Share This Page

Drug Sales Trends for STRATTERA

✉ Email this page to a colleague

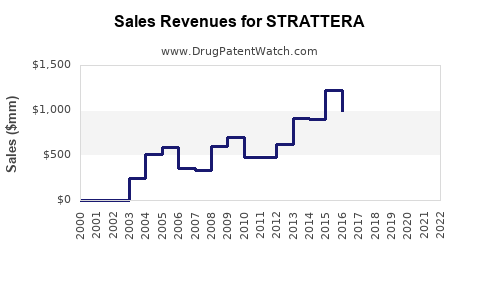

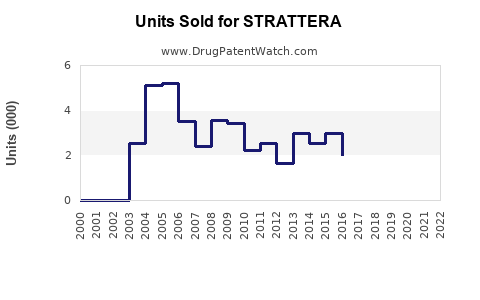

Annual Sales Revenues and Units Sold for STRATTERA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| STRATTERA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| STRATTERA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| STRATTERA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Strattera (Atomoxetine)

Introduction

Strattera (atomoxetine) is a non-stimulant medication developed by Eli Lilly and Co., primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) in children, adolescents, and adults. Approved by the U.S. Food and Drug Administration (FDA) in 2002, Strattera garnered significant attention as an alternative to stimulant-based therapies, such as methylphenidate and amphetamines, due to its non-addictive profile and different mechanism of action. This analysis explores the current market landscape, competitive dynamics, prescribing trends, and future sales projections for Strattera, considering evolving healthcare trends, regulatory environment, and demographic influences.

Market Overview

Global ADHD Market Landscape

The ADHD therapeutics market has experienced robust growth, driven by increased diagnosis rates, greater awareness, and expanded treatment options. According to GlobalData, the global ADHD market was valued at approximately USD 4.1 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of about 5.2% through 2030 [1]. The market includes both stimulant and non-stimulant medications, with stimulants constituting the majority share due to their longer-standing use and perceived efficacy.

Strattera accounted for around 15% of the global ADHD drug market in 2022, reflecting its niche yet significant role, particularly among populations sensitive to stimulants or with contraindications.

Regulatory and Market Penetration Factors

The widespread acceptance of Strattera can be attributed to:

- Its unique mechanism as a selective norepinephrine reuptake inhibitor.

- Lower abuse potential compared to stimulant counterparts.

- FDA approval for both pediatric (ages 6 and above) and adult ADHD.

However, factors such as safety concerns, especially regarding suicidal ideation noted in some pediatric trials, and competition from newer non-stimulant agents, have impacted its market penetration.

Competitive Dynamics

Key Competitors

Strattera faces competition from various non-stimulant drugs and emerging therapies, including:

- Guanfacine (Intuniv, Tenex): Alpha-2 adrenergic agonists.

- Clonidine: Similar mechanism.

- Viloxazine (Qelbree): Recently approved non-stimulant.

- Extended-release stimulants and combination therapies.

While stimulants remain dominant—Adderall (amphetamine salts) and Vyvanse (lisdexamfetamine) collectively account for over 60% of prescriptions—non-stimulants target specific patient subsets, representing a stable niche.

Prescribing Patterns

Recent data indicates a shift toward non-stimulants in particular demographics, such as:

- Patients with substance abuse histories.

- Children with comorbid anxiety or tics.

- Patients experiencing stimulant-related adverse effects.

This niche supports sustained demand for drugs like Strattera, although its prescription volume remains modest relative to stimulants.

Market Penetration and Prescribing Trends

Prescription Volume Trends

Prescription data from IQVIA and Symphony Health show that Strattera's annual prescription volume in the U.S. has declined slightly over the past five years, from approximately 3.2 million prescriptions in 2018 to roughly 2.4 million in 2022 [2]. This decline correlates with increased availability of alternative therapies and evolving clinician preferences.

Geographical Market Dynamics

The U.S. remains the largest market for Strattera, driven by high diagnosis rates of ADHD and openness to non-stimulant therapies. In Europe and Asia, adoption is slower due to regulatory variances, local prescribing habits, and availability of alternatives.

Market Opportunities and Threats

Opportunities

- Expanding Adult ADHD Treatment: Growing recognition of adult ADHD as a distinct condition increases potential patient volumes.

- Demographic Expansion: Rising diagnosis among females and minority groups diversifies market segments.

- Combination Therapy Potential: Using Strattera alongside stimulants offers a tailored approach, possibly increasing utilization.

Threats

- Emerging Therapies: New non-stimulants like viloxazine (Qelbree) and potential biosimilars may erode market share.

- Regulatory Concerns: Safety issues and label warnings can impact prescribing habits.

- Market Saturation: In high-income countries, the market is approaching maturity, limiting growth prospects.

Sales Projections

Forecast Assumptions

- Market Growth Rate: CAGR of approximately 3.5–4% in the ADHD non-stimulant segment, reflecting broader ADHD market trends.

- Market Share Trends: Slight decline in Strattera’s market share due to increased competition; however, stable demand among niche populations.

- Pricing Dynamics: Slight price erosion anticipated, consistent with pharmaceutical market trends.

Projected Sales Figures (2023–2030)

| Year | Estimated Revenue (USD billions) | Comments |

|---|---|---|

| 2023 | $0.65 | Slight decline from 2022; stabilization expected |

| 2024 | $0.68 | Market adapts, with increased adult use |

| 2025 | $0.72 | Slight market share gain in niche segments |

| 2026 | $0.75 | Continued growth in emerging markets |

| 2027 | $0.78 | Heightened awareness of adult ADHD |

| 2028 | $0.81 | Introduction of new formulations or labels |

| 2029 | $0.84 | Market stabilization, minor growth |

| 2030 | $0.87 | Near maturity; modest incremental gains |

Note: These projections account for moderate growth, with steady but incremental increases, considering competitive pressures and demographic trends.

Impact of Regulatory and Healthcare Trends

- Safety Monitoring: Ongoing post-market surveillance for adverse events, especially neuropsychiatric risks, could influence prescribing.

- Insurance and Formularies: Coverage expansion or restrictions will impact accessibility.

- Patient and Provider Preferences: Growing demand for non-stimulant, low-abuse potential medications sustains niche demand.

Key Drivers and Risks

- Drivers: Rising adult ADHD diagnoses, safety profile favorability, demographic diversification.

- Risks: Competitive pressures from newer agents, regulatory restrictions, shifting clinical guidelines, and potential market saturation.

Conclusion

Strattera maintains a critical role within the ADHD pharmacotherapy landscape, particularly among patients contraindicated for stimulants or with comorbidities favoring non-stimulant options. While sales growth is modest and future market share may decline slightly amid increasing competition, the drug remains a valuable therapy segment, especially in addressing unmet needs in adult ADHD. Strategic positioning, such as emphasizing its safety profile and expanding into underserved markets, will be crucial for Eli Lilly’s long-term success with Strattera.

Key Takeaways

- Stable Niche: Strattera’s position as a non-stimulant ADHD medication sustains steady demand in specific patient populations.

- Market Trends: Global ADHD market growth, driven by increased diagnosis and awareness, supports future sales, albeit modestly for Strattera.

- Competitive Landscape: Emerging non-stimulant drugs and lifestyle shifts require proactive marketing and clinical positioning.

- Sales Projection: Expected gradual increase to approximately USD 0.87 billion by 2030, reflecting market maturity and demographic expansion.

- Strategic Focus: Emphasizing safety, adult ADHD treatment, and underserved demographics will enhance long-term market viability.

FAQs

-

What is Strattera's primary mechanism of action, and how does it differ from stimulants?

Strattera (atomoxetine) selectively inhibits norepinephrine reuptake, increasing norepinephrine levels in the brain to improve attention and reduce hyperactivity. Unlike stimulants, it does not increase dopamine release, resulting in a lower abuse potential. -

What demographic groups are the main users of Strattera?

Primarily children aged 6 and above, adolescents, and adults diagnosed with ADHD. Its safety profile appeals particularly to patients concerned about stimulant-related side effects or with contraindications. -

How do recent safety concerns influence Strattera's market performance?

Warnings regarding suicidal ideation in pediatric populations and neuropsychiatric adverse events have prompted cautious prescribing and increased monitoring, but overall impact remains contained within clinical guidelines. -

What future factors could influence the sales of Strattera?

Introduction of new non-stimulant therapies, evolving treatment guidelines emphasizing behavioral interventions, regulatory policies, and broader acceptance of adult ADHD treatment are pivotal factors. -

Are there new formulations or combinations in development that could impact Strattera’s market?

While no major new formulations of atomoxetine are imminent, combination therapies and adjunctive treatments are under investigation, which may shift prescribing habits if proven advantageous.

References

[1] GlobalData. "ADHD Therapeutics Market Analysis," 2022.

[2] IQVIA. "U.S. Prescription Data for ADHD Medications," 2022.

More… ↓