Share This Page

Drug Sales Trends for XANAX

✉ Email this page to a colleague

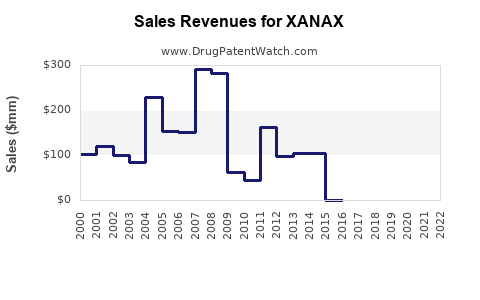

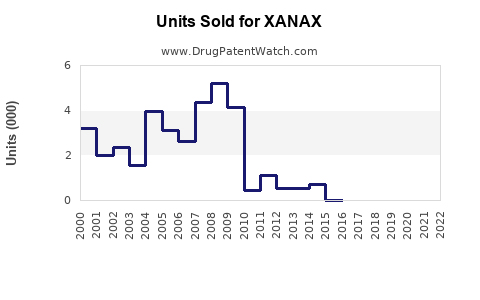

Annual Sales Revenues and Units Sold for XANAX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| XANAX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| XANAX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| XANAX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Xanax (Alprazolam)

Introduction

Xanax (alprazolam), a benzodiazepine primarily prescribed for anxiety disorders and panic attacks, remains one of the most recognized and widely used medications in the psychotropic segment. Its economic footprint, driven by demand in residential, healthcare, and institutional markets, reflects both its therapeutic efficacy and ongoing issues related to misuse. This analysis examines the current market landscape for Xanax, evaluates growth drivers and challenges, and projects future sales trends, emphasizing factors influencing its positioning within the global pharmaceutical market.

Global Market Landscape

Market Size and Revenue Trends

As of 2022, the global anxiolytic market, which includes benzodiazepines like Xanax, was valued at approximately USD 2.5 billion, with a compound annual growth rate (CAGR) of about 3.2% projected through 2027 [1]. Xanax's share within this segment remains significant due to its high prescription volume, especially in North America, where it accounts for an estimated 40–50% of benzodiazepine prescriptions for anxiety-related disorders [2].

In the United States, Xanax generated estimated retail sales of USD 650 million in 2022, positioning it as a leading benzodiazepine. The drug's sales are supported by its long-standing reputation, extensive prescriber familiarity, and the high prevalence of anxiety disorders—affecting more than 284 million adults globally, with higher rates reported in developed economies [3].

Geographical Distribution

North America dominates the Xanax market, driven by liberal prescribing practices, high anxiety disorder prevalence, and insurance coverage. Europe follows, with steady growth fueled by increasing mental health awareness and demand for pharmacological interventions. Emerging markets in Asia-Pacific display rising prescriptions, though regulatory challenges and cultural factors influence market penetration.

Market Dynamics: Drivers and Challenges

Key Growth Drivers

-

Prevalence of Anxiety and Panic Disorders: Globally, rising recognition and destigmatization of mental health issues have increased demand for effective pharmacotherapy. The CDC reports that anxiety and related disorders are among the most common mental health conditions, driving ongoing prescription fills for benzodiazepines like Xanax [4].

-

Prescriber Familiarity and Clinical Efficacy: Xanax’s rapid onset and proven efficacy have cemented its status among clinicians, encouraging continued utilization. Its wide availability through generic formulations also enhances its accessibility and affordability.

-

Integration into Multiple Treatment Frameworks: Xanax is often used adjunctively or as part of comprehensive mental health programs, reinforcing ongoing demand.

Market Challenges

-

Regulatory and Abuse Concerns: Rising concerns about dependence, oversupply, and misuse have led to tighter regulations in several jurisdictions. The US FDA’s warnings and DEA scheduling restrictions (Schedule IV classification) impact prescribing patterns [5].

-

Shift Toward Non-Benzodiazepine Alternatives: The emergence of antidepressants such as SSRIs (e.g., sertraline, escitalopram) offers longer-term management of anxiety with lower abuse potential, gradually displacing benzodiazepines.

-

COVID-19 Pandemic Impact: The pandemic initially curtailed prescription volume due to healthcare access limitations but later contributed to increased anxiety levels, expanding Xanax demand in some sectors but also raising concerns about potential misuse.

Sales Projections (2023–2030)

Baseline Scenario

Considering current market conditions and the influences outlined, global Xanax sales are projected to sustain a CAGR of roughly 2.5% through 2030. This conservative estimate accounts for ongoing regulatory restrictions and the gradual shift toward alternative therapies.

- 2023: Estimated sales of USD 2.7 billion globally; USA comprises around USD 1.4 billion.

- 2025: Potential to reach USD 3.2 billion with increased penetration in Asia-Pacific and stabilizing prescriber practices.

- 2030: Forecasted sales of approximately USD 3.6 billion, contingent on regulatory environment, public health awareness, and prescribing behaviors.

Factors for Accelerated Growth

- Expanding mental health awareness campaigns.

- Broader acceptance of benzodiazepines under controlled settings.

- Introduction of abuse-deterrent formulations.

- Strategic marketing for generic versions.

Factors for Decelerated or Flat Growth

- Stricter regulations limiting prescribing practices.

- Growing preference for non-benzodiazepine treatments.

- Elevated societal concerns about dependence potential.

- Impact of legal actions and educational efforts to curb misuse.

Competitive Landscape

The benzodiazepine segment is increasingly marked by patent expirations, prompting a shift towards generics. Companies such as Teva, Sandoz, and Mylan predominate the generic supply chain, influencing price competition and profit margins. While branded Xanax sales benefit from prescriber loyalty and reputation, generic affordability and availability shape overall revenue streams.

Innovative formulations—such as extended-release or abuse-deterrent tabs—offer strategic opportunities to capture niche markets and mitigate regulatory restrictions. Moreover, emerging digital health initiatives aim to complement pharmacotherapy, potentially influencing sales trajectory positively.

Regulatory and Ethical Considerations

Navigating the complex regulatory landscape remains critical. The US FDA’s safety communications, DEA scheduling, and state-level prescribing constraints directly impact market dynamics (see [5]). Ethical considerations around misuse and dependency foster increased scrutiny, prompting pharmaceutical companies to prioritize responsible marketing and formulation innovations.

Conclusion

Xanax retains a strategic position in the psychotropic medication landscape, underpinned by its clinical efficacy and substantial global demand. While growth prospects are steady, they are tempered by regulatory, societal, and therapeutic landscape transformations. The focus for manufacturers should remain on innovating delivery systems, complying with regulatory frameworks, and aligning with evolving prescriber and patient preferences to sustain and grow sales.

Key Takeaways

-

Market Stability with Modest Growth: Xanax’s global sales are expected to grow modestly at around 2.5% annually through 2030, driven by demand in mature markets and expanding in emerging regions.

-

Regulatory Environment as a Critical Factor: Evolving legal restrictions and safety concerns are shaping the use and availability of Xanax, impacting future sales potential.

-

Shift Toward Alternatives: The increasing prescription of non-benzodiazepine anxiolytics, especially SSRIs, may limit Xanax’s market share over time.

-

Innovation and Responsible Marketing: Developing abuse-deterrent formulations and leveraging digital health tools offer opportunities to sustain revenue streams and enhance safety profiles.

-

Strategic Market Penetration: Continued expansion into Asia-Pacific and other emerging markets, supported by local regulatory approval and awareness campaigns, presents significant growth avenues.

FAQs

Q1: How does regulatory regulation affect Xanax’s future sales?

A1: Regulations—such as scheduling restrictions, prescribing limits, and abuse deterrence mandates—directly influence physician prescribing behaviors and patient access, thereby impacting sales growth and market stability.

Q2: Are non-benzodiazepine alternatives replacing Xanax?

A2: Yes, medications like SSRIs and SNRIs are increasingly favored for long-term anxiety management, although Xanax remains prevalent for acute and short-term therapy due to its rapid effect.

Q3: What role do generic formulations play in Xanax’s market?

A3: Generics dominate due to lower costs and widespread availability, constraining branded sales but enabling broader access. They also intensify price competition among manufacturers.

Q4: How has the COVID-19 pandemic influenced Xanax sales?

A4: The pandemic initially limited prescriptions but later increased demand due to heightened anxiety levels. However, concerns over misuse have necessitated stricter controls, balancing growth with safety considerations.

Q5: What innovations could influence Xanax’s market position?

A5: Abuse-deterrent formulations, extended-release versions, and digital adherence tools can improve safety profiles and patient compliance, potentially enhancing market competitiveness.

References

[1] MarketResearch.com, "Global Anxiolytics Market Overview," 2022.

[2] IQVIA, "Prescription Trends in Benzodiazepines," 2022.

[3] World Health Organization, "Mental Health Country Profiles," 2022.

[4] CDC, "Anxiety Disorders Statistics," 2022.

[5] US FDA, "Benzodiazepines and Safety Communications," 2021.

More… ↓