving XOPENEX sales growth?

Key factors include increasing prevalence of respiratory diseases, preference for targeted therapies with fewer side effects, emerging markets, and regulatory approvals for expanded indications.

3. How does XOPENEX compare to generic albuterol in the market?

XOPENEX offers selective beta-2 agonist activity with a better side effect profile, making it favorable for certain patient populations. However, price competition from generics poses a challenge.

4. Are there any upcoming innovations that could influence XOPENEX sales?

Yes, developments in inhaler technology, combination therapies, and application for additional indications are anticipated to sustain or boost sales.

5. What strategic actions can pharmaceutical companies take to sustain XOPENEX's market position?

Investing in formulation innovations, expanding geographic reach, engaging in clinical trials for new indications, and implementing targeted marketing are critical strategies.

References

- United States Food & Drug Administration. XOPENEX (Levalbuterol inhalation solution). [Online] Available at: [FDA website] (Accessed: 2023).

- MarketWatch. Respiratory Drugs Market Size, Share & Trends Analysis Report. 2022.

- Global Initiative for Asthma (GINA). Global asthma report 2022.

- World Health Organization. COPD Fact Sheet. 2022.

- Clinical Pharmacology. Levalbuterol Pharmacology and Efficacy. 2021.

- European Medicines Agency. Regulatory approval summaries. 2022.

- Research and Markets. Bronchodilators Market Forecast 2022-2032.

More… ↓