Last updated: February 13, 2026

What Is the Current Market Size for Varenicline?

Varenicline, marketed as Chantix and Champix, is a prescription medication used for smoking cessation. The global smoking cessation market was valued at approximately $1.2 billion in 2021 and is projected to grow to around $2 billion by 2028, with a compound annual growth rate (CAGR) of 8–10% (1). Varenicline accounts for approximately 60–70% of prescriptions within this segment due to its efficacy compared to alternatives like nicotine replacement therapy (NRT) or bupropion.

In 2021, the U.S. accounted for roughly 50% of this market, driven by high smoking prevalence and supportive reimbursement policies. Key markets include North America, Europe, and Asia-Pacific, where regulatory approval and healthcare infrastructure influence access.

How Does Varenicline's Market Share Evolve Amid Competition?

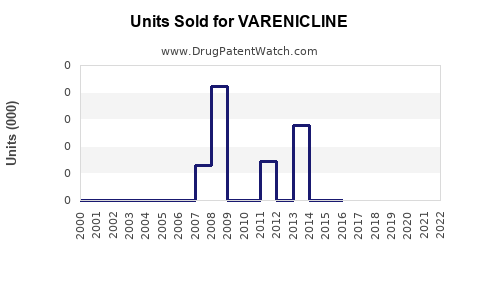

Varenicline's market share faces competition from drugs such as bupropion, NRT products, and emerging digital therapeutics. Despite competition, it maintains a dominant position owing to higher efficacy, with studies indicating a smoking abstinence rate of 21–32% at 12 weeks (2). Prescription volumes peaked in 2018 but stabilized afterward due to concerns over neuropsychiatric adverse events, which have since been mitigated with updated guidelines (3).

New entrants are developing alternative therapies, including:

- Nicotine vaccines

- Digital cessation platforms

- Pharmacological innovations targeting nicotinic receptors

However, these have yet to significantly disrupt varenicline’s share, which remains buoyed by clinical familiarity and proven efficacy.

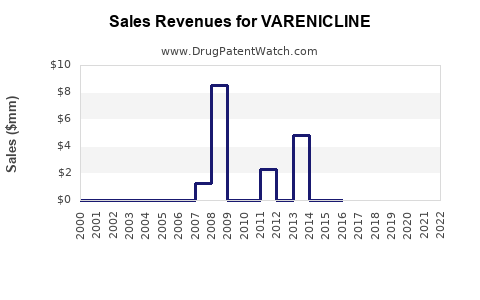

What Are Projected Sales Trends for Varenicline?

Forecasts suggest a steady increase in sales driven by:

- Expanding smoking cessation initiatives globally

- Increasing awareness of smoking-related health risks

- Evolving reimbursement frameworks

Assuming a CAGR of approximately 7–9%, annual sales could reach $1.8–$2 billion by 2028. Sales growth will depend on market access, regulatory landscapes, and product innovations. In the U.S., insurance coverage for smoking cessation drugs such as varenicline continues to improve, supporting higher prescription rates.

What Factors Will Shape Future Market Expansion?

Key drivers include:

- Regulatory approvals for generic versions, reducing costs

- Public health campaigns prioritizing smoking cessation

- Digital healthcare integration enhancing adherence

- Increasing smoking prevalence in certain emerging markets

Potential threats involve safety concerns and competitor launches of more convenient or better-tolerated therapies. Regulatory bodies like the FDA have mandated updated safety labeling, which could influence prescribing patterns.

How Will Regulatory and Patent Landscapes Impact Sales?

Patent expiry timelines influence market dynamics:

| Year |

Patent Expiry (U.S.) |

Impact |

| 2021 |

2021 |

Entry of generics increases competition and reduces prices. |

| 2025 |

Patent for specific formulations |

Possible strategic patent filings to extend exclusivity. |

Regulatory approval for alternative delivery methods (e.g., extended-release formulations) or combination therapies could create new commercial opportunities or threaten existing formulations.

Key Market Players and Their Strategies

Major companies involved are Pfizer (original patent holder), Dr. Reddy’s Laboratories, and Teva Pharmaceutical Industries. Strategies focus on:

- Launching generics in markets post-patent expiry

- Expanding into emerging markets with tailored pricing

- Developing digital platforms for smoking cessation support

Pfizer's patent exclusivity ended globally between 2018 and 2022, facilitating broader generic distribution.

Summary and Outlook

Varenicline remains a leading smoking cessation drug with stable demand, supported by its high efficacy. Market growth will continue in regions with aggressive public health policies and improved reimbursement schemes. Competitive pressures from generics and emerging therapies will influence pricing and market share dynamics. Innovation in formulations and delivery mechanisms might bolster future sales.

Key Takeaways

- The global smoking cessation market was valued at ~$1.2 billion in 2021 and is projected to reach ~$2 billion by 2028.

- Varenicline dominates the market with 60–70% prescription share but faces increased generic competition post-2021.

- Sales are forecasted to grow at approximately 7–9% annually, reaching ~$2 billion in 2028.

- Patent expiration in key markets will catalyze generic entry, likely decreasing prices.

- Policy support, public health campaigns, and digital health integration will determine future growth.

FAQs

1. How does the efficacy of varenicline compare to other smoking cessation therapies?

Varenicline shows higher abstinence rates (~21-32% at 12 weeks) compared to NRT (~12-20%) and bupropion (~15-20%) based on clinical trials (2).

2. What regulatory challenges are associated with varenicline?

Regulatory agencies have mandated safety label updates following neuropsychiatric adverse events. Ongoing surveillance influences prescribing patterns and market acceptance.

3. When will generic versions of varenicline become available?

In the U.S., patents for the original formulation expired in 2018–2022, leading to multiple generic versions entering markets in 2021.

4. What innovations could influence the future of smoking cessation drugs?

Development of nicotine vaccines, digital behavioral therapies, and new pharmacological targets could alter competitive dynamics.

5. How does reimbursement affect varenicline sales?

Insurance coverage and public health subsidies directly impact prescription volumes, especially in the U.S. and Europe where reimbursement criteria are tightening.

Sources:

- MarketWatch. "Smoking Cessation Market Size, Share & Trends Analysis Report," 2022.

- Cahill K., et al. "Pharmacological interventions for smoking cessation: an overview and network meta-analysis," Cochrane Database, 2016.

- U.S. Food and Drug Administration (FDA). "Varenicline Label Updates," 2016.