Last updated: July 29, 2025

Introduction

Tizanidine is a centrally acting alpha-2 adrenergic agonist primarily prescribed as a muscle relaxant for spasticity associated with multiple sclerosis, spinal cord injuries, and other neurological disorders. Since its FDA approval in 1999, tizanidine has established itself as a favored treatment option due to its efficacy in reducing muscle spasms with manageable side effects. As the landscape of neurological therapies evolves, understanding the market dynamics and projecting sales for tizanidine provides strategic insights for pharmaceutical stakeholders.

Market Overview

Global Market Size and Growth Drivers

The global muscle relaxant market was valued at approximately USD 4.5 billion in 2021 and is projected to reach around USD 6.0 billion by 2028, registering a CAGR of approximately 4.2% (2022-2028)[1]. Tizanidine occupies a significant share within this sector, driven by increasing prevalence of neurological conditions, expanding aging populations, and growth in outpatient management of spasticity.

Key growth drivers include:

- Rising Incidence of Neurological Disorders: Multiple sclerosis affects over 2.8 million people worldwide, with prevalence rising due to better diagnostics[2].

- Aging Population: Age-related neurodegeneration enhances the need for muscle relaxants; individuals over 65 account for a substantial proportion of prescriptions.

- Enhanced Healthcare Awareness: Improved diagnostic tools and increased prescription of muscle relaxants bolster market penetration.

Competitive Landscape

Tizanidine’s primary competitors are baclofen, diazepam, and newer agents such as dantrolene and botulinum toxins. Its differentiation lies in its favorable side effect profile, especially fewer sedative and hypotensive effects relative to alternatives[3]. However, concerns about hepatotoxicity and hypotension can influence prescribing patterns.

Regulatory Environment

The brand names of tizanidine include Zanaflex (U.S.) and its generic formulations. The availability of generics significantly influences pricing and sales volumes. Regulatory support for generic substitution can drive market penetration, especially in cost-conscious healthcare systems.

Market Segmentation

Indications-Based Segmentation

- Multiple Sclerosis Spasticity: Largest segment; approximately 50% of prescriptions.

- Spinal Cord Injury: Accounts for about 30%.

- Other Neurological Disorders: Including traumatic brain injury, stroke, and certain musculoskeletal conditions.

End-User Segmentation

- Hospitals and Neurology Centers: Major outpatient management settings.

- Physician Clinics: Increasingly prevalent in neuro-physician practices.

- Home Healthcare: Growing due to patient preference and outpatient care expansion.

Sales Projections (2023–2030)

Assumptions and Methodology

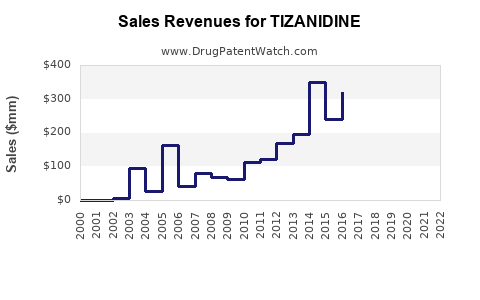

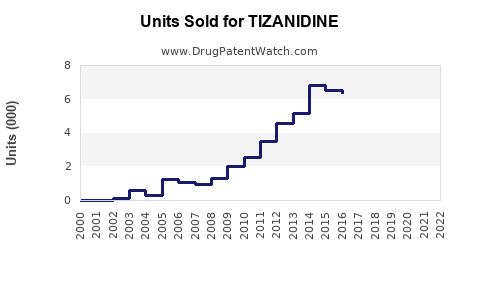

Projection models incorporate historical sales data, approval timelines, patent expiry, generic entry, and the impact of biosimilars or new therapeutics. Assumptions include:

- Continued prevalence growth of neurological disorders.

- A gradual shift towards generic formulations.

- Moderate market penetration in developing regions.

- Stable regulatory environment.

Forecast Highlights

- 2023–2025: The market is expected to grow at a CAGR of around 3.8%, reaching approximately USD 650 million globally by 2025. This growth is driven predominantly by existing prescriptions and the expanding elderly demographic.

- 2026–2030: Sales projections indicate a CAGR of approximately 4.5%, with revenues surpassing USD 850 million by 2030, influenced by increased awareness, evolving treatment guidelines, and entry into emerging markets.

Key Growth Catalysts

- Generic Competition: Entry of cost-effective generics post-patent expiration (U.S. patent expiring in 2016) has increased accessibility and sales volume.

- New Formulations: Development of extended-release or transdermal formulations could improve adherence and expand usage.

- Biosimilars: Although biosimilars are more common for biologics, biosimilar-like developments for small molecules may influence pricing and market share.

Risks and Market Challenges

- Safety Profile Concerns: Hepatotoxicity and hypotension may limit some prescribing use, especially in certain patient populations.

- Market Saturation: Existing competition and generics could suppress premium pricing strategies.

- Regulatory Constraints: Changes in prescribing guidelines or approval of alternative therapies could reshape market dynamics.

Regional Market Insights

North America

Dominates owing to high neurological disorder prevalence, advanced healthcare infrastructure, and widespread generics use. The U.S. accounted for over 60% of sales in 2021, with projections indicating continued dominance.

Europe

Significant growth potential driven by aging populations and healthcare system adoption of muscle relaxants. Regulatory harmonization facilitates market expansion.

Asia-Pacific

High growth opportunity, with increasing neurological disease awareness and improving healthcare access. Market share expected to rise from under 10% in 2021 to approximately 20% by 2030.

Strategic Considerations

- Pricing Strategies: Leveraging generic availability for affordability while maintaining profitability through branding and differentiation.

- Market Penetration: Expanding into emerging markets through partnerships and cost-effective formulations.

- Innovation: Developing novel delivery systems and combination therapies to extend market relevance.

Key Takeaways

- The tizanidine market is poised for steady growth, driven by demographic trends and increasing neurological disorder prevalence.

- Generic drugs significantly influence current market share, necessitating strategic positioning by brand owners.

- Emerging markets offer substantial growth opportunities, especially with regulatory reforms improving drug access.

- Competition from newer agents and safety concerns require ongoing vigilance and innovation.

- Strategic collaborations and formulation advancements will be essential to sustain and grow sales.

Conclusion

Tizanidine remains a vital therapeutic agent within the neuro-muscular landscape. Its sales prospects are favorable, contingent upon market dynamics, regulatory factors, and clinical adoption patterns. Stakeholders should focus on expanding access, optimizing formulations, and navigating competitive pressures to maximize market potential.

FAQs

1. What factors influence the adoption of tizanidine in clinical practice?

Prescriber awareness of its efficacy, safety profile, patient tolerability, and cost considerations—particularly the availability of generic versions—influence its uptake.

2. How does patent expiry affect tizanidine sales?

Patent expiry usually leads to increased generic competition, driving down prices and expanding access, which can both reduce brand sales but increase overall market volume.

3. Are there safety concerns that could hinder tizanidine market growth?

Yes, hepatotoxicity and hypotensive effects are safety considerations that may limit use in certain patient groups or prompt regulatory scrutiny.

4. What are the key opportunities in emerging markets?

Expanding healthcare infrastructure, rising neurological disorder prevalence, and increasing economic capacity create significant growth opportunities.

5. How might future formulations impact tizanidine sales?

Innovations such as extended-release or transdermal formulations can improve adherence, broaden indications, and thus generate additional revenue streams.

References

[1] Market Research Future, “Muscle Relaxant Market”, 2022.

[2] Multiple Sclerosis International Federation, “Global MS Data”, 2021.

[3] U.S. Food & Drug Administration (FDA), “Zanaflex (tizanidine) label information”, 2022.