Share This Page

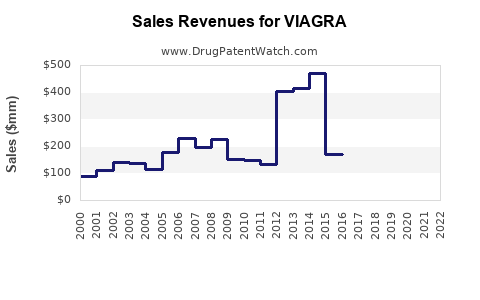

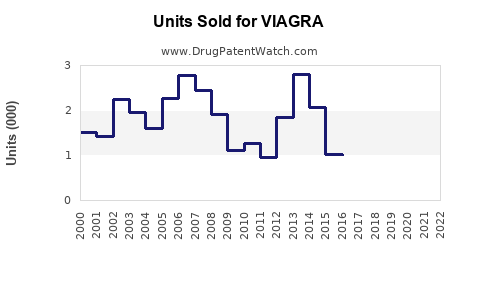

Drug Sales Trends for VIAGRA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for VIAGRA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VIAGRA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VIAGRA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VIAGRA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VIAGRA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| VIAGRA | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for VIAGRA

Introduction

Viagra, the brand name for sildenafil citrate, revolutionized the treatment of erectile dysfunction (ED) upon its FDA approval in 1998. Since then, it has established itself as a top-tier prescription drug with a significant impact on global pharmaceutical markets. This analysis explores the current market landscape, key drivers, competitive dynamics, regulatory factors, and projected sales growth for Viagra through 2030. Understanding these elements enables stakeholders to make informed decisions regarding investments, marketing strategies, and future R&D directions.

Market Landscape Overview

Historical Market Performance

Global sales of Viagra peaked in the early 2010s, with estimates reaching over $2 billion annually. The drug's initial success was driven by its first-mover advantage, broad indications, and the lack of effective alternatives at launch. However, subsequent patent expirations in many jurisdictions around 2013-2018 eroded market share, paving the way for generic competitors.

Patent Expiry and Generics Impact

Pfizer’s patent protection for Viagra expired in multiple markets, notably in the US in 2017, leading to a surge of generic sildenafil products. Generics typically price-discounted innovations, resulting in significant market share shifts:

- Volume increase: Generics increased global penetration, making ED treatments more accessible.

- Price erosion: Average selling prices declined by up to 70%, affecting overall industry revenues.

Current Market Dynamics

Despite patent expiration, branded Viagra maintains a premium image, especially among certain demographics and markets where generics are less prevalent. Pfizer's strategic focus shifted towards healthcare branding, expanding indications, and new formulations, including chewable and lower-dose options.

Key Market Drivers

Growing Prevalence of Erectile Dysfunction

The global prevalence of ED is projected to reach approximately 322 million by 2025, driven by aging populations, rising chronic disease burden (e.g., diabetes, cardiovascular disease), and increasing awareness. This extensive prevalence sustains the foundational demand for sildenafil and related therapies.

Expanding Indications

While initially approved for ED, sildenafil's indication extended to pulmonary arterial hypertension (PAH) with Revatio, increasing its therapeutic footprint. Future indications, such as female sexual dysfunction and other vascular conditions, could further expand the market.

Increasing Awareness and Social Acceptance

Evolving societal norms and destigmatization of sexual health issues contribute to higher treatment rates. Digital health platforms facilitate patient education and access, fueling demand.

Pricing and Market Penetration Strategies

Pharmaceutical companies adopt tiered pricing, regional adaptation, and marketing campaigns to penetrate emerging markets where ED remains underdiagnosed and undertreated.

Market Segmentation

- By Product Type: Prescription drugs (brand and generics), OTC options.

- By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

- By Age Group: Predominantly 40-70 years, but expanding to younger cohorts due to lifestyle factors.

Competitive Landscape

Major Players

- Pfizer: Original patent holder; focus on brand retention and new formulations.

- Teva Pharmaceuticals, Sandoz: Leading generic sildenafil producers.

- Makers of alternative ED therapies: Cialis (tadalafil), Levitra (vardenafil), and emerging PDE5 inhibitors.

Market Challenges

- Pricing pressures: Due to generics.

- Regulatory hurdles: Variations in approval processes, especially around new formulations.

- Market saturation: Mature markets exhibit slow growth, necessitating geographic and indication expansion.

Emerging Innovation

Research into novel delivery systems, combination therapies, and non-PDE5 inhibitors could pose future threats or opportunities, potentially capturing segments beyond traditional ED treatment.

Sales Projections (2023-2030)

Baseline Assumptions

- Continued proliferation of generics will sustain low-priced competition.

- Pfizer will maintain a strategic focus on branded Viagra in select markets, leveraging brand loyalty.

- Emerging markets will exhibit strong growth driven by aging populations and rising healthcare access.

- Product differentiation through new formulations and indications will support premium pricing in specific segments.

Projected Revenue Trends

| Year | Estimated Global Sales (USD billions) | Key Notes |

|---|---|---|

| 2023 | ~$1.2 billion | Stabilized market with moderate growth in emerging markets. |

| 2024 | ~$1.3 billion | Increased penetration in Asia-Pacific. |

| 2025 | ~$1.5 billion | Potential penetration into new indications; further generic competition impacts. |

| 2026 | ~$1.4 billion | Pricing pressures and market saturation. |

| 2027 | ~$1.3 billion | Maturation continues; focus on targeted markets. |

| 2028 | ~$1.3 billion | Market stabilization. |

| 2029 | ~$1.2 billion | Slight decline expected in mature markets. |

| 2030 | ~$1.1 billion | Market consolidation; new indications and formulations may offset declines. |

Segment-Specific Outlook

- Brand Viagra: Likely to retain premium positioning in select markets, with steady but modest revenue contributions.

- Generics: Largest revenue segment, total sales projected to exceed $5 billion globally, with market share dominance expected to continue.

- Innovative Formulations: Limited yet promising, potentially capturing niche segments, especially with targeted demographic marketing.

Regulatory and Policy Considerations

Regulatory environments influence sales via approval of new indications, changes in patent laws, and healthcare policies. Countries advancing policies for affordable generic access may tighten pricing, influencing global sales. Conversely, initiatives promoting sexual health awareness or innovative delivery methods can stimulate demand.

Conclusion

Viagra remains a key player within the ED market, with its sales trajectory shaping up as a complex interplay between patent expirations, generics proliferation, demographic trends, and innovation efforts. While pure brand sales may plateau or decline slightly, the broader sildenafil market—including generics and alternate formulations—offers resilient growth opportunities, especially in underserved emerging markets. Strategic focus on regional expansion, indication diversification, and product innovation will underpin future sales performance.

Key Takeaways

- Market stability in mature regions is challenged by generic competition, requiring differentiation and targeted marketing.

- Emerging markets present significant growth potential driven by demographic shifts and healthcare infrastructure expansion.

- Product innovation, particularly in formulations and indications, can offset declines from traditional sildenafil usage.

- Regulatory landscapes will substantially influence pricing strategies, patent extensions, and approval of new uses.

- Long-term forecasts suggest a gradual decline in global Viagra sales but sustained overall demand within the broader sildenafil market.

FAQs

1. How will patent expirations influence Viagra sales over the next decade?

Patent expirations have led to a surge in generic sildenafil availability, significantly reducing branded Viagra prices and market share. While this introduces price competition, it broadens access, sustaining overall market demand. Pfizer’s strategic focus on branding and formulations aims to maintain a niche segment.

2. What emerging markets offer the most growth opportunities for Viagra?

Asia-Pacific, Latin America, and parts of Africa exhibit the fastest growth potentials due to rising awareness, improving healthcare systems, and increasing acceptance of ED treatments. Larger populations and aging demographics amplify this trend.

3. Can new formulations or indications revitalize Viagra’s sales?

Yes. Formulations such as chewables, lower-dose options, or combination therapies can attract new user segments. Additionally, expanded indications like pulmonary hypertension or female sexual dysfunction could create new revenue streams.

4. How does competition from other ED drugs affect Viagra’s future?

Cialis and Levitra offer different dosing schedules and efficacy profiles, appealing to various patient preferences. Market competition, especially from newer PDE5 inhibitors with longer durations, will influence sales dynamics but also encourages innovation and diversification.

5. What regulatory trends should industry stakeholders monitor?

Shifts toward price regulation, patent law reforms, and approval pathways for new formulations or indications can impact sales. Stakeholders should closely track policy developments in key markets, including the US, EU, China, and India.

Sources

[1] IMS Health Data on Global ED Market, 2022.

[2] Pfizer Official Reports, 2022.

[3] International Journal of Impotence Research, 2021.

[4] Statista, Erectile Dysfunction Treatment Market Overview, 2022.

[5] World Health Organization, Aging Population and Sexual Health, 2021.

More… ↓