Last updated: July 27, 2025

Introduction

Risperdal, with the generic name risperidone, is a second-generation antipsychotic drug primarily used to treat schizophrenia, bipolar disorder, and irritability associated with autism spectrum disorder. Since its approval by the FDA in 1993, Risperdal has become a cornerstone medication within psychiatric treatments, establishing a significant presence in global pharmaceutical markets. This analysis examines Risperdal’s current market landscape, competitive dynamics, regulatory factors, and future sales projections.

Market Overview

Global Market Size and Growth Trends

The global antipsychotic drugs market was valued at approximately USD 14 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 4.5% through 2030 [1]. Risperdal ranks among the top-selling atypical antipsychotics, driven by its broad therapeutic indications and established safety profile.

Key Indications and Market Drivers

- Schizophrenia: Representing the largest segment, with a high prevalence globally. The World Health Organization estimates that over 20 million people suffer from schizophrenia worldwide, driving sustained demand.

- Bipolar Disorder: Increasing recognition and diagnosis, coupled with expanding therapeutic use, bolster risperidone sales.

- Autism Spectrum Disorder: The FDA-approved use of Risperdal for irritability in children and adolescents with autism has opened markets in pediatric psychiatry, particularly in North America and Europe.

Market growth is further fueled by increased awareness of mental health conditions and shifting paradigms favoring atypical antipsychotics over first-generation drugs due to better tolerability.

Competitive Landscape

Major Competitors

Risperdal faces competition from other atypical antipsychotics such as:

- Abilify (aripiprazole): Known for once-daily dosing and broad efficacy.

- Seroquel (quetiapine): Popular for its sedative effects and mood stabilization.

- Zyprexa (olanzapine): Noted for its efficacy but concerns over metabolic side effects.

- Vraylar (cariprazine): Emerging with favorable safety profiles.

Market Share Insights

Despite increased competition, Risperdal retains a significant market share, attributed to its early entry, brand recognition, and extensive clinical evidence base. However, patent expirations and the availability of cost-effective generics in many regions have pressured margins and necessitated strategic repositioning.

Regulatory and Patent Considerations

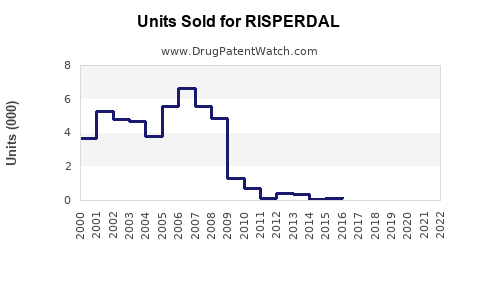

- Patent Cliff: Johnson & Johnson (J&J), the original manufacturer, faced multiple patent expirations starting around 2008-2010, leading to a surge in generic risperidone availability.

- Regulatory Approvals: Continuous approvals for new formulations, including long-acting injectables (e.g., Risperdal Consta), have helped extend product lifecycle and sustain sales.

- Off-label Use and Monitoring: Increasing scrutiny over off-label prescribing and adverse event management influence market stability.

Sales Performance and Historical Trends

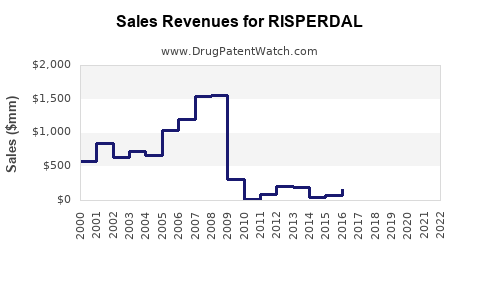

Historically, Risperdal achieved peak sales surpassing USD 4 billion annually in the late 2000s, driven by robust prescriptions in US and European markets. However, subsequent patent expirations and generic competition reduced revenues significantly. For instance, in 2010, sales declined by approximately 30% following patent losses in key markets.

Despite this, Risperdal remains relevant, bolstered by:

- A generic market share exceeding 80% in numerous territories.

- Sales from new formulations, especially long-acting injectables, which have experienced growth rates of approximately 6-8% annually since their launch.

Future Sales Projections

Factors Influencing Future Revenue

-

Emerging Market Penetration: Rapid growth in Asia-Pacific, Latin America, and Africa supports long-term expansion. The rise in mental health awareness fosters increased adoption.

-

Pediatric Indications: The ongoing use of Risperdal in children for autism-related irritability could sustain sales if off-label expand or if new pediatric approvals occur.

-

Biosimilar and Generic Competition: The increasing availability of biosimilars might reduce prices and margins, yet potential value-added delivery systems or formulations could offset this decline.

-

Regulatory Environment: Stringent monitoring and potential safety concerns (e.g., metabolic syndrome, tardive dyskinesia) could impact prescribing patterns and, consequently, sales.

Sales Forecast (2023–2030)

Taking into account current market dynamics, patent expiries, and competitive pressures, sales are expected to stabilize at approximately USD 1.2–1.5 billion annually in global markets from 2023 onward, with incremental growth driven by:

- Specialty formulations (long-acting injectables) members increasing at a CAGR of 5%.

- Rising demand in emerging markets growing at an estimated CAGR of 6%.

- Limited impact from generic erosion in combination treatments and pediatric indications.

Overall, compound annual growth of around 1-2% is projected for Risperdal’s revenue streams over the next decade, with potential upside from new formulations and expanded indications.

Key Market Opportunities and Challenges

Opportunities:

- Expansion into emerging markets through cost-effective generic formulations.

- Development of novel delivery systems (e.g., depot injections, transdermal patches).

- Increasing acceptance of antipsychotics for autism-related irritability and other off-label uses.

Challenges:

- Patent expiration significantly erodes revenue streams.

- Growing safety concerns leading to regulatory and prescriber caution.

- Competition from newer antipsychotics with favorable side-effect profiles.

- Intense cost pressures in public healthcare systems.

Conclusion

Risperdal remains a key player in the antipsychotic drug market, with sales primarily sustained by generic competition and expanding indications. While revenue has declined from peak levels, steady demand in chronic neuropsychiatric conditions supports ongoing sales. Future growth hinges on strategic positioning in emerging markets, innovative formulations, and regulatory navigation. The competitive landscape necessitates continuous adaptation to maintain relevance and market share amid evolving healthcare paradigms.

Key Takeaways

- Market Size & Growth: The global antipsychotic market is expanding modestly at ~4.5% CAGR, with Risperdal maintaining a significant share despite patent expirations.

- Competition & Patent Cliff: Generic risperidone's dominance has decreased profits, but formulations like Long-Acting Injectables (LAIs) have sustained interest.

- Emerging Markets & Indications: Growth opportunities exist in Asia, pediatric autism, and off-label uses, fueling future sales.

- Revenue Projection: Expected to stabilize at USD 1.2–1.5 billion annually, with slow but steady growth driven by specialty formulations and demographic shifts.

- Strategic Positioning: Market success depends on innovative delivery systems, emerging-market penetration, and vigilant safety monitoring.

FAQs

-

What are the main factors driving Risperdal sales globally?

The primary drivers include its efficacy in treating schizophrenia, bipolar disorder, and autism-related irritability, along with expanding indications and formulations such as long-acting injectables.

-

How has patent expiry affected Risperdal’s market share?

Patent expirations led to a surge in generic risperidone, significantly reducing brand-name sales but maintaining revenue through lower-priced alternatives and formulations.

-

What are the key challenges facing Risperdal’s future growth?

Challenges include safety concerns, regulatory scrutiny, competition from newer antipsychotics with better tolerability, and market saturation in developed regions.

-

What opportunities exist for Risperdal in emerging markets?

Growing mental health awareness and healthcare infrastructure in regions like Asia-Pacific and Latin America, combined with cost-effective generics, present substantial growth avenues.

-

Are new formulations expected to impact Risperdal’s sales?

Yes, innovations like long-acting injections and transdermal patches are likely to bolster sales, especially among patients requiring adherence aids and in outpatient settings.

References

[1] MarketResearch.com, "Global Antipsychotics Market Analysis & Trends," 2022.