Share This Page

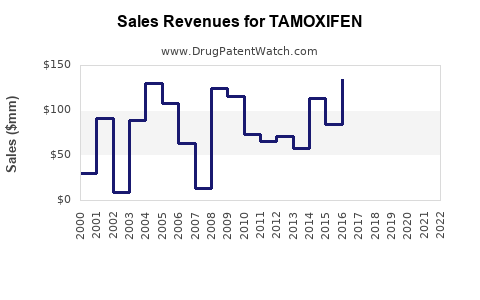

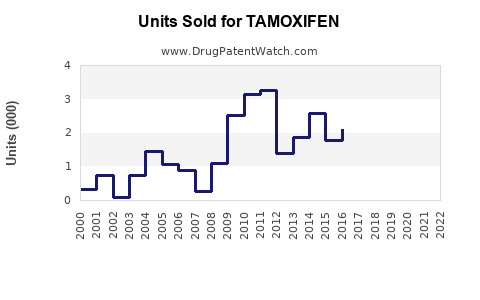

Drug Sales Trends for TAMOXIFEN

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for TAMOXIFEN

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| TAMOXIFEN | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tamoxifen

Introduction

Tamoxifen, a selective estrogen receptor modulator (SERM), remains a cornerstone in breast cancer therapy and risk reduction since its approval by the FDA in 1977. Its multifaceted application encompasses treatment of estrogen receptor-positive (ER+) breast cancers, prophylaxis in high-risk populations, and off-label uses. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and forecasts future sales trajectories of tamoxifen, aiding stakeholders in strategic decision-making.

Market Overview

Historical Context and Market Position

Tamoxifen's clinical efficacy, especially in ER+ breast cancers, has established it as an essential drug in oncology. The drug's broad therapeutic profile, including use in pre- and postmenopausal women, aligned with its long-standing status, has fostered a steady demand globally. According to IQVIA data, the global breast cancer therapeutics market was valued at approximately USD 21 billion in 2022, with endocrine therapies like tamoxifen accounting for roughly 25-30% of this, indicating a significant and sustained market segment.

Therapeutic Indications and Clinical Guidelines

Supported by authoritative guidelines (e.g., NCCN, ASCO), tamoxifen's indication spectrum spans:

- Treatment of ER+ early and advanced breast cancers

- Adjuvant therapy for postmenopausal women

- Risk reduction in high-risk women (e.g., BRCA mutation carriers, women with atypical hyperplasia)

The recommendation persists due to proven efficacy in reducing recurrence and mortality rates. Emerging data supporting extended use and prophylactic applications may further bolster demand.

Global Market Dynamics

Regionally, North America and Europe represent mature markets with high prescription rates driven by established clinical practices and healthcare infrastructure. Emerging economies—such as China, India, and Brazil—offer growth potential due to increasing breast cancer incidence and expanding healthcare access. The increasing awareness and screening programs augment the pool of eligible patients, fostering demand growth.

Competitive Landscape

Major Producers

- Hoffmann-La Roche (Nolvadex)

- Teva Pharmaceuticals (generic Tamoxifen)

- Mylan, Sun Pharma, and Cipla (generics market)

- Other regional manufacturers

The patent exclusivity period for original formulations expired decades ago, leading to a robust generics market, which sustains competitive pricing and wide availability. Innovative formulations or combination therapies have thus far limited major novel entrants dedicated solely to tamoxifen.

Market Penetration and Pricing Trends

Generic proliferation has resulted in significant price erosion, especially in mature markets. For therapeutic compliance and affordability, generic formulations dominate, which constrains average selling prices but sustains high volume sales.

Regulatory Environment & Impact

Patent Status

Original patents have long expired; however, recent regulatory considerations include approvals for new indications or formulations, which may momentarily influence sales. Additionally, any patent litigation or exclusivity extensions can impact market dynamics.

Regulatory Approvals & Labeling

Regulatory authorities have endorsed extended adjuvant therapy durations, such as 10 years of treatment, which could influence sales volume. Regulatory support for use in prophylactic settings, especially guided by emerging trials, could open new market avenues.

Key Market Drivers & Barriers

Drivers:

- Increasing breast cancer incidence globally

- Advances in clinical guidelines favoring extended therapy durations

- Growing awareness of risk-reduction strategies

- Expansion into emerging markets

Barriers:

- Competition from other endocrine agents (e.g., aromatase inhibitors)

- Side-effect profile leading to non-compliance

- Off-label and generic competition suppressing prices

Market Forecast and Sales Projections (2023-2030)

Methodology

Market projections integrate epidemiological data, demographic trends, approval landscapes, treatment guidelines, and pricing models. Emphasis is placed on global demand, pipeline activity, and healthcare access.

Projected Growth Trends

- Compound annual growth rate (CAGR): Estimated at 3-5% globally over the forecast period.

- 2023 baseline sales: Approximate USD 500 million—considering the core treatment and prophylactic use combined.

- Influencing factors:

- Increased adoption in prophylaxis: As awareness increases and guidelines endorse longer durations, sales are expected to rise.

- Emergence of biosimilars and generics: Will sustain volumes but suppress prices.

- New indications or combination therapies: Potential to generate incremental sales.

- Market saturation in mature regions may temper growth, but expansion into emerging markets provides upside.

Regional Outlook

| Region | 2023 Market Size (USD millions) | CAGR (2023-2030) | Key Drivers |

|---|---|---|---|

| North America | 200 | 3-4% | High adoption, mature market |

| Europe | 120 | 3-4% | Clinical guideline adherence |

| Asia-Pacific | 80 | 5-7% | Rising breast cancer prevalence, healthcare access expansion |

| Latin America | 50 | 4-6% | Screening programs, increasing awareness |

| Rest of World | 50 | 4-6% | Growth in emerging markets |

Impact of Future Trends

Personalized Medicine & Biomarker Development

Development of predictive biomarkers could refine patient selection, optimizing therapy use and potentially expanding prophylactic applications, thereby positively influencing sales.

Generics & Biosimilars

The influx of biosimilars and generics will maintain competitive pricing but may limit revenue per unit. Continuous price erosion could marginally dampen toplines unless volume increases sufficiently.

Novel Formulations & Delivery Systems

Partial advances, like extended-release formulations or combination therapies with targeted agents, could boost sales by improving adherence and efficacy.

Epidemiological Shifts

The rising global breast cancer incidence, coupled with increased screening, enlarges the treatment population, underpinning long-term sales sustainability.

Risks & Uncertainties

- Regulatory constraints impacting approved indications or post-marketing safety concerns.

- Competitive pressures from newer endocrine therapies with improved side-effect profiles.

- Healthcare policy shifts affecting reimbursement or drug access.

- Long-term safety perceptions influencing off-label prophylactic use.

Key Takeaways

- Tamoxifen remains a pivotal therapy in breast cancer management with a stable, yet gradually expanding, market.

- Generics dominate supply, constraining margins but ensuring wide access, especially in emerging economies.

- Future growth hinges on expanded prophylactic indications, improved adherence therapies, and pipeline innovations.

- Market expansion into emerging regions offers considerable upside, driven by epidemiological and healthcare infrastructure advancements.

- Competitive landscape requires focus on differentiating factors such as formulation improvements, safety profile updates, and combination regimens.

FAQs

-

What is the primary therapeutic use of tamoxifen?

Tamoxifen is primarily used for treating and preventing estrogen receptor-positive breast cancer in women. It also offers prophylactic benefits for high-risk populations. -

How will generic competition impact tamoxifen sales?

Generics, introduced after patent expiry, have significantly lowered prices, driving volume but compressing profit margins. Long-term sales depend on demand volume and market penetration. -

Are new indications expected to boost tamoxifen sales?

Yes; emerging evidence supports extended adjuvant therapy and prophylactic use, which could expand the eligible patient base and increase sales. -

What role do emerging markets play in the future of tamoxifen?

Increasing breast cancer incidence, improved healthcare access, and awareness campaigns position emerging markets as critical growth areas, likely to contribute substantially to global sales. -

What competitive therapies are gaining ground over tamoxifen?

Aromatase inhibitors (e.g., anastrozole, letrozole) are increasingly preferred in certain settings due to improved side-effect profiles and efficacy, potentially reducing tamoxifen's market share in specific indications.

References

[1] IQVIA. Global Oncology Market Insights 2022.

[2] National Comprehensive Cancer Network (NCCN) Guidelines.

[3] American Society of Clinical Oncology (ASCO) Guidelines.

[4] Market research reports and epidemiological data sources.

More… ↓