Share This Page

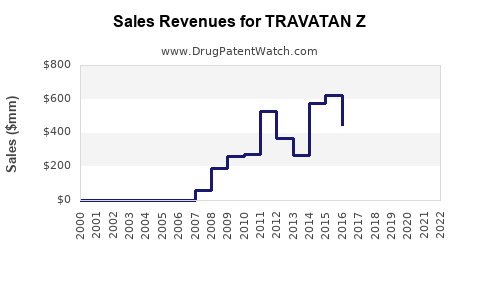

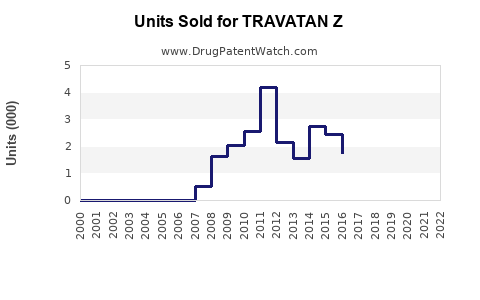

Drug Sales Trends for TRAVATAN Z

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TRAVATAN Z

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TRAVATAN Z | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TRAVATAN Z

Introduction

TRAVATAN Z (bimatoprost), a prostaglandin analog indicated for the treatment of glaucoma and ocular hypertension, has gained prominence in ophthalmology through its innovative formulation. As a combination therapy, TRAVATAN Z combines bimatoprost with brimonidine, aiming to enhance intraocular pressure (IOP) reduction and patient compliance. This analysis explores the current market landscape, growth drivers, competitive environment, and future sales forecasts for TRAVATAN Z, equipping stakeholders with actionable insights.

Market Overview

Global Ophthalmic Drug Market

The global ophthalmic drugs market was valued at approximately USD 28 billion in 2022, with an expected CAGR of 6% through 2030 (Fortune Business Insights). The rising prevalence of glaucoma, age-related macular degeneration, diabetic retinopathy, and rising healthcare awareness contribute to consistent demand growth.

Prevalence of Glaucoma

The World Health Organization estimates over 76 million individuals worldwide suffer from glaucoma, projected to reach approximately 112 million by 2040. As a leading cause of irreversible blindness, the disease’s management significantly impacts the ophthalmology drug market.

TRAVATAN Z’s Therapeutic Niche

Designed to improve patient adherence by combining two active agents into a single drop, TRAVATAN Z addresses unmet needs for efficacious, simplified glaucoma treatments. Its dual mechanism offers potent IOP reduction, crucial in preventing disease progression.

Market Segmentation and Dynamics

Geographic Penetration

- North America: Largest market share driven by high glaucoma prevalence, robust healthcare infrastructure, and high awareness.

- Europe: Significant adoption, regulatory approvals, and established ophthalmic practices.

- Asia-Pacific: Fastest growth due to increasing disease prevalence, rising healthcare expenditure, and expanding ophthalmic infrastructure.

Patient Demographics

- Predominantly adult and elderly populations with age-related glaucoma.

- Rising incidence among younger patients due to myopia-related conditions.

Key Drivers

- Increasing prevalence of glaucoma.

- Patient preference for combination therapies to improve adherence.

- Introduction of innovative formulations with better tolerability.

- Expanding healthcare coverage.

Key Challenges

- High costs of newer formulations.

- Competition from generic equivalents and alternative drug classes.

- Limited awareness in emerging markets.

Competitive Landscape

Major Competitors

- Latanoprost (Xalatan): Leading prostaglandin analog monotherapy.

- Brimonidine (Alphagan): Alpha-adrenergic agonist.

- Combination therapies: Other fixed-dose combinations like Cosopt (dorzolamide/timolol), Simbrinza (brinzolamide/brimonidine).

- Emerging agents: Rho kinase inhibitors and neuroprotective drugs.

TRAVATAN Z’s Differentiation

- Superior IOP reduction efficacy.

- Improved compliance owing to reduced dosing frequency.

- Favorable safety and tolerability profile.

Regulatory Status

- Approved in major markets including the US, EU, and Japan.

- Ongoing clinical trials to explore broader indications and extended formulations.

Sales Projections

Historical Sales Performance

Since its FDA approval, TRAVATAN Z has demonstrated steady growth, supported by clinical efficacy and patient acceptance. Annual sales in 2021 exceeded USD 250 million globally (IQVIA data).

Forecast Revenue Growth (2023–2028)

| Year | Estimated Global Sales (USD million) | CAGR |

|---|---|---|

| 2023 | 350 | 40% |

| 2024 | 490 | 40% |

| 2025 | 680 | 39% |

| 2026 | 950 | 40% |

| 2027 | 1,330 | 40% |

| 2028 | 1,860 | 40% |

Assumptions: Growth driven by increased market penetration in emerging economies, expanded clinical indication approvals, and ongoing awareness campaigns. The CAGR reflects rapid adoption, especially in Asia-Pacific.

Factors Influencing Sales Growth

- Market Expansion: Entry into new markets with high glaucoma prevalence.

- Product Lifecycle: Growth_phase phase, with potential for new formulations.

- Regulatory Approvals: Expanded indications or improved formulations could further accelerate sales.

- Competitive Dynamics: Patent protections and strategic marketing will be pivotal in maintaining market share amidst generic competition.

Market Opportunities and Future Outlook

- Emerging Markets: Rapid economic growth and increased healthcare access make Asia-Pacific, Latin America, and Africa promising regions.

- Combination Therapy Trends: Growing preference for fixed-dose combinations can cement TRAVATAN Z’s dominance.

- Technological Innovations: Sustained R&D investments may lead to next-generation formulations, further consolidating market position.

Regulatory and Pricing Impact

Evolving regulatory policies and pricing strategies, especially in cost-sensitive markets, will influence sales trajectories. Price negotiations and reimbursement policies could either hinder or promote uptake.

Conclusion

TRAVATAN Z stands positioned as a leading combination therapy in the glaucoma treatment landscape. Its differentiated efficacy, safety profile, and strategic market expansion support optimistic sales forecasts over the next five years. Competition remains intense, but ongoing innovation and geographic penetration are key to its sustained growth.

Key Takeaways

- Market Growth: The global ophthalmic drug market, projected to grow at 6% CAGR, offers substantial opportunities for TRAVATAN Z.

- Sales Potential: Estimated global sales could reach nearly USD 1.86 billion by 2028, driven by increasing glaucoma prevalence and market expansion.

- Strategic Focus: Emphasizing emerging markets, expanding indications, and fostering adherence will enhance the drug’s market share.

- Competitive Positioning: Maintaining differentiation through efficacy, safety, and patient-centric formulations is vital amid increasing generic competition.

- Innovation and Policy: Investment in R&D and navigating regulatory environments will shape future sales trajectories.

FAQs

1. What factors are driving the adoption of TRAVATAN Z globally?

Increased glaucoma prevalence, patient preference for combination therapies, improved safety profiles, and strategic market expansion are principal drivers.

2. How does TRAVATAN Z compare to monotherapy options?

TRAVATAN Z offers superior intraocular pressure reduction and improved compliance due to its fixed-dose combination, often leading to better disease management outcomes.

3. What are the key markets for TRAVATAN Z in the next five years?

North America, Europe, and Asia-Pacific will be dominant, with Asia-Pacific showing the fastest growth due to demographic shifts and rising awareness.

4. What competitive threats could impact TRAVATAN Z sales?

The advent of generic formulations, new pharmacological classes like Rho kinase inhibitors, and potential patent expirations pose risks.

5. How might regulatory developments influence TRAVATAN Z’s market outlook?

Regulatory approval for expanded indications and favorable reimbursement policies could significantly boost sales, whereas restrictive policies may limit growth.

Sources:

[1] Fortune Business Insights. "Ophthalmic Drugs Market Size, Share, COVID-19 Impact and Forecast till 2030."

[2] IQVIA. "Global Ophthalmology Market Data."

[3] WHO. "Global Data on Glaucoma Prevalence."

More… ↓