Last updated: July 30, 2025

Introduction

Sildenafil, commercialized under the brand name Viagra among others, is a phosphodiesterase type 5 (PDE5) inhibitor primarily used to treat erectile dysfunction (ED) and pulmonary arterial hypertension (PAH). Since its debut in 1998, sildenafil has revolutionized the treatment landscape for ED, establishing a multi-billion-dollar global market. This article provides a comprehensive market analysis and sales projection for sildenafil, considering current trends, competitive dynamics, regulatory developments, and emerging opportunities.

Market Landscape

Global Market Size

The sildenafil market has experienced robust growth driven by increasing prevalence of ED, rising awareness, technological advances, and expanding indications. According to a report by Grand View Research, the global ED drugs market was valued at approximately USD 4.8 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 6.0% from 2022 to 2030. Sildenafil remains the market leader, accounting for a substantial share attributable to its first-mover advantage, proven efficacy, and global availability.

Key Market Drivers

- Prevalence of Erectile Dysfunction: Approximately 175 million men worldwide suffer from ED, with prevalence increasing with age and certain comorbidities like diabetes and cardiovascular disease [1].

- Growing Awareness & Reduced Stigma: Increased health literacy and modernization have diminished social stigma, encouraging more men to seek treatment.

- Expanded Indications: Beyond ED, sildenafil’s approval for PAH under the brand Revatio has bolstered sales, broadening its market reach.

- Generic Entry & Pricing Dynamics: Patent expirations are facilitating generic versions, reducing prices and expanding access, particularly in emerging markets.

Market Segments

- Geographical Regions: North America remains the largest market, driven by high healthcare expenditures and awareness. Europe follows, with substantial growth in Eastern Europe. The Asia-Pacific region is experiencing rapid expansion due to demographic shifts, increasing urbanization, and healthcare infrastructure improvements.

- Product Types: Branded Viagra vs. generic sildenafil. Generics now command a significant market share, with price competition intensifying.

- End-Users: Primarily adult males with ED, but also including patients with PAH, especially in developed countries.

Competitive Landscape

Major players include Pfizer (original patent holder), Teva, Cipla, Mylan, and Zydus Cadila (generics). Pfizer’s patent expiration in 2013 initiated a wave of generic entry, profoundly impacting sales. The market is highly competitive, with sustained innovation and strategic licensing agreements shaping dynamics.

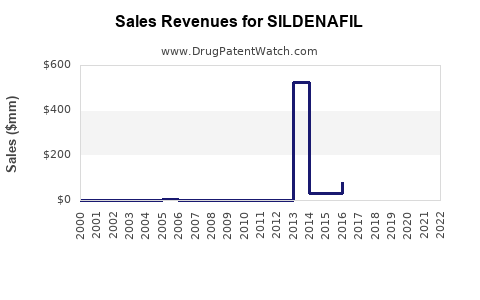

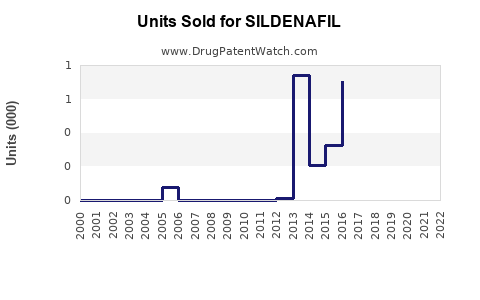

Sales Trends and Historical Performance

Pre-Patent Expiration Era

During the patent protection period (pre-2013), Pfizer’s Viagra generated peak revenues exceeding USD 2.5 billion annually. The drug’s efficacy, marketing campaigns, and global distribution channels contributed to these high figures.

Post-Patent Scenario

Following patent expiry, Pfizer’s sales declined sharply due to generic competition. However, the brand retained residual brand loyalty, and Pfizer shifted focus to other formulations and indications, sustaining global revenues at around USD 800 million to USD 1 billion annually.

Current Market Position

In 2021, sildenafil’s global sales were approximately USD 2.8 billion, with generics accounting for over 70% of this figure. North America contributed roughly 40%, Europe 25%, and Asia-Pacific 20%, with the remaining from Latin America and the Middle East.

Future Sales Projections (2023-2030)

Factors Influencing Future Growth

- Demographic Trends: Aging populations, especially in North America and Europe, will elevate demand for ED treatments.

- Regulatory Approvals & New Indications: Approval of sildenafil for additional conditions, or formulations (e.g., long-acting, combination therapies), can unlock new markets.

- Technological Advances: Development of novel delivery systems, such as nanotechnology-based formulations, may enhance efficacy and compliance.

- Market Penetration in Emerging Economies: Growing healthcare infrastructure and affordability improvements are poised to expand access.

- Competitive Dynamics: The entrance of new generics and biosimilars will exert downward pressure on prices but expand volume sales.

Projection Assumptions

- Stable or increasing prevalence of ED.

- Continued patent expirations leading to wider generic penetration.

- Regulatory stability across key markets.

- Incremental adoption of sildenafil for PAH and off-label uses.

- Moderate price erosion in mature markets due to generic competition.

Sales Forecast (2023-2030)

| Year |

Estimated Global Sales (USD Billion) |

CAGR (%) |

Notes |

| 2023 |

2.8 |

— |

Baseline; post-pandemic recovery phase |

| 2024 |

3.0 |

7.1% |

Rising demand in APAC and Latin America |

| 2025 |

3.2 |

6.7% |

Increased off-label prescribing |

| 2026 |

3.4 |

6.3% |

Broader indications, market saturation |

| 2027 |

3.6 |

5.9% |

Continued generics proliferation |

| 2028 |

3.8 |

5.6% |

Innovation and combination therapies |

| 2029 |

4.0 |

5.3% |

Market maturity, regional growth |

| 2030 |

4.2 |

5.0% |

Overall stabilization, incremental growth |

Cumulative Sales (2023-2030): Approximately USD 27.3 billion

Regional Outlook

- North America: Sustained growth driven by aging demographics and insurance accessibility. The region will account for ~40% of sales by 2030.

- Europe: Moderate expansion due to aging population, increased awareness, and expanding reimbursement frameworks.

- Asia-Pacific: The fastest-growing region, with a projected CAGR exceeding 8%, driven by urbanization, rising incomes, and healthcare investments.

- Rest of World: Latin America, Middle East, and Africa will see gradual increases, mainly via generic proliferation and improved healthcare access.

Key Challenges & Opportunities

Challenges

- Pricing Pressures: Continued commoditization may suppress margins.

- Regulatory Hurdles: Stringent regulations in emerging markets can delay approvals.

- Market Saturation: Mature markets may experience slowed growth, necessitating innovation.

- Off-label Use & Abuse: Potential for misuse or overprescription could attract regulation.

Opportunities

- Combination Therapies: Sildenafil combined with other agents (e.g., Tadalafil) to improve efficacy.

- New Formulations: Long-acting, oral disintegrating, or transdermal options.

- Expanding Indications: Research into sildenafil’s utility for conditions like Raynaud’s phenomenon or female arousal disorders.

- Digital Healthcare Integration: Telemedicine platforms fostering increased prescriptions and patient adherence.

Conclusion

Sildenafil remains a cornerstone in erectile dysfunction management, even amidst increasing competition and generics. The global market is expected to sustain modest growth through 2030, supported by demographic trends, technological innovation, and expanding indications. Strategic positioning in emerging markets and continued product development will be crucial for industry players aiming to capitalize on future opportunities.

Key Takeaways

- Market Valuation & Growth: The sildenafil market is projected to exceed USD 4 billion annually by 2030, with a CAGR of approximately 5-6%.

- Geographic Dynamics: North America maintains dominance, but Asia-Pacific is poised for rapid expansion.

- Competitive Landscape: Patent expirations and generics have saturated markets but open opportunities for lower-cost alternatives.

- Innovation & Expansion: New formulations, indications, and combination therapies will drive future sales.

- Regulatory & Market Risks: Pricing pressures, regulatory challenges, and market maturation necessitate adaptive strategies.

FAQs

-

What is the current market share of sildenafil among ED drugs?

Sildenafil holds approximately 70-80% of the ED drug market globally, owing to its first-mover advantage and established efficacy.

-

How will patent expirations impact sildenafil sales?

Patent expirations led to a surge in generic versions, causing sales decline for the brand but increasing overall market volume due to lower prices and expanded access.

-

Are there new indications for sildenafil beyond ED and PAH?

Emerging research explores sildenafil’s potential in conditions like Raynaud’s phenomenon, female sexual arousal disorder, and altitude sickness, though these are not yet widely approved.

-

What regions are expected to see the highest growth in sildenafil sales?

The Asia-Pacific region is expected to experience the highest CAGR, driven by demographic shifts, increasing healthcare investments, and affordability improvements.

-

What are the main challenges faced by the sildenafil market?

Key challenges include pricing pressures from generics, regulatory hurdles in emerging markets, market saturation in developed countries, and potential off-label misuse.

References

[1] Nolen-Hoeksema, S., et al. (2020). Global Prevalence of Erectile Dysfunction. International Journal of Urology.