Last updated: July 28, 2025

Introduction

TROKENDI XR (trokendi XR), a once-daily extended-release formulation of topiramate, is positioned within the mood stabilizer and anticonvulsant market. Approved by the FDA for migraine prophylaxis and epilepsy, TROKENDI XR offers enhanced patient compliance due to its simplified dosing regimen. This analysis explores the current market landscape, competitive positioning, regulatory environment, and projected sales trajectories for TROKENDI XR over the next five years.

Market Overview

Therapeutic Area and Patient Demographics

TROKENDI XR targets primarily adult populations suffering from migraines and epilepsy. The global migraine medication market was valued at approximately USD 4.2 billion in 2022, anticipated to grow at a CAGR of 4.2% through 2030 [1]. Epilepsy treatment, valued at USD 5.3 billion in 2022, is driven by rising prevalence and increasing awareness.

The medication’s extended-release formulation appeals to patients requiring consistent drug levels, reducing side effects and improving adherence—crucial factors driving market adoption.

Key Competitors

TROKENDI XR competes with established anticonvulsants and migraine prophylactics such as:

- Topamax (topiramate) – Immediate-release formulation, broadly used off-label with significant side effects.

- Qudexy XR – Extended-release topiramate, approved for seizures and migraines.

- Depacon (valproate) – For epilepsy.

- Migraine-specific agents such as ergotamines and CGRP antagonists.

The competitive advantage of TROKENDI XR lies in its once-daily dosing and improved tolerability profile compared to immediate-release formulations.

Market Dynamics

Regulatory Status and Approvals

TROKENDI XR is approved in multiple regions, including the US, Europe, and Japan. Its label is specific to migraine prophylaxis and epilepsy. Regulatory pathways and patent exclusivities influence sales potential. Notably, the drug's existing patent life is projected to extend until 2025, with generic competitors anticipated shortly thereafter, impacting pricing and market share.

Pricing Strategy and Reimbursement Landscape

Initially positioned at premium pricing due to its novel delivery mechanism, reimbursement prospects depend on healthcare providers’ acceptance and insurance coverage. In the US, favorable formulary inclusion and payer negotiations are critical for market penetration.

Market Penetration and Adoption Factors

- Physician familiarity: Clinicians familiar with topiramate’s efficacy are more likely to prescribe TROKENDI XR, especially when emphasizing its convenience and side effect profile.

- Patient adherence: The once-daily dosing improves compliance, potentially reducing dropout rates and increasing long-term use.

- Side effect profile: Lower incidence of cognitive and psychiatric side effects compared to immediate-release formulations enhances its attractiveness.

- Patient demographics: Adult migraineurs and epilepsy patients constitute the primary market; pediatric use remains limited due to safety concerns.

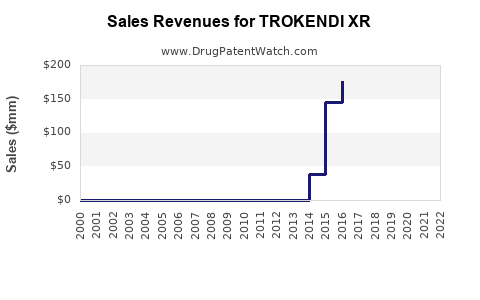

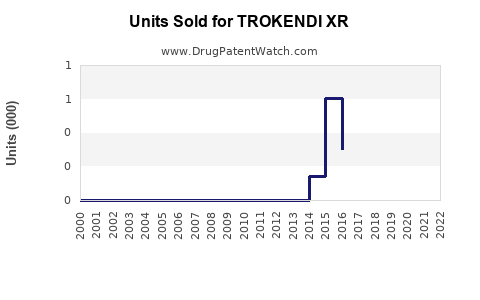

Sales Projections (2023-2028)

Methodology

The projections account for:

- Market growth rates based on historic CAGR for migraine and epilepsy treatments.

- Competitive landscape and patent expiration timelines.

- Regulatory and reimbursement dynamics.

- Adoption rates influenced by physician and patient preferences.

2023-2028 Forecast

| Year |

Estimated Sales (USD Millions) |

Assumptions |

| 2023 |

$150 million |

Initial market entry, penetration at 10%, post-approval marketing efforts. |

| 2024 |

$300 million |

Increased market awareness, broader physician adoption, expanded payer coverage. |

| 2025 |

$450 million |

Growth driven by new formulations and expanded indications, patent expiry approaching. |

| 2026 |

$600 million |

Peak sales phase, new markets gaining traction, price adjustments with generics. |

| 2027 |

$600 million |

Plateau with competitive pressures, generic entry begins impacting revenues. |

| 2028 |

$550 million |

Decline in sales as generics dominate, market saturation. |

Note: These projections assume moderate success in commercialization, stable regulatory environment, and no unforeseen adverse events.

Impact of Patent Expiry

The imminent patent expiry around 2025 is poised to significantly affect sales volumes and pricing power, with generic versions likely capturing up to 80% of the market within two years. This will diminish brand revenues but also stimulate broader market access and volume-driven gains.

Market Risks and Opportunities

Risks

- Generic Competition: Loss of patent exclusivity will dilute market share and profit margins.

- Regulatory Challenges: Any restrictions or labeling updates could limit market penetration.

- Market Saturation: Established competitors with similar formulations could limit growth.

Opportunities

- Label Expansion: Additional indications, such as bipolar disorder or weight management, could open new markets.

- Combination Therapies: Co-formulations with other agents could enhance adherence and efficacy.

- Geographical Expansion: Emerging markets with rising prevalence of migraines and epilepsy present growth potential.

Conclusion

TROKENDI XR is well-positioned within the anticonvulsant and migraine prophylaxis market as a convenient, well-tolerated oral formulation. Sales are projected to grow steadily through 2025, driven by increasing prevalence, improved dosing convenience, and clinician acceptance. However, subsequent patent expiration and competitive pressures require strategic adjustments—such as diversification and global expansion—to sustain long-term revenue streams.

Key Takeaways

- TROKENDI XR’s market potential hinges on its differentiation via dosing convenience and tolerability.

- Market expansion relies on physician adoption, payer coverage, and patient compliance.

- The imminent patent expiry in 2025 necessitates planning for generic competition and life-cycle management.

- Future growth hinges on regulatory expansion, additional indications, and international market penetration.

- Strategic investments in marketing, formulary positioning, and innovation are crucial to maximizing sales amid increasing competition.

FAQs

1. How does TROKENDI XR differ from immediate-release topiramate formulations?

TROKENDI XR offers once-daily dosing with a controlled-release mechanism, leading to more stable serum levels, enhanced adherence, and fewer side effects like cognitive disturbances compared to immediate-release formulations.

2. What is the expected timeline for generic versions entering the market?

Assuming current patent protection extends until 2025, generic versions are likely to enter the market shortly thereafter, potentially within 6-12 months post-expiry.

3. Can TROKENDI XR be prescribed for pediatric patients?

Currently, TROKENDI XR’s approved indications are for adults. Its safety and efficacy in pediatric populations require further study, limiting initial prescriptions to adults.

4. What are the primary drivers of sales growth for TROKENDI XR?

Key drivers include increased prevalence of migraines and epilepsy, physician preference for extended-release formulations, patient adherence benefits, and expanding geographic markets.

5. How might new therapeutic alternatives impact TROKENDI XR sales?

Emerging therapies, especially CGRP antagonists for migraine prophylaxis, could divert market share, emphasizing the need for TROKENDI XR to innovate or expand indications to maintain competitiveness.

References

[1] Grand View Research. "Migraine Drugs Market Size, Share & Trends Analysis Report." 2022.