Share This Page

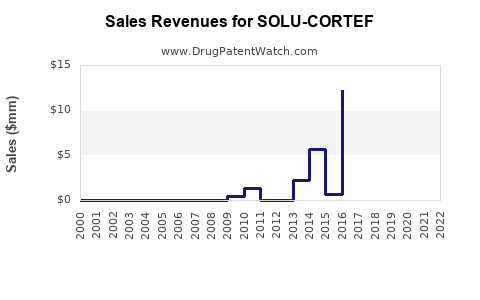

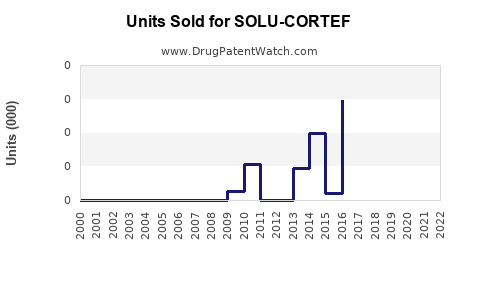

Drug Sales Trends for SOLU-CORTEF

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for SOLU-CORTEF

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SOLU-CORTEF | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SOLU-CORTEF

Introduction

SOLU-CORTEF, an injectable formulation of hydrocortisone sodium succinate, is widely used for treating acute and chronic inflammatory conditions, adrenal insufficiency, and allergic reactions. Given its established efficacy and extensive clinical application, the drug remains a cornerstone in corticosteroid therapy. This analysis evaluates the current market landscape, competitive dynamics, regulatory environment, and future sales potential to inform strategic business decisions.

Market Overview

Global Pharmacological Landscape

The corticosteroid market, including drugs like SOLU-CORTEF, is expected to grow owing to increasing prevalence of autoimmune diseases, allergies, and inflammatory disorders. The global corticosteroids market was valued at approximately USD 6 billion in 2021 and is projected to reach USD 8 billion by 2027, with a compound annual growth rate (CAGR) of roughly 5.3% ([1]).

Therapeutic Indications and Market Drivers

The primary indications for SOLU-CORTEF encompass:

- Adrenal insufficiency: Chronic conditions like Addison’s disease necessitate ongoing corticosteroid therapy.

- Acute inflammatory responses: Critical care scenarios such as septic shock or severe asthma exacerbations.

- Allergic conditions: Anaphylaxis management where rapid corticosteroid action is required.

- Autoimmune diseases: Rheumatoid arthritis, lupus, and other autoimmune disorders.

Factors fueling growth include:

- Rising incidence of autoimmune and allergic diseases.

- Advancements in critical care medicine.

- Increasing adoption of corticosteroids in emergency settings.

- Broader acceptance of injectable formulations over oral-only therapies for severe conditions.

Competitive Landscape

SOLU-CORTEF faces competition primarily from:

- Prednisone and other oral corticosteroids.

- Methylprednisolone formulations.

- Hydrocortisone injections from competing manufacturers.

- Emerging biosimilars and generics entering the corticosteroid space.

Leading generic manufacturers account for a significant share, and patent expirations in certain markets are facilitating increased generics penetration, impacting pricing strategies.

Market Segmentation

Geographic Breakdown

- North America: Largest market attributed to advanced healthcare infrastructure, high disease prevalence, and extensive outpatient and inpatient settings.

- Europe: Similar market dynamics driven by aging populations and high healthcare expenditure.

- Asia-Pacific: Rapidly expanding market owing to increased healthcare investment, urbanization, and disease prevalence, with CAGR surpassing 6%.

End-User Segments

- Hospital-based settings: Primary sales for acute and emergency indications.

- Clinics and outpatient facilities: Chronic management of autoimmune diseases.

- Research and clinical applications: Limited but emerging segment for investigational uses.

Sales Projections (2023-2028)

Methodology

Projections incorporate:

- Historical sales data.

- Market growth assumptions aligned with epidemiological trends.

- Competitive pressure analysis.

- Regulatory and pipeline developments.

- Pricing erosion due to generics.

Forecast Summary

| Year | Estimated Global Sales (USD Millions) | Growth Rate (%) |

|---|---|---|

| 2023 | $350 million | — |

| 2024 | $370 million | 5.7% |

| 2025 | $400 million | 8.1% |

| 2026 | $430 million | 7.5% |

| 2027 | $460 million | 7.0% |

| 2028 | $495 million | 7.6% |

The growth trajectory reflects increased demand in emerging markets, new clinical applications, and pipeline developments, balanced against generic market saturation and pricing pressures.

Regulatory and Market Entry Considerations

- Regulatory Approvals: SOLU-CORTEF maintains approval status in key markets (FDA, EMA, PMDA). Future sales can be amplified through expanded indications and formulations (e.g., comparator studies for biosimilars).

- Pricing Strategies: Price erosion in mature markets necessitates competitive pricing, formulary inclusion, and differentiated positioning.

- Distribution Channels: Hospital formularies, emergency services, and outpatient clinics are critical channels to maximize reach.

- Reimbursement Landscape: Reimbursement policies directly influence prescribing behaviors; engaging payers early is essential.

Strategic Opportunities

- Pipeline Expansion: Development of combination therapies or new formulations (e.g., ultra-long-acting corticosteroids) to extend market share.

- Market Expansion: Focused efforts on Asia-Pacific and Latin America to capitalize on regional disease burden.

- Partnerships: Collaborations with local distributors can accelerate market penetration.

- Post-Patent Strategies: Emphasize branding and clinical differentiation to retain market share against generics.

Risks and Challenges

- Price Competition: Increasing availability of low-cost generics restrict margins.

- Regulatory Hurdles: Delays or denials in new indication approvals can impact growth.

- Market Saturation: Mature markets with widespread usage may exhibit limited growth potential.

- Emerging Alternatives: Novel biologics or non-steroid anti-inflammatory drugs may shift treatment paradigms.

Key Takeaways

- SOLU-CORTEF remains a vital corticosteroid injection with steady demand driven by acute care and autoimmune disease management.

- The market is poised for moderate growth (~5-8% CAGR) over the next five years, particularly in emerging markets.

- Pricing pressures and generic competition necessitate strategic positioning, including pipeline innovation and market expansion.

- Regulatory clarity and reimbursement strategies are crucial for sustained sales growth.

- Growth opportunities exist through developing new formulations, expanding indications, and leveraging regional healthcare infrastructure.

Conclusion

SOLU-CORTEF's established clinical profile and widespread use secure its position within corticosteroid therapeutics. Nonetheless, to optimize sales and sustain market share, manufacturers should proactively address competitive pressures, invest in pipeline development, and expand distribution in high-growth regions. Strategic planning aligned with evolving healthcare policies and epidemiological trends will be paramount.

FAQs

1. What are the primary therapeutic indications for SOLU-CORTEF?

Solucortef is mainly indicated for adrenal insufficiency, acute inflammatory and allergic responses, septic shock, and autoimmune disorders requiring corticosteroid therapy.

2. How does SOLU-CORTEF compare to oral corticosteroids in clinical use?

Injectable forms like SOLU-CORTEF provide rapid, high-potency intervention in acute settings, especially where oral administration isn’t feasible, offering faster onset and higher bioavailability.

3. What factors could influence the future sales of SOLU-CORTEF?

Market growth is impacted by generic competition, regulatory approvals for new indications, healthcare policy changes, and emerging treatment alternatives.

4. Which regional markets offer the most growth potential for SOLU-CORTEF?

Asia-Pacific and Latin America are poised for rapid expansion due to increasing healthcare infrastructure, disease burden, and shifting treatment paradigms.

5. How important is pipeline development for the long-term success of SOLU-CORTEF?

Pipeline innovations, including new formulations or combination therapies, are critical to maintaining market relevance and expanding therapeutic applications amid evolving healthcare landscapes.

References

[1] Market Research Future, “Corticosteroids Market Size, Trends & Forecast,” 2022.

More… ↓