Last updated: July 28, 2025

Introduction

SPIRIVA (tiotropium bromide) remains a cornerstone in the management of chronic obstructive pulmonary disease (COPD) and asthma. Since its approval in the early 2000s, SPIRIVA has established itself as a leading long-acting bronchodilator, with consistent market demand driven by the growing prevalence of respiratory diseases worldwide. This analysis offers a detailed overview of SPIRIVA’s current market landscape, competitive positioning, upcoming growth drivers, and future sales projections amid evolving healthcare dynamics.

Market Landscape and Key Drivers

Prevalence and Demographic Trends

The global COPD market is projected to expand significantly, driven by aging populations, increased tobacco use, and environmental pollutants. According to the World Health Organization, COPD affects over 300 million people globally, with a prevalence expected to rise as demographic shifts favor older age groups. Similarly, asthma affects approximately 262 million individuals worldwide, emphasizing the need for effective long-term therapies like SPIRIVA.

Therapeutic Positioning

SPIRIVA’s prominence stems from its efficacy as a long-acting muscarinic antagonist (LAMA), delivering sustained bronchodilation. It’s prescribed primarily for COPD and positioned as a first-line maintenance therapy, often combined with inhaled corticosteroids (ICS) for enhanced efficacy. The drug’s oral inhaler delivery system is regarded as user-friendly, fostering adherence and improving treatment outcomes.

Competitive Landscape

The respiratory market features competing agents such as umeclidinium (UMEC), glycopyrrolate, aclidinium, and combination therapies involving LABAs and ICS. Notably, recent developments include fixed-dose combination inhalers that enhance convenience and compliance. Despite competition, SPIRIVA maintains a dominant market share due to its early entry, physician familiarity, and proven long-term safety profile.

Regulatory and Market Access Factors

Regulatory Approvals and Labeling

SPIRIVA received approval from the FDA in 2004 for COPD, followed by expanded indications for asthma management. Regulatory bodies worldwide, including EMA and Health Canada, have upheld its safety and efficacy profiles, supporting continued market penetration.

Pricing and Reimbursement

Reimbursement policies significantly influence sales. SPIRIVA’s pricing strategies in developed markets like the US and Europe remain competitive, with manufacturer agreements facilitating formulary inclusion. Emerging markets are gradually adopting SPIRIVA, subject to price negotiations and healthcare infrastructure improvements.

Sales Performance and Historical Trends

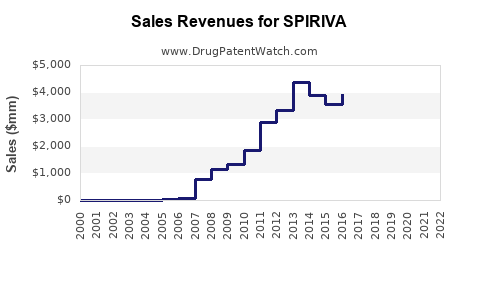

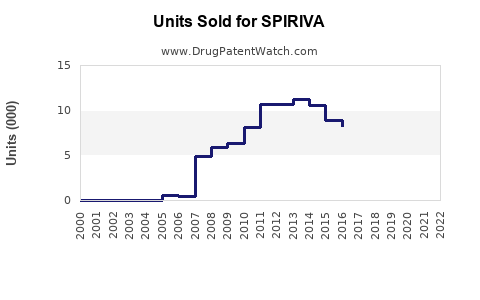

Historical Sales Data

Since its launch, SPIRIVA’s global sales have demonstrated sustained growth. According to data from industry analysts, the global inhaler-based bronchodilator market was valued at approximately $8 billion in 2021, with SPIRIVA capturing a significant share, estimated over $3 billion annually. Sales growth averaged around 4-6% annually pre-pandemic, with a brief slowdown during COVID-19 due to disruptions in healthcare access.

Geographic Distribution

North America accounts for roughly 50% of SPIRIVA’s sales owing to high COPD prevalence, widespread adoption, and robust reimbursement pathways. Europe contributes around 30%, with Asia-Pacific showing considerable potential driven by emerging markets and increasing disease awareness.

Future Market Dynamics and Growth Drivers

Pipeline and Formulation Innovations

The pharmaceutical industry is investing in innovative inhaler devices optimized for ease of use, particularly in elderly populations. The development of fixed-dose combination inhalers, integrating SPIRIVA with LABAs (e.g., SPIRIVA RESPIMAT with olodaterol), is expected to boost adherence and sales.

Expanding Indications and Off-label Uses

Research into SPIRIVA’s potential for treating other respiratory conditions, such as bronchiectasis and certain neurogenic bladder disorders, may open new markets. However, such expansions require regulatory approval and clinical validation.

Digital Health and Telemedicine

With the rise of digital inhalers and telehealth platforms, SPIRIVA’s integration into remote monitoring and personalized treatment plans promises enhanced adherence and real-world effectiveness, translating to sustained sales growth.

Market Penetration in Emerging Economies

Growing healthcare infrastructure and increasing awareness in Asian and Latin American markets present substantial revenue opportunities. Local partnerships and tiered pricing strategies will be critical to capturing these markets effectively.

Sales Projections (2023–2030)

Based on current trends, market data, and industry forecasts, SPIRIVA’s sales are anticipated to follow a steady upward trajectory with the following considerations:

-

2023–2025: Growth CAGR of approximately 3.5-5%, reaching around $3.3–3.7 billion annually. Growth will be supported by increased adoption in emerging markets and demographic shifts in developed regions.

-

2026–2030: A compound annual growth rate (CAGR) of 4-6% could propel annual sales toward $4–4.5 billion by 2030. Key factors include market saturation in mature markets, pipeline-driven innovations, and expanding indications.

-

Market Share Stability: While competition remains formidable, SPIRIVA’s entrenched market position and ongoing formulation enhancements are likely to sustain its leadership.

Risks and Market Challenges

- Intense Competition: Introduction of novel LAMAs and fixed-dose combinations could erode market share.

- Pricing Pressures: Cost-containment measures and biosimilar or generic entries might influence pricing and margins.

- Regulatory Hurdles: Variations in regulatory approvals for new indications or formulations may delay revenue streams.

- Pandemic Impact: COVID-19 disrupted routine care and pharmaceutical supply chains, and ongoing pandemic dynamics may influence future sales.

Key Takeaways

- Growing Disease Burden: Rising COPD and asthma prevalence globally provide a strong foundation for sustained demand for SPIRIVA.

- Market Leadership & Innovation: Early market entry, established safety profile, and formulation improvements will underpin continued growth.

- Emerging Markets & Digital Integration: Expansion into emerging economies and incorporation of digital health tools are strategic avenues for future sales acceleration.

- Competitive Landscape: Maintaining market share requires ongoing innovation and strategic pricing amid increasing competition.

- Sales Outlook: Expect steady growth with potential to reach $4.5 billion globally by the end of the decade, influenced by demographic trends, pipeline progress, and healthcare trends.

FAQs

1. What factors contribute to SPIRIVA’s dominant position in the respiratory drug market?

Its early approval, proven long-term safety, physician familiarity, and effective delivery device contribute to its leadership. Continuous innovations and broad clinical adoption further solidify its market share.

2. How will emerging markets influence SPIRIVA’s future sales?

Rapid healthcare infrastructure development, increased disease awareness, and expanding insurance coverage in regions like Asia-Pacific and Latin America present significant growth opportunities, potentially doubling sales over the next decade.

3. What are the main competitors to SPIRIVA, and how might they impact its market share?

Competitors include other LAMAs like umeclidinium and glycopyrrolate, as well as combination inhalers with LABAs. These alternatives may capture parts of the market, especially as new formulations with better adherence features come to market.

4. How does the development of digital inhalers affect SPIRIVA’s sales prospects?

Digital inhalers enable remote monitoring and personalized treatment, enhancing adherence. Integration with digital health platforms could differentiate SPIRIVA and sustain its relevance amid evolving patient preferences.

5. What regulatory trends could influence SPIRIVA’s sales in the near term?

Approval of new indications, formulations, and combination therapies, along with changes in reimbursement policies, particularly in emerging markets, will play a critical role in shaping sales trajectories.

References

- World Health Organization. (2022). Chronic respiratory diseases.

- MarketWatch. (2022). Global COPD drugs market size and forecast.

- IQVIA. (2022). The Global Use of Medicines in 2021 & 2022.

- Teva Pharmaceuticals. (2021). SPIRIVA product profile and clinical overview.

- European Medicines Agency. (2023). Regulatory updates on respiratory medications.