Last updated: July 29, 2025

Introduction

Venlafaxine, marketed under brand names such as Effexor, is a serotonin-norepinephrine reuptake inhibitor (SNRI) primarily prescribed for major depressive disorder (MDD), generalized anxiety disorder (GAD), social anxiety disorder, and panic disorder. Since its patent expiration, the generic version’s availability has significantly impacted market dynamics, influencing sales volume and pricing strategies. This analysis explores current market trends, competitive landscape, prescribing patterns, and future sales projections for venlafaxine.

Pharmacological Profile and Therapeutic Positioning

Venlafaxine’s mechanism involves inhibiting serotonin and norepinephrine uptake, addressing multiple neurochemical pathways implicated in depression and anxiety. Its efficacy and tolerability profile have contributed to its widespread adoption, particularly in treatment-resistant cases or where SSRIs provide inadequate response. The drug’s versatility positions it favorably within psychiatry and primary care settings, underpinning consistent demand.

Market Landscape Overview

Global Market Size and Growth Trends

The global antidepressant market, valued at approximately USD 16 billion in 2022, is projected to grow at a CAGR of around 3.8% through 2030, driven by increasing mental health awareness, diagnosis rates, and expanding treatment coverage, especially in emerging markets (Grand View Research, 2022). Venlafaxine accounts for a substantial portion of this market share owing to its longstanding clinical use.

Key Markets

- United States: Dominates due to high prescribing rates, insurance coverage, and mature healthcare infrastructure.

- Europe: Represents significant market share, with increasing acceptance of SNRI classes.

- Asia-Pacific: Rapid growth potential, with expanding mental health services and increased prescription rates.

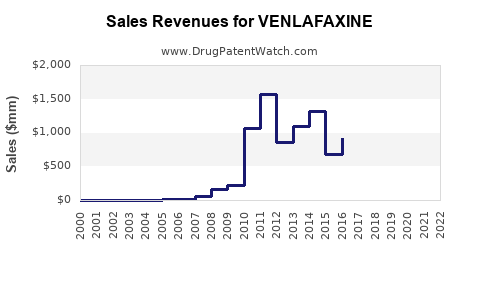

Patent Status and Impact

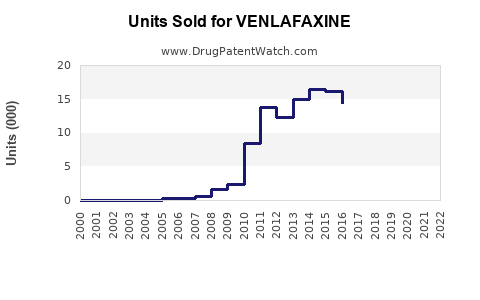

The expiration of Effexor’s patent in 2014 led to widespread generic manufacturing, dramatically reducing prices and increasing accessibility. This shift resulted in an initial decline in branded sales but stimulated volume growth through increased prescription frequency.

Pricing Dynamics

Generic availability has resulted in a price erosion of over 60% since patent expiry, emphasizing volume-driven sales over high-margin branded products.

Sales Drivers and Constraints

Drivers

- Rising Prevalence of Mental Disorders: The World Health Organization estimates over 264 million people suffer from depression globally (WHO, 2021).

- Enhanced Diagnosis and Treatment Access: Increased mental health awareness campaigns have elevated treatment initiation rates.

- Expanding Indications: Off-label uses include certain neuropathic pain conditions, further broadening the market scope.

- Generic Market Penetration: Facilitates higher volume sales due to affordability.

Constraints

- Generic Competition: Multiple formulations from various manufacturers reduce market share for branded versions.

- Competition from Other SNRIs: Duloxetine and desvenlafaxine offer comparable efficacy with different side effect profiles.

- Side Effect Profile: Potential adverse effects, such as hypertension, nausea, and withdrawal symptoms, may influence prescribing behaviors.

- Regulatory Scrutiny: Increasing focus on antidepressant safety profiles impacts prescribing and sales.

Competitive Landscape

Major generic manufacturers include Teva Pharmaceuticals, Mylan (now part of Viatris), and Sandoz, all competing in price and supply. Innovator Pfizer’s Effexor XR maintains a niche but has largely been overshadowed by generics. New entrants or biosimilars are unlikely for a small-molecule drug like venlafaxine, but combination therapies and novel formulations could influence future trends.

Prescribing Patterns and Market Penetration

Data indicates that:

- Prescriptions doubled post-patent expiry, driven by cost considerations.

- Primary care physicians remain the primary prescribers (~75%), with psychiatrists accounting for a smaller share.

- Patient adherence remains high, owing to efficacy and tolerability, ensuring steady demand.

Future Sales Projections (2023-2030)

Assumptions

- Continued growth in mental health disorder prevalence.

- Stable insurance coverage and reimbursement landscapes.

- Incremental market share gains among generics.

- Emergence of novel formulations or combination therapies remains limited.

Projected Market Volume and Revenue

- 2023-2025: Sales are expected to stabilize at approximately USD 1.2–1.5 billion annually, factoring in competitive pressures and price erosion.

- 2026-2030: Moderate growth projected at 2-3% CAGR, driven by demand in emerging markets and broader indications, reaching USD 1.8 billion by 2030.

Regional Outlook

- US Market: Sustains dominant share, with annual sales around USD 800–1 billion through 2030.

- Europe: Growth moderate but consistent, accounting for USD 300–400 million.

- Emerging Markets: Fastest growth, potentially doubling sales figures as access and awareness improve.

Market Opportunities & Challenges

Opportunities

- Expanding indications: Off-label uses and potential new formulations (e.g., extended-release, combination drugs).

- Digital health integration: Enhanced adherence and monitoring may improve treatment outcomes.

- Market penetration in emerging economies driven by affordability and growing mental health awareness.

Challenges

- Price competition remains intense, pressuring margins.

- Regulatory shifts emphasizing safety could restrict prescribing or impose additional scrutiny.

- Evolving treatment algorithms: Preference for newer agents or non-pharmacological therapies could affect volume.

Conclusion

Venlafaxine maintains a robust position within the antidepressant market, benefiting from its proven efficacy, broad prescribing base, and relative affordability due to generic competition. While growth rates are modest, steady demand driven by mental health needs, especially in underserved regions, sustains its market relevance. Strategic focus on expanding indications and optimizing supply chains can enhance sales prospects amid competitive and regulatory pressures.

Key Takeaways

- The global venlafaxine market is mature, with significant sales driven by generics, especially in North America and Europe.

- Sales projections indicate stable growth of 2-3% annually through 2030, reaching USD 1.8 billion.

- Market expansion hinges on increasing mental health awareness and improving access in emerging markets.

- Competitive pressures from other SNRI agents and evolving prescribing habits necessitate strategic positioning.

- Opportunities exist in off-label uses and formulation innovations, but regulatory hurdles remain.

FAQs

1. How has patent expiration impacted venlafaxine sales?

Patent expiry in 2014 led to a surge in generic manufacturing, dramatically lowering prices and increasing volume sales, even as branded Effexor sales declined.

2. What regions are expected to drive future venlafaxine demand?

Emerging markets in Asia-Pacific and Latin America are poised for rapid growth due to expanding mental health services and affordability.

3. How does venlafaxine compete with newer antidepressants?

While newer agents may offer improved side effect profiles or targeting, venlafaxine remains preferred due to established efficacy, affordability, and broad indications.

4. What are the main challenges facing venlafaxine's market growth?

Intense price competition, regulatory scrutiny, and the rise of alternative therapies threaten growth prospects.

5. Are there upcoming innovations in venlafaxine formulations?

Currently, no major innovations are imminent; however, extended-release formulations and combination therapies could influence future dynamics.

Sources

[1] Grand View Research. "Antidepressants Market Size & Share Analysis." 2022.

[2] World Health Organization. "Depression and Other Common Mental Disorders." 2021.