Last updated: July 28, 2025

Introduction

VYVANSE (lisdexamfetamine) is a prescription stimulant primarily indicated for Attention Deficit Hyperactivity Disorder (ADHD) and moderate to severe binge eating disorder. Approved by the FDA in 2007, VYVANSE has experienced significant growth due to expanding indications, evolving clinical guidelines, and a competitive landscape shaped by new formulations and alternative therapies. This analysis explores the market dynamics, competitive positioning, regulatory environment, and sales forecasts that define VYVANSE’s commercial trajectory.

Market Overview

Global ADHD Treatment Market

The global ADHD treatment market was valued at approximately USD 19 billion in 2022, with stimulant medications accounting for over 70% of sales [1]. North America leads the market, driven by high diagnosis rates, favorable reimbursement policies, and robust prescription rates.

Key Indications and Patient Demographics

ADHD affects approximately 5-10% of children and 2-5% of adults worldwide [2]. Market penetration is robust in pediatric populations, but adult ADHD diagnosis and treatment are rapidly expanding, propelled by increased awareness and healthcare provider acceptance. Binge Eating Disorder, for which VYVANSE received FDA approval in 2017, targets an estimated 2.8 million adults in the U.S. alone [3].

Competitor Landscape

VYVANSE’s primary competitors include:

- Adderall (amphetamine/dextroamphetamine): The market leader in stimulant therapy.

- Concerta and Janssen’s Daytrana (methylphenidate formulations).

- Atomoxetine (Strattera): Non-stimulant alternative.

- Other lisdexamfetamine formulations: Vyvanse is the only lisdexamfetamine currently marketed; however, generics and biosimilars could emerge.

Additionally, non-stimulant options and behavioral therapies constitute competing treatment modalities, especially in populations with contraindications.

Regulatory and Reimbursement Landscape

Reimbursement policies favor branded formulations due to patent protections and exclusive rights, which sustain premium pricing. The recent expiration of VYVANSE’s patent in certain jurisdictions signals potential dilution from generics, affecting sales.

Market Segmentation and Key Drivers

Geographic Distribution

- United States: Dominant market, accounting for around 80% of VYVANSE sales due to high diagnosis and prescribing rates.

- Europe: Growing but constrained by regulatory differences, prescription preferences, and reimbursement policies.

- Asia-Pacific: Emerging market with increasing awareness and diagnosis, offering long-term growth potential.

Prescription Trends

Popularity of VYVANSE is driven by:

- Its long-acting, once-daily formulation, improving adherence.

- Favorable side effect profile relative to older stimulants.

- Expansion of indications to adults and binge eating disorder.

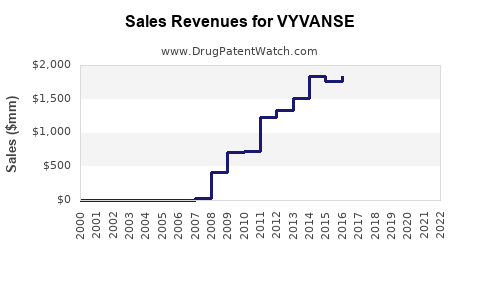

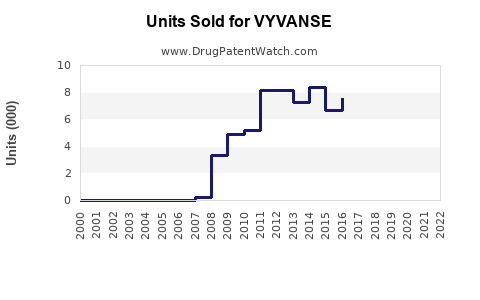

Sales Performance and Historical Growth

Since its launch in 2007, VYVANSE has demonstrated consistent growth. In 2020, Pfizer reported annual sales revenue surpassing USD 2.2 billion globally [4], with the North American market representing the majority. Despite patent expiration threats, strategic marketing and expanding indications sustain revenue streams.

Sales Projections (2023–2028)

Assumptions

- Continued adoption in adult ADHD and binge eating disorder populations.

- Limited impact from generics initially due to patent exclusivity, but gradual erosion post-expiration.

- Increasing awareness and diagnosis in emerging markets.

- Competitive pressures from new formulations and non-stimulant options.

Projected Sales Trajectory

| Year |

Estimated Global Sales (USD billions) |

Key Factors |

| 2023 |

$2.5 billion |

Mature market, stable prescriptions, patent exclusivity persists. |

| 2024 |

$2.7 billion |

Expansion in adult ADHD, increased awareness, generic entry potential. |

| 2025 |

$2.9 billion |

Growing binge eating disorder treatment, further market penetration. |

| 2026 |

$3.1 billion |

Emerging markets contributing, new formulations possibly launching. |

| 2027 |

$3.3 billion |

Competition intensifies, but long-acting formulations remain favored. |

| 2028 |

$3.5 billion |

Market saturation in mature regions; sustained growth in emerging markets. |

Note: These projections assume moderate market erosion post-patent expiry, with continued demand driven by expanding indications.

Market Challenges and Opportunities

Challenges

- Patent expiration and the rise of generic versions threaten pricing power and revenue.

- Increased competition from non-stimulant medications and behavioral therapies.

- Regulatory scrutiny over stimulant abuse potential and scheduling.

- Variability in healthcare policies across regions impacting sales volumes.

Opportunities

- Growing acceptance and diagnosis of adult ADHD.

- Second-generation formulations enhancing patient adherence.

- Expansion into new therapeutic indications (e.g., treatment-resistant depression).

- Penetration into emerging markets through collaborations and localized marketing.

- Development of abuse-deterrent formulations to mitigate misuse concerns.

Strategic Outlook

To sustain and grow sales, the manufacturer could focus on:

- Accelerating the launch of novel formulations with improved efficacy or safety profiles.

- Investing in awareness campaigns targeting adult populations and underserved regions.

- Partnering with healthcare systems to expand indication coverage.

- Preemptively addressing regulatory and abuse concerns through reformulation and education.

Key Takeaways

- VYVANSE remains a significant player in stimulant therapy for ADHD, with stable revenue driven by long-acting formulation advantages.

- The impending patent expiry presents both risks of generic substitution and opportunities via biosimilars and line extensions.

- The expanding diagnosis of adult ADHD and binge eating disorder secures growth prospects, especially in North America and emerging markets.

- Competitive pressures necessitate innovation, strategic marketing, and diversification into new indications.

- The evolving regulatory environment mandates proactive compliance and evidence generation to maintain market share.

Conclusion

VYVANSE's market position remains robust due to its differentiated profile and expanding indications. While patent expirations pose potential threats, strategic initiatives centered on formulation innovation, market expansion, and educational outreach can preserve and enhance sales projections. Stakeholders should monitor regulatory developments, competitive dynamics, and demographic trends to adapt effectively.

FAQs

1. How does patent expiration affect VYVANSE sales?

Patent expiration typically leads to the entry of generic competitors, which can significantly reduce prices and sales volume. However, the timing and impact depend on patent litigation outcomes and market acceptance of generics.

2. Are there upcoming formulations of VYVANSE that could impact sales?

Yes. The development of abuse-deterrent formulations and new delivery systems could bolster adherence and safety, providing a competitive edge in the market focus.

3. What is the outlook for VYVANSE in emerging markets?

Growing awareness and diagnosis of ADHD, coupled with expanding healthcare infrastructure, position emerging markets as promising growth areas, potentially doubling sales over the next decade.

4. How significant is VYVANSE’s role in treating binge eating disorder?

Post-FDA approval in 2017, VYVANSE became one of the few pharmacotherapies approved for moderate to severe binge eating disorder, opening new revenue channels and indicating its strategic importance beyond ADHD.

5. What competitive strategies should VYVANSE’s manufacturer pursue?

Fostering innovation through new formulations, expanding indications, expanding geographic footprint, engaging in educational initiatives, and maintaining strong clinical evidence are critical to sustaining market share.

References

[1] IQVIA, "Global ADHD Market Report," 2022.

[2] American Psychiatric Association, "DSM-5 Field Trials," 2013.

[3] National Institute of Mental Health, "Binge Eating Disorder," 2021.

[4] Pfizer Annual Report, 2020.